PennStateCLJ

Dryer sheet aficionado

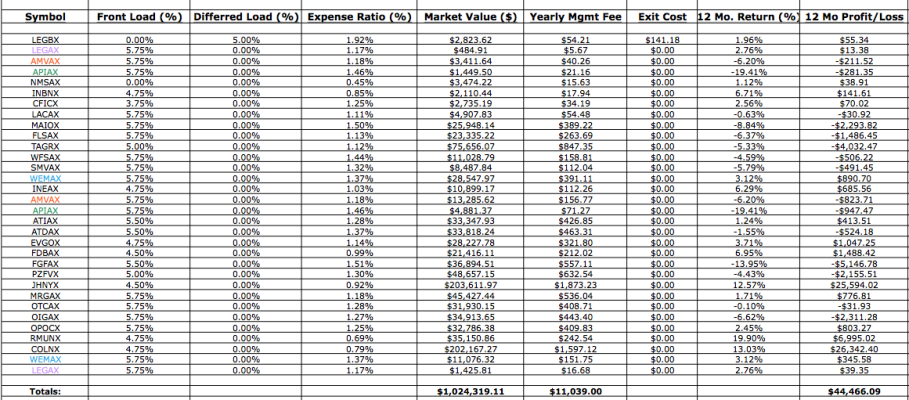

Just for future use- I think the only kind of annuity you ever "need" to buy is the SPIA- Single Premium Immediate Annuity. You give insurance company X dollars in a lump sum and they pay you $xxx.xx monthly for life. Kind of like creating your own pension. There are many hidden costs in variable and fixed annuities that really just extract more money from you. The same applies to cash value life insurance- also called whole life/universal life/variable universal life/permanent life insurance. Unlike mutual fund companies, insurance companies are not required to list all their costs. Insurance companies have been called invisible bankers because they control as much money as banks but are much less regulated. Expensive educations hurt. I know because I started one of these without knowing what I was really buying. I encountered a similar surrender penalty. Lesson learned.