Franklin

Recycles dryer sheets

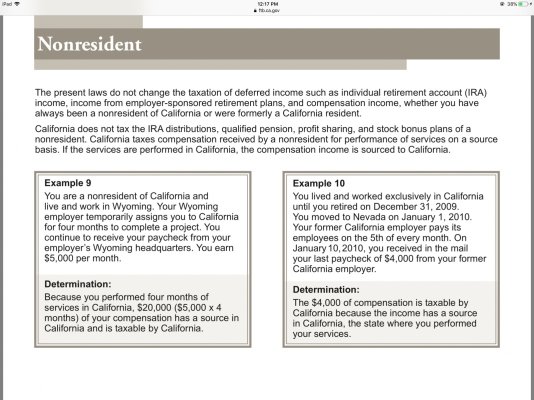

Does anyone gave a good resource center for deferred comp. I have a question about which state will tax my distributions. I earned all of the monies in a high tax state and plan to move to a low tax state once the distributions begin. The distributions are mixed per each year I deferred. Some will payout over 5 years and others I ran out to 15 years. From my research so far I get mixed messaging. I'd hate to have the high tax state take their cut once I move to the low cost state (then have the low cost state ask for their cut once I move). Anyone out there have experience with this?