Welcome to the group!

First I think it's vital that you gain a good understanding yourself before taking any action on recommendations (including mine).

So I think the questions asked previously about what you need to retire, how much you spend, etc are vital.

For investing I think it's vital to understand taxes, fees and inflation... more important than market returns because you can control them more

. I recommend reading jlcollins series on it... it also covers some elements of retirement.

http://jlcollinsnh.com/stock-series/

Now my personal advice which should be taken with grains of salt.

The biggest revelation for me was understanding that the way investments work is like a job.

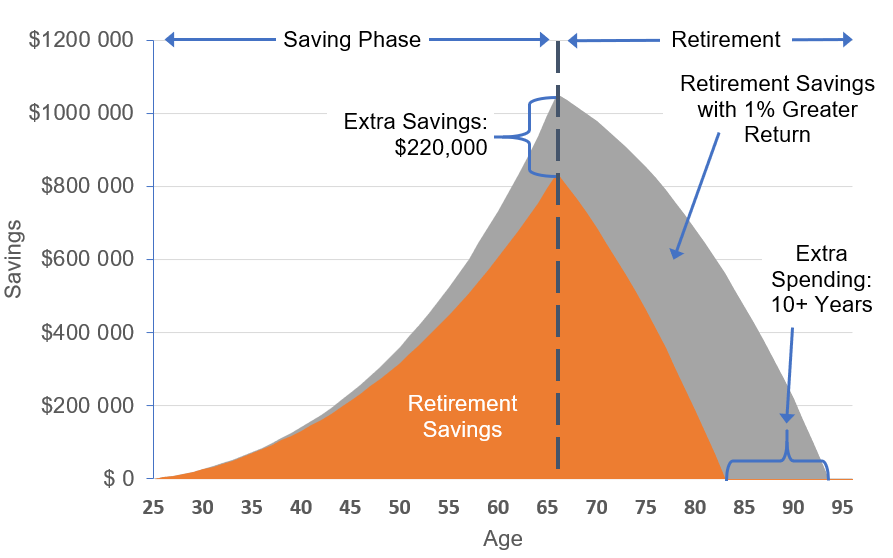

If you have 500K for example, you can expect that job to pay you around 20K/year inflation adjusted forever. That's using the 4% rule" which you can find out about and easily adjust.

If you're gainfully employed, your income is a second job

... if not, you have to live on that income your asset job brings in.

So I remove the 500K and replace it with 20K/yr.

Why? Because that's my basis for figuring out what I am willing to spend on services, fees, etc.

Financial services tend to charge based on assets managed... so 1.5% on 500K is 7.5K. If there's an average 1% fund fee on top that's another 5K bringing the total to 12.5K.

If I look at 500K that's doesn't seem like that much... if I take the income view (20K) I'm giving over half my pay away for someone else to manage it. So that's a pretty big chunk.

Then I can ask myself what I get for that? If they can beat the market consistently by 50% maybe it's worth it. If they keep me from doing really stupid things maybe it's worth it. Personally I try to keep those numbers as low as possible.

I also include CPA, legal advice, insurance people, taxes, etc. Anyone who "helps" me manage my money is paid by that 20K... and what's left over after all those costs is what my job actually pays.

Then I look at what hurts my pay the most and try to get rid of it. Taxes are hard to get rid of, inflation is hard to control, stock returns I don't think I can change much. So that leaves fees and advice rates.

The good news is this forum chargers 0% for AUM and many members give equally good advice if not better

. Since it's a bunch of retired people with little or nothing to do all day

they can afford to be honest as well.

Keep digging... I'm sure you'll figure out what works for you best!

Sent from my HTC One_M8 using Early Retirement Forum mobile app