|

|

10-30-2012, 08:46 AM

10-30-2012, 08:46 AM

|

#21

|

|

Full time employment: Posting here.

Join Date: Feb 2012

Posts: 648

|

Quote: Quote:

Originally Posted by Nords

For starters, losing 50% of buying power over a decade implies a sustained inflation rate over 7%/year.

|

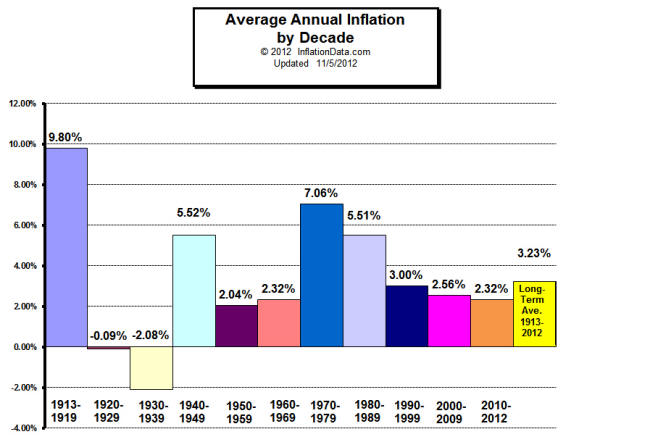

Inflation average above 7% has happened twice in the last 100 years (1920's and 1970's)... and above 5.5% has happened four times (1920's, 1940's, 1970's and 1980's).

In fact, over the last 100 years we've never had 3 straight decades with inflation averaging less than 5.5%... some people like to think that our government can control it today, but historically speaking I wouldn't count on anything less than 5% on average for the next 10-20 years; we've been hovering extremely low on the inflation scale for the last 22 years. We're due for a correction.

Inflation is a disaster to those of us who have accumulated wealth, but for those carrying massive debt (like our government and many in CC debt or underwater homes) inflation will actually slowly, ironically heal many problems by essentially taking from those with capital and giving to those without. It erases the size of debt while raising wages. It's where we're headed, I'm sure of it.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

10-30-2012, 08:52 AM

10-30-2012, 08:52 AM

|

#22

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2009

Posts: 9,343

|

Quote: Quote:

|

Originally Posted by marko

In some parts of the country $35-45K is considered subsistence living.... and the only travel is to the food pantry. Respectfully, can you really live 'middle class' on $35K? (45K minus 10K travel)

|

It certainly depends on where you live, and remember he has no debts. When my financial obligations of my child ends next year, I will be at that level. In fact, paying for my own HI, having a mortgage, factoring in a new car payment with no money down the road, and budgeting $500 on month on entertainment, my yearly retirement budget expenses are still slightly under $40k. My budget really isn't even determined by my finances, as I still have close to $2k a month left over each month ($3500 counting my PT job). I don't lack for anything, so yes it's certainly doable in the right location. Of course being single, and healthy certainly helps in my expenses being lower, though, but a lot of people also don't carry a mortgage, or car payment either while retired, which certainly lower their costs.

|

|

|

10-30-2012, 09:40 AM

10-30-2012, 09:40 AM

|

#23

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by marko

In some parts of the country $35-45K is considered subsistence living.... and the only travel is to the food pantry. Respectfully, can you really live 'middle class' on $35K? (45K minus 10K travel)

|

Sure! In 2011 the median household income was right at $50,000. Statistically, I would say that amount of income affords one a middle class existence, since half the households in the US live on less than that (some of which periodically visit the food pantry).

The typical $50,000 per year household works for a living. In contrast, I'll be collecting dividends, long term cap gains, and maybe a little IRA withdrawal here and there (in other words, very tax efficient income vs tax inefficient ordinary income from W-2 employment). I won't have a job and the payroll taxes and costs of employment associated with it (car maintenance and depreciation, gas, parking, tolls, work clothes, lunches out, paying a premium because I am limited as to when I can consume goods and services due to work). I will have a paid off house, unlike the typical household, so I won't have a mortgage.

$50,000 middle class income, minus:

3800 payroll tax (7.65% on $50,000

2000 state and fed income tax due to working

2000 Extra work expenses (commuting, work clothes, lunches out etc)

7200 Mortgage ($600/month)

From the $50,000 middle class income, we are left with $35,000 a year to pay for everything else that I will have to pay (except $10,000 per year foreign travel). I would say that is the amount to buy you an average middle class lifestyle in the US overall.

