My advisor was nice too, that is, until I started moving money away from Ameriprise. The best thing to do is have your Ameriprise statements ready and call Vanguard, Schwab, etc and you can discuss what you have and what they can do as well as any tax consequences. Ameriprise will show returns without taking into account their fees and they will cherry pick the time period. They've been perfecting their operation and pitches for many years. They have material and presentations to handle about anything you could throw at them.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hi! Ameriprise client needing advice...

- Thread starter cucumber

- Start date

REattempt

Recycles dryer sheets

- Joined

- Feb 27, 2010

- Messages

- 293

Wow...

Cucumber,

Hang in there! You are on the right path by asking the questions!

If you want a really good book that is easy to read and one of the best that encapsulates most of the arguments you need, try this:

The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between: William J. Bernstein, Jonathan Clements: 9781118073766: Amazon.com: Books

If it makes you feel any better, I have an MBA from a top 5 business school, been thinking about financial issues and planning retirement since I was 20. Granted I was busy working, but after a couple of questionable financial advisors recommended by friends, I decided I really needed to study and figure it out. I spent 2 years (I was working) reading, cross-correlating and building an understanding of what I should do and why. Moving from my FA was still incredibly difficult because of all the psychological issues with smart people making bad financial decisions. FA's can be very persuasive salespeople.

Right at the end of my 2 years of study, as I was selling my business for a significant amount of money and about to retire, another friend suggested I talk to Alliance Bernstein (AB)...these guys are "private wealth management." Very upscale and serve "High Net Worth" individuals. Personalized service, office in the highest building in the city, posh offices, secretaries, drinks, warm cookies.

I had given them some prelims of my holdings and they had prepared a special spiral bound notebook with 8x11.5 color glossies of my future, complete with Monte Carlo simulations. I thought, OK, I'll test my knowledge with them and challenge them with the best I got.

I was ready. All the pieces fell into place and they had no answers for my questions. Lots of sales, no substance. I even used an obscure piece on the falicy of Monte Carlo simulations that Jim Otar had done. When the FA was silent, didn't have any answers, and it was obvious he was in over his head, he brought in the Managing Partner. We went through it again for another 1/2 hour. Loved the cookies by the way. When he couldn't counter my arguements for low-cost, passive, index investing with a value tilt...the coup di grace...they admitted that if they didn't work at AB they would do what I was doing. I was stunned and said nothing. You could hear a pin drop. THAT was a powerful moment.

It was like NEO in the Matrix when he could finally "see" the Matrix.

It all became clear. I realized I was worrying about it too much. That everything I had learned was right. The transition conversations still weren't easy. The good part is the when I told my FA, he told me I would do fine. He actually handled it well without a whole lot of pushback.

So, moral of the story, do your research. Start with the book I mentioned above. Of the 50+ books I read, it is the best, easiest to read encapsulation of all the others. I gave a copy to my child when they turned 18 (along with a collection of books I felt important they have) and said "follow this and be confident."

At some point, if you spend the time, do the research, develop your understanding, you too will see the Matrix.

Cucumber,

Hang in there! You are on the right path by asking the questions!

If you want a really good book that is easy to read and one of the best that encapsulates most of the arguments you need, try this:

The Investor's Manifesto: Preparing for Prosperity, Armageddon, and Everything in Between: William J. Bernstein, Jonathan Clements: 9781118073766: Amazon.com: Books

If it makes you feel any better, I have an MBA from a top 5 business school, been thinking about financial issues and planning retirement since I was 20. Granted I was busy working, but after a couple of questionable financial advisors recommended by friends, I decided I really needed to study and figure it out. I spent 2 years (I was working) reading, cross-correlating and building an understanding of what I should do and why. Moving from my FA was still incredibly difficult because of all the psychological issues with smart people making bad financial decisions. FA's can be very persuasive salespeople.

Right at the end of my 2 years of study, as I was selling my business for a significant amount of money and about to retire, another friend suggested I talk to Alliance Bernstein (AB)...these guys are "private wealth management." Very upscale and serve "High Net Worth" individuals. Personalized service, office in the highest building in the city, posh offices, secretaries, drinks, warm cookies.

I had given them some prelims of my holdings and they had prepared a special spiral bound notebook with 8x11.5 color glossies of my future, complete with Monte Carlo simulations. I thought, OK, I'll test my knowledge with them and challenge them with the best I got.

