Meekie, congrats on your savings/investments and also on striking out on your own!

I wholeheartedly agree with your advice. As much as I've always wanted to start my own business for years I never did it because of the nice and consistent paychecks I got from jobs. My IT field has been infrastructure -though I have a degree in CS and have done development and programming, the last 15 years have been infrastructure i.e. servers, windows/linux/unix, storage, networks, cloud solutions/migrations etc. Out of those 12years I've been in middle upper management for about 8). So if started something on my own it would be consulting in those areas. A few other ideas I have are, take an open source product, remove the complexity and turn it into a turn-key product. Yet another idea is to start an IT placement business since i've done enough hiring and firing and come from a hands-on technical background I can tell pretty easily if someone's a good fit for a given technical position. Or get out of IT/tech altogether and run a store/shop/franchise, Togos/Subway etc.

I wholeheartedly agree with your advice. As much as I've always wanted to start my own business for years I never did it because of the nice and consistent paychecks I got from jobs. My IT field has been infrastructure -though I have a degree in CS and have done development and programming, the last 15 years have been infrastructure i.e. servers, windows/linux/unix, storage, networks, cloud solutions/migrations etc. Out of those 12years I've been in middle upper management for about 8). So if started something on my own it would be consulting in those areas. A few other ideas I have are, take an open source product, remove the complexity and turn it into a turn-key product. Yet another idea is to start an IT placement business since i've done enough hiring and firing and come from a hands-on technical background I can tell pretty easily if someone's a good fit for a given technical position. Or get out of IT/tech altogether and run a store/shop/franchise, Togos/Subway etc.

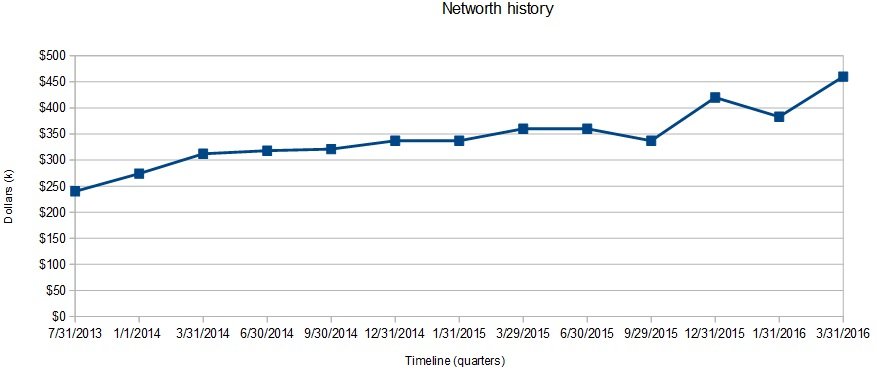

) when I started this thread I was at $240k so my networth doubled in exactly three years, I'll take it!

) when I started this thread I was at $240k so my networth doubled in exactly three years, I'll take it!