We can debate forever what does "middle class" mean. If one is accustomed to earning $200,000 or $300,000 per year and their peers are similarly situated, then I understand the difficulty in grasping how one could live a middle class lifestyle on $50,000 per year (working with a mortgage) or $35000 per year as an ER.

I'll throw a broad range out there for what constitutes "middle class": $40,000 to $250,000. A South Dakota teacher, fire fighter or police officer making $40,000/yr with a stay at home spouse can afford a middle class lifestyle, as could a pair of NYC apartment dweller 30-ish parents of young kids, whose jobs pay $125,000 each. Obviously the NYC couple could afford what most would consider more luxurious things, but at the end of the day, child care, taxes, and larger cost of living will eat up a huge chunk of disposable income. One couple might like steaks or burgers on Friday nights, the other might dine on molecular food at a gastropub.

And for our household, we are currently spending what will add up to around $35000 after adding in and taking our expenses that will change once we aren't working any more.

There has been so much debt fueled lifestyle inflation the last couple decades it is hard to remember that half the nation does actually earn less than $50,000 and gets along just fine, just not quite as fine as the other half. But that is ok!

__________________

Retired in 2013 at age 33. Keeping busy reading, blogging, relaxing, gaming, and enjoying the outdoors with my wife and 3 kids (8, 13, and 15).

|

|

|

10-30-2012, 11:15 AM

10-30-2012, 11:15 AM

|

#24

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,418

|

Holy crap! I gotta move out of the Boston area!!

Cheapo rents here are $14K a year (a nice place will set you back $20-$30K) and even if you own your house debt free, property taxes hover around $6-8K. Another $1200 for heat, another $10-15K for mandatory HI, plus taxes on income, excise, sales, meals, gas, road tolls... $50K won't go far.

Might be time...........sounds like I could double my lifestyle by getting out of Dodge!

But wait! I might miss all the legendarily pleasant and super friendly natives and the refreshing below zero winters!

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

10-30-2012, 12:15 PM

10-30-2012, 12:15 PM

|

#25

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

My nephew just moved to Manhattan, and rented a little studio for $2K/month somewhere near the UN. He said neighbors of his included a retired couple, who had a real apartment which would have cost quite a bit more. I guess if one wants an exciting city life, one has to pay. I am glad my tastes run cheaper.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

10-30-2012, 01:01 PM

10-30-2012, 01:01 PM

|

#26

|

|

Moderator Emeritus

Join Date: May 2007

Posts: 12,901

|

Quote: Quote:

Originally Posted by NW-Bound

My nephew just moved to Manhattan, and rented a little studio for $2K/month somewhere near the UN. He said neighbors of his included a retired couple, who had a real apartment which would have cost quite a bit more. I guess if one wants an exciting city life, one has to pay. I am glad my tastes run cheaper.

|

Moving from the deep south to San Francisco, we have seen our cost of living increase dramatically... But it's almost entirely due to housing and state income taxes. Surprisingly, the rest of our budget has remained virtually unchanged.

Housing cost went up because we went from living in a paid for house to renting an apartment near downtown SF. Owning a condo outright instead of renting would probably go a long way towards reducing those housing costs.

|

|

|

10-30-2012, 01:19 PM

10-30-2012, 01:19 PM

|

#27

|

|

Recycles dryer sheets

Join Date: Jan 2010

Posts: 91

|

Quote: Quote:

Originally Posted by marko

In some parts of the country $35-45K is considered subsistence living.... and the only travel is to the food pantry. Respectfully, can you really live 'middle class' on $35K? (45K minus 10K travel)

|

Quote: Quote:

Originally Posted by Mulligan

It certainly depends on where you live, and remember he has no debts. When my financial obligations of my child ends next year, I will be at that level. In fact, paying for my own HI, having a mortgage, factoring in a new car payment with no money down the road, and budgeting $500 on month on entertainment, my yearly retirement budget expenses are still slightly under $40k. My budget really isn't even determined by my finances, as I still have close to $2k a month left over each month ($3500 counting my PT job). I don't lack for anything, so yes it's certainly doable in the right location. Of course being single, and healthy certainly helps in my expenses being lower, though, but a lot of people also don't carry a mortgage, or car payment either while retired, which certainly lower their costs.

|

We are at that level of spending ($40-$45) for a family of 4 (and children are 4 & 1, so still our financial obligation for quite some time). We live well below our means and I will also agree that we don't feel that any area of our lives is lacking. In fact, I still see many areas in which we could spend less and have less stuff. We are in Philly suburbs. Not a low cost rural area, but not the SF bay area, either.