I was ready. All the pieces fell into place and they had no answers for my questions. Lots of sales, no substance. I even used an obscure piece on the falicy of Monte Carlo simulations that Jim Otar had done. When the FA was silent, didn't have any answers, and it was obvious he was in over his head, he brought in the Managing Partner. We went through it again for another 1/2 hour. Loved the cookies by the way. When he couldn't counter my arguements for low-cost, passive, index investing with a value tilt...the coup di grace...they admitted that if they didn't work at AB they would do what I was doing. I was stunned and said nothing. You could hear a pin drop. THAT was a powerful moment.

It was like NEO in the Matrix when he could finally "see" the Matrix.

It all became clear. I realized I was worrying about it too much. That everything I had learned was right. The transition conversations still weren't easy. The good part is the when I told my FA, he told me I would do fine. He actually handled it well without a whole lot of pushback.

So, moral of the story, do your research. Start with the book I mentioned above. Of the 50+ books I read, it is the best, easiest to read encapsulation of all the others. I gave a copy to my child when they turned 18 (along with a collection of books I felt important they have) and said "follow this and be confident."

At some point, if you spend the time, do the research, develop your understanding, you too will see the Matrix.

Meadbh

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 22, 2006

- Messages

- 11,401

Great story, REattempt! I have had a similar experience, in which I learnt that I knew more about finance than some so called financial advisors.

Cucumber, you are getting great advice on this thread. Indexing makes sense by the numbers. The research is clear. Do take your time and educate yourself so that you can make a decision you are comfortable with based on data, not just opinions. Your FA is a salesperson who must meet targets. She is not your friend, no matter how hard she tries to make you think so. Attempts to bully you or stall transfer of your funds are unethical. As others gave said, if you do decide to transfer your portfolio to Vanguard or another indexing firm, get them to handle it for you.

Cucumber, you are getting great advice on this thread. Indexing makes sense by the numbers. The research is clear. Do take your time and educate yourself so that you can make a decision you are comfortable with based on data, not just opinions. Your FA is a salesperson who must meet targets. She is not your friend, no matter how hard she tries to make you think so. Attempts to bully you or stall transfer of your funds are unethical. As others gave said, if you do decide to transfer your portfolio to Vanguard or another indexing firm, get them to handle it for you.

I agree with REattempt that Investor's Manifesto is a great book. Unfortunately, it is difficult for someone new to the subject to digest. That's why I recommend Millionaire Teacher for newbies. Even my math deficient DW claimed it made sense and she understands our investments. William Berstein said he cut out a lot of the math and details but it is still a difficult read if you don't already have an understanding of the subject. Some math skills don't hurt but you can get through without worrying about the math. He is pretty thorough.

It's a big improvement in readability over the Four Pillars. I like to call it the "Seven Pillars" because it's hard to believe that only four pillars could be so dry and boring. I'm an engineer so the math skills were there. It was just way too deep for any but the most committed individuals trying to understand how and why indexing works so much better.

Another point is that I don't think it's necessary for cucumber to "win" any discussion with Ameriprise. He just needs to accept the fact that he is giving them money for nothing and get his accounts moved ASAP.

It's a big improvement in readability over the Four Pillars. I like to call it the "Seven Pillars" because it's hard to believe that only four pillars could be so dry and boring. I'm an engineer so the math skills were there. It was just way too deep for any but the most committed individuals trying to understand how and why indexing works so much better.

Another point is that I don't think it's necessary for cucumber to "win" any discussion with Ameriprise. He just needs to accept the fact that he is giving them money for nothing and get his accounts moved ASAP.

It all became clear. I realized I was worrying about it too much. That everything I had learned was right.

I gotta love this part. I read Investor's Manifesto along with several others about 2-3 months ago and it actually made sense.

You have clearly spent a lot more time on this, have a lot more education in it that I do (no MBA on this end) and my 457 rollover check will arrive at Vanguard sometime today to go into index funds.

The validation gives me a warm fuzzy.

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

I had given them some prelims of my holdings and they had prepared a special spiral bound notebook with 8x11.5 color glossies of my future, complete with Monte Carlo simulations. I thought, OK, I'll test my knowledge with them and challenge them with the best I got

I was ready. All the pieces fell into place and they had no answers for my questions. Lots of sales, no substance. I even used an obscure piece on the falicy of Monte Carlo simulations that Jim Otar had done.

Did you debate Dr. Markowitz and Sharpe too?