To the OP, the numbers look good. Go for it.

|

|

|

10-30-2012, 02:06 PM

10-30-2012, 02:06 PM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by FUEGO

Sure! In 2011 the median household income was right at $50,000. Statistically, I would say that amount of income affords one a middle class existence, since half the households in the US live on less than that (some of which periodically visit the food pantry).

|

You mind is made up, so congrats. But remember that at least 25% of that bottom 50% are getting aid and non-cash services and even some cash not counted as income. A free cell phone, a book full of food stamps, subsidized lunches for the kids, Medicaid, Section 8 subsidies, et cetera can make a big difference.

And I am sure that those food stampers I see in the market wearing fashionable shoes and long leather coats are getting some cash that wolud not be counted in your income statistics.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

10-30-2012, 03:18 PM

10-30-2012, 03:18 PM

|

#29

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by haha

You mind is made up, so congrats. But remember that at least 25% of that bottom 50% are getting aid and non-cash services and even some cash not counted as income. A free cell phone, a book full of food stamps, subsidized lunches for the kids, Medicaid, Section 8 subsidies, et cetera can make a big difference.

And I am sure that those food stampers I see in the market wearing fashionable shoes and long leather coats are getting some cash that wolud not be counted in your income statistics.

Ha

|

Ha, you know I'm defining middle class living as living at the median HH income, right? The governmental transfers to the bottom 25% of the bottom half of the population has zero direct impact on the median HH income. I am also certain that some of those households earning $50,000 are receiving some of this government largesse that you are talking about. But many middle class and upper class families do (mortgage interest deduction, anyone?).

Informal income earned by the bottom quintile or quartile or third of the population also has no impact on the median HH income. Although, again, I am certain that some households even at the median income level still receive some informal income. That doesn't water down my basic assertion that you can live a middle class income at $35k/yr (as an ER) or $50k per year (as a wage earner). I understand that costs of living vary greatly region to region, so maybe that is why I see things one way and others don't see it the same way. I certainly wouldn't want to ER to a large NE city or a big Pacific Coast city on $35k/yr. It wouldn't stretch nearly as far as it does here in the city in the southeast US. But what is the point of discussing it, our minds are made up.

__________________

Retired in 2013 at age 33. Keeping busy reading, blogging, relaxing, gaming, and enjoying the outdoors with my wife and 3 kids (8, 13, and 15).

|

|

|

10-30-2012, 04:19 PM

10-30-2012, 04:19 PM

|

#30

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by FUEGO

Ha, you know I'm defining middle class living as living at the median HH income, right? The governmental transfers to the bottom 25% of the bottom half of the population has zero direct impact on the median HH income. I am also certain that some of those households earning $50,000 are receiving some of this government largesse that you are talking about. But many middle class and upper class families do (mortgage interest deduction, anyone?).

Informal income earned by the bottom quintile or quartile or third of the population also has no impact on the median HH income. Although, again, I am certain that some households even at the median income level still receive some informal income. That doesn't water down my basic assertion that you can live a middle class income at $35k/yr (as an ER) or $50k per year (as a wage earner). I understand that costs of living vary greatly region to region, so maybe that is why I see things one way and others don't see it the same way. I certainly wouldn't want to ER to a large NE city or a big Pacific Coast city on $35k/yr. It wouldn't stretch nearly as far as it does here in the city in the southeast US. But what is the point of discussing it, our minds are made up.  |

Agree on the bold! Way too much waffling today!

But maybe I don't understand how median household income is determined. I have never looked into it.

If a family has low enough income to qualify for goodies, do they not get counted as a household? "Hey you, stand over there, you're no household!"

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

10-30-2012, 05:08 PM

10-30-2012, 05:08 PM

|

#31

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2010

Location: midwestern city

Posts: 4,061

|

Yes. I live on $30,000-$40,000 a year (I live on my own) which is a small percentage of my income. My standard of living is "middle class" although my income is "upper class".