When the FA was silent, didn't have any answers, and it was obvious he was in over his head, he brought in the Managing Partner. We went through it again for another 1/2 hour. Loved the cookies by the way. When he couldn't counter my arguements for low-cost, passive, index investing with a value tilt...the coup di grace...they admitted that if they didn't work at AB they would do what I was doing. I was stunned and said nothing. You could hear a pin drop. THAT was a powerful moment.

Well, at least you were amused...........

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,264

Just a point to the last few posters.... and some of the FA that are on the board...

I do not have a problem with a FA for someone who freezes when it comes to making a financial decision... or to someone who is not interested in spending the time in keeping up with investing (think high paid Dr. or lawyer or internet millionaire)....

I know that one of my sisters would not have started to invest if it were not for a FA walking the halls of where she worked and talked her into investing... sure, it was not a great product as the fees were high.... but it got her started!!! Once her stash got bigger, then she started to take a longer look at fees etc. and decided to change... when I talk to her, she still thanks the FA for her start.... (BTW, she has been retired for a few years now and is doing just fine.... )

I do not have a problem with a FA for someone who freezes when it comes to making a financial decision... or to someone who is not interested in spending the time in keeping up with investing (think high paid Dr. or lawyer or internet millionaire)....

I know that one of my sisters would not have started to invest if it were not for a FA walking the halls of where she worked and talked her into investing... sure, it was not a great product as the fees were high.... but it got her started!!! Once her stash got bigger, then she started to take a longer look at fees etc. and decided to change... when I talk to her, she still thanks the FA for her start.... (BTW, she has been retired for a few years now and is doing just fine.... )

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

That's true. Even payday lenders perform a service that their customers are grateful for.Just a point to the last few posters.... and some of the FA that are on the board...

I do not have a problem with a FA for someone who freezes when it comes to making a financial decision... or to someone who is not interested in spending the time in keeping up with investing (think high paid Dr. or lawyer or internet millionaire)....

I know that one of my sisters would not have started to invest if it were not for a FA walking the halls of where she worked and talked her into investing... sure, it was not a great product as the fees were high.... but it got her started!!! Once her stash got bigger, then she started to take a longer look at fees etc. and decided to change... when I talk to her, she still thanks the FA for her start.... (BTW, she has been retired for a few years now and is doing just fine.... )

The other thing that struck me as annoying was when I mentioned that I might want to move some of our monies to a low-cost fund at Vanguard and the FA's response was that we could but we'd have to do it all ourselves and she wouldn't advise us on any of it. But isn't that why we pay her the annual fee of $750 so that she can manage our finances whether it be at Ameriprise or not? Because I would think she would need to advise us by taking into account all of our monies in total as opposed to just the money at Ameriprise in order to give us an accurate financial plan... Still waiting on a response from her in regards to the fund comparisons she made in her meeting.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,264

The other thing that struck me as annoying was when I mentioned that I might want to move some of our monies to a low-cost fund at Vanguard and the FA's response was that we could but we'd have to do it all ourselves and she wouldn't advise us on any of it. But isn't that why we pay her the annual fee of $750 so that she can manage our finances whether it be at Ameriprise or not? Because I would think she would need to advise us by taking into account all of our monies in total as opposed to just the money at Ameriprise in order to give us an accurate financial plan... Still waiting on a response from her in regards to the fund comparisons she made in her meeting.

NO, she is not responsible to put you in funds outside of Ameriprise.... if she put you in Vanguard, how is she going to make more money from you and hide it

Silly you

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

I know it's hard cutting ties with someone that has 'helped you'. Not trying to diagnose, the following is just something to think about. See if the information below helps explain. From Wikipedia:

MRG

Stockholm syndrome, or capture-bonding, is a psychological phenomenon in which hostages express empathy and sympathy and have positive feelings toward their captors, sometimes to the point of defending them. These feelings are generally considered irrational in light of the danger or risk endured by the victims, who essentially mistake a lack of abuse from their captors for an act of kindness.[1][2] The FBI's Hostage Barricade Database System shows that roughly 8% of victims show evidence of Stockholm syndrome.[3]

Link:

http://en.m.wikipedia.org/wiki/Stockholm_syndrome

MRG

Stockholm syndrome, or capture-bonding, is a psychological phenomenon in which hostages express empathy and sympathy and have positive feelings toward their captors, sometimes to the point of defending them. These feelings are generally considered irrational in light of the danger or risk endured by the victims, who essentially mistake a lack of abuse from their captors for an act of kindness.[1][2] The FBI's Hostage Barricade Database System shows that roughly 8% of victims show evidence of Stockholm syndrome.[3]

Link:

http://en.m.wikipedia.org/wiki/Stockholm_syndrome

easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

Cucumber,

Another argument (well, maybe too strong of a word) to go with indexing and DIY.

If even Warren Buffet couldn't beat the market consistently, what makes you think your FA has the further insight to do so?

Buffett posts record profit but loses again to S&P - Businessweek

Another argument (well, maybe too strong of a word) to go with indexing and DIY.

If even Warren Buffet couldn't beat the market consistently, what makes you think your FA has the further insight to do so?

Warren Buffett's Berkshire Hathaway reeled in record profits in 2013 as its wide-ranging businesses capitalized on the improving U.S. economy, though its performance again failed to keep pace with the surging S&P 500.

Buffett's preferred measure of Berkshire's performance is the growth in book value — its assets minus liabilities. By that measure, Berkshire gained a substantial 18.2 percent in 2013, but couldn't match the S&P 500's 32.4 percent run-up. That marks the fifth straight year that the company has underperformed the S&P. But in his letter, Buffett noted that over the full six-year market cycle — which would include the 2008 rock-bottom market year — the Omaha, Neb., company outperformed the benchmark index.

Buffett posts record profit but loses again to S&P - Businessweek

Nothing like a mention of Vanguard, and fees to scare the crap out of Amerprise.

It probably won't surprise you to learn that Blue fund is the BRBCX. Nor will it surprise long time forum members to learn the yellow fund is none other than Vanguard Wellesley.

If you have any more comparison of Amerprise vs Vanguard fund to make I am sure we can help provide a different view.

As soon as I mentioned moving my funds and Ameriprise's high fees, my FA quickly scheduled a meeting to discuss. I appreciate the comparison. I'll definitely look into the Vanguard Wellesley fund more closely and as soon as I obtain the fund comparisons from my FA, which I am still waiting for by the way, hopefully I can get your insight on whether she was just cherry-picking the funds or if it was legit. I think I know the answer but just would want to confirm and give her the benefit of the doubt.

Can you tell we're suspicious of her comparison method?

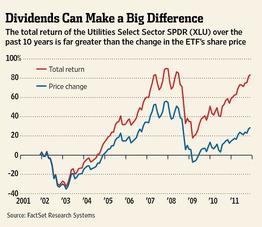

There's another trick used to stack the deck for a particular comparison: comparing price appreciation for one fund against the total return of another fund.

An example of how including reinvested dividend and capital gains distributions makes a very significant difference:

As clifp suggests, the "appreciation from $10,000 invested" comparison avoids this.

I'm curious. Did she share copies of her comparison data with you? Or just attempt to dazzle you with a slide show? If the latter, it's very likely an indication of the comparison's validity.

I'm still waiting for her to provide it to me. It literally would take her a minute out of her day to send it to me since she had it printed out. I'm very ashamed to say that I'm not really sure exactly what she compared because she went over it so quickly and just pointed out some numbers that showed her fund performed better that I was thrown off. Hopefully if and when she provides her comparison data that I will be able to tell if she was BSing us or not.

I finally learned how to use the multi-quote!

Wouldn't I just be able to roll it over to Vanguard in kind? When I call Vanguard, they should be able to advise me on the best and most tax-efficient method, right?

Thanks for the support!! I think I'm almost there...

Very good point!!

Thanks for your support!! I didn't think it would be this difficult to break away but I'm having a more difficult time doing it than I imagined. The 529 certainly got me fired up on top of the VUL she has us invested in...

HAHAHA!!! Very true story!! This is my Ameriprise rehab. You all are helping me so much!! I will be Ameriprise-free soon, I hope.

I thought I liked our interaction but now that my eyes have been opened to reality, I'm not all that fond of our Ameriprise interaction. We actually have been contributing monthly to our brokerage account that has a back-end load if withdrawn before a year. I'm thinking that I want to stop those contributions immediately. And the front-end load, really got me fired up and honestly I wanted to fire her on the spot when I found out but didn't have the heart.

Great story! Unfortunately I'm learning that the hard and expensive way.

Find out the tax implications of moving this money. You need to understand this in any case. Then, people here can help you reallocate it at Vanguard.