Quote: Quote:

|

Originally Posted by marko

Respectfully, can you really live 'middle class' on $35K? (45K minus 10K travel)

|

__________________

Very conservative with investments. Not ER'd yet, 48 years old. Please do not take anything I write or imply as legal, financial or medical advice directed to you. Contact your own financial advisor, healthcare provider, or attorney for financial, medical and legal advice.

|

|

|

10-30-2012, 07:19 PM

10-30-2012, 07:19 PM

|

#32

|

|

Full time employment: Posting here.

Join Date: Jan 2012

Posts: 518

|

Seems that housing cost is the real wildcard, aside from health insurance. We pay more in HOA dues alone than some of the mortgage amounts described.

I suppose this is why some folks retire comfortably on 1.2 million, while others need twice that to meet expenses.

SIS

|

|

|

10-30-2012, 09:02 PM

10-30-2012, 09:02 PM

|

#33

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by ShortInSeattle

Seems that housing cost is the real wildcard, aside from health insurance. We pay more in HOA dues alone than some of the mortgage amounts described.

I suppose this is why some folks retire comfortably on 1.2 million, while others need twice that to meet expenses.  |

We don't plan on needing a lot more than that (unless we are just running up the score). No HOA does help, and property taxes of only $1400/yr (yet great municipal services are provided).

I totally get that $35000 net a year in, say SF or NYC or Boston would not provide a comfortable lifestyle. Apparently even if you had a paid off residence, you may spend 1/3 to 1/2 your budget on property taxes or other high taxes.

__________________

Retired in 2013 at age 33. Keeping busy reading, blogging, relaxing, gaming, and enjoying the outdoors with my wife and 3 kids (8, 13, and 15).

|

|

|

10-30-2012, 09:11 PM

10-30-2012, 09:11 PM

|

#34

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by haha

Agree on the bold! Way too much waffling today!

But maybe I don't understand how median household income is determined. I have never looked into it.

If a family has low enough income to qualify for goodies, do they not get counted as a household? "Hey you, stand over there, you're no household!"

|

Always fund to butt heads with you, Ha.

My point, not well illustrated I suppose, was that if the bottom quartile hid $5000-10000 per household in income, as long as it didn't push them into the 50th percentile, hence the median, then the median household income remains unchanged. The 25th percentile could earn $20000 or $30000 or $40000 and the median would still be $50000.

I don't think they exclude anyone from the calcs. Maybe inmates in custody? That does add up to a few million people, but probably not a big impact on median. A bigger question might be how do they account for governmental transfers in the household income totals. If I get $10,000 in welfare benefits does that count in my income?

__________________

Retired in 2013 at age 33. Keeping busy reading, blogging, relaxing, gaming, and enjoying the outdoors with my wife and 3 kids (8, 13, and 15).

|

|

|

10-30-2012, 09:18 PM

10-30-2012, 09:18 PM

|

#35

|

|

Full time employment: Posting here.

Join Date: Sep 2011

Location: Bushnell

Posts: 607

|

Quote: Quote:

|

Originally Posted by FUEGO

We don't plan on needing a lot more than that (unless we are just running up the score). No HOA does help, and property taxes of only $1400/yr (yet great municipal services are provided).

I totally get that $35000 net a year in, say SF or NYC or Boston would not provide a comfortable lifestyle. Apparently even if you had a paid off residence, you may spend 1/3 to 1/2 your budget on property taxes or other high taxes.

|

Actually, one can live reasonably well in NYC on $35k per year. I live in Manhattan and that's about what I will spend this year. And that includes some fun vacations and a car (which I park on the street but rarely drive). The key is that I own my apartment free and clear and pay a very modest monthly maintenance fee. Property taxes are less than $4k for me. Plus I have a great girlfriend who shares my frugal habits.

|

|

|

10-30-2012, 09:24 PM

10-30-2012, 09:24 PM

|

#36

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by truenorth418

...a car (which I park on the street but rarely drive).

|

My nephew had to leave his baby behind, an Audi with a V-8 and a 6-spd transmission. He said it cost too much to park. Maybe he did not know where to leave it on the street.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

10-30-2012, 10:39 PM

10-30-2012, 10:39 PM

|

#37

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by truenorth418

Plus I have a great girlfriend who shares my frugal habits.

|

If she looks like your avatar, you hit the jackpot.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

10-31-2012, 12:26 AM

10-31-2012, 12:26 AM

|

#38

|

|

Moderator Emeritus

Join Date: Dec 2002

Location: Oahu

Posts: 26,860

|

Quote: Quote:

Originally Posted by EvrClrx311

Inflation average above 7% has happened twice in the last 100 years (1920's and 1970's)... and above 5.5% has happened four times (1920's, 1940's, 1970's and 1980's).