Wouldn't I just be able to roll it over to Vanguard in kind? When I call Vanguard, they should be able to advise me on the best and most tax-efficient method, right?

The only thing keeping you handcuffed to Ameriprise is your reluctance to use the key you hold in your hand. Be strong - do it.

Thanks for the support!! I think I'm almost there...

I am absolutely dumbfounded that OP finds it necessary to engage in a debate with the FA about the merits of Vanguard vs. Ameriprise. When I go to the bank to withdraw money, I would be aghast if the teller started arguing with me about whether I should make the withdrawal. It's none of their business, and I would certainly report such behavior from a teller to the bank's management. I don't see why the same shouldn't happen to this FA.

Very good point!!

You don't see it yet but you did very well. Use the 529 as your motivation.

Thanks for your support!! I didn't think it would be this difficult to break away but I'm having a more difficult time doing it than I imagined. The 529 certainly got me fired up on top of the VUL she has us invested in...

I think we are developing a reputation as a place for recovering Ameriprise clients to enter rehab and provide support for one another.

HAHAHA!!! Very true story!! This is my Ameriprise rehab. You all are helping me so much!! I will be Ameriprise-free soon, I hope.

If you like your interaction with Ameriprise, then continue asking them to compare your portfolio's funds with similar Vanguard index funds (the same ones each time), don't buy anything with a front-end or back-end load, and don't buy any annuities or insurance products. Your FA already slipped in one front-end load fund, that's pretty much a firing offense right there.

I thought I liked our interaction but now that my eyes have been opened to reality, I'm not all that fond of our Ameriprise interaction. We actually have been contributing monthly to our brokerage account that has a back-end load if withdrawn before a year. I'm thinking that I want to stop those contributions immediately. And the front-end load, really got me fired up and honestly I wanted to fire her on the spot when I found out but didn't have the heart.

This kinda reminds me of an anecdote on another forum. The poster had dropped by a car dealership to look at new cars. They took his car keys to "appraise" his trade in. When he decided he wanted to leave without buying, no one could find the keys to his car. The poor guy was stuck there for hours enduring a hard sell.

My point is that sales people will walk over you just as much as you let them. Sometimes you just have to assert yourself.

Great story! Unfortunately I'm learning that the hard and expensive way.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I think Vanguard will only go so far in advising you on tax matters. For instance, if VG fund states "tax-efficient" they will say tax-efficient! As far as you bringing taxable investments to them in a taxable brokerage, Vanguard will let you know if you can bring the investment, but they can't really give you tax advice.Wouldn't I just be able to roll it over to Vanguard in kind? When I call Vanguard, they should be able to advise me on the best and most tax-efficient method, right?

travelover

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 31, 2007

- Messages

- 14,328

............Wouldn't I just be able to roll it over to Vanguard in kind? When I call Vanguard, they should be able to advise me on the best and most tax-efficient method, right?..........

To roll over in kind, the exact same investment must be available at the new location (i.e. Vanguard). Ameriprise may have their own unique product. This is only a concern for after tax accounts, not IRAs or other tax deferred accounts.

Ready

Thinks s/he gets paid by the post

Cucumber, you will need to analyze how much capital gains you have in your taxable accounts and what the tax hit will be if you sell all the funds and move them into Vanguard index funds. This shouldn't be too difficult to do. Sadly, with all the fees you've been paying, I suspect the gains won't be so significant that you will need to pay all that much in taxes to make the move.

Worst case if you move all tax sheltered accounts asap, and sell the taxable funds over a couple of years to spread out the gains if need be.

Worst case if you move all tax sheltered accounts asap, and sell the taxable funds over a couple of years to spread out the gains if need be.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Cucumber, you will need to analyze how much capital gains you have in your taxable accounts and what the tax hit will be if you sell all the funds and move them into Vanguard index funds. This shouldn't be too difficult to do. Sadly, with all the fees you've been paying, I suspect the gains won't be so significant that you will need to pay all that much in taxes to make the move.

Worst case if you move all tax sheltered accounts asap, and sell the taxable funds over a couple of years to spread out the gains if need be.

+1 I was thinking the same thing. You need to figure out what the proceeds would be to liquidate each holding (considering back end fees and most importantly taxes). Then transfer/move in kind if possible all those where there is no or little cost. For those with significant cost you may need to cherry-pick and do it over time, wait for back-end fees to expire, etc