In fact, over the last 100 years we've never had 3 straight decades with inflation averaging less than 5.5%... some people like to think that our government can control it today, but historically speaking I wouldn't count on anything less than 5% on average for the next 10-20 years; we've been hovering extremely low on the inflation scale for the last 22 years. We're due for a correction.

|

You're saying that there's a 20% chance (20/100) or perhaps only a 2.2% chance (two rolling 10-year periods out of 90 of them) that inflation will exceed 7%/year for 10 years. Based on this, he's supposed to invest in the stock market? What if inflation doesn't revert to the mean?

The last few decades of growing computing power and better data collection may have changed our ability to cope with inflation more significantly than anything we've done since getting off the gold standard. One of those 7%+ periods was during a World War, the other during Vietnam. We've been at war for over a decade yet inflation seems to have dropped during that decade.

I wonder if three straight decades of lower inflation implies that we're getting a handle on its causes and collecting the right kinds of data to track it.

But I don't waste my time trying to forecast inflation when I can just diversify to live with it. Stocks are one way, but they're not the only way. And if someone doesn't have the desire to own stocks (especially based on negative experiences) then they're highly unlikely to follow that advice anyway.

Back to OP's example. All of his expenses are met from rental income. He has a big cash stash left over and he's been burned by the stock market before. Which scenario is he more likely to pursue?

1. Invest his cash in the stock markets and learn how to "stay the course" through whatever volatility or inflation or other economic impacts come our way.

2. Hold his cash in CDs and pray for high inflation and a big recession to crater the local real estate market. Then he can scoop up more foreclosed properties for huge cash discounts, raising his rental income even further and giving himself more of a cushion against that inflation.

He seems to be doing pretty well for himself with real estate and cash. Why invest in asset classes that he doesn't like and is unlikely to hold on to?

__________________

*

Co-author (with my daughter) of “Raising Your Money-Savvy Family For Next Generation Financial Independence.”

Author of the book written on E-R.org: "The Military Guide to Financial Independence and Retirement."

I don't spend much time here— please send a PM.

|

|

|

10-31-2012, 06:16 AM

10-31-2012, 06:16 AM

|

#39

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

$35,000 to $40,000 taken partially from already taxed money in your investments will let you grab a lot of those government benefits (subsidized healthcare, tax credits, etc.).

It may be that $40,000, of which at least $20,000 is taken from already taxed money, is equivalent to a job income of $55,000 to $65,000. Remember, you don't pay SS, medicare, or even much state or federal tax with dividend and capital gains of only $20,000/yr for a married couple.

|

|

|

10-31-2012, 08:21 AM

10-31-2012, 08:21 AM

|

#40

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2007

Posts: 7,746

|

Quote: Quote:

Originally Posted by truenorth418

Actually, one can live reasonably well in NYC on $35k per year. I live in Manhattan and that's about what I will spend this year. And that includes some fun vacations and a car (which I park on the street but rarely drive). The key is that I own my apartment free and clear and pay a very modest monthly maintenance fee. Property taxes are less than $4k for me. Plus I have a great girlfriend who shares my frugal habits.

|

There you go, you prove the case! Middle class (or just comfortable?) lifestyle in Manhattan at $35k/yr. Probably easier with you by yourself (my assumption?) than with a family of 5 like we have here in the southeast (where we have a 4 BR house). We could easily move to a studio or 1-2 BR apartment here in the SE and cut the housing costs more obviously. But housing is relatively cheap here so a larger house is something we choose to spend up on. I wonder what a lakefront 4 BR house on 1/3 acre would run in Manhattan?

__________________

Retired in 2013 at age 33. Keeping busy reading, blogging, relaxing, gaming, and enjoying the outdoors with my wife and 3 kids (8, 13, and 15).

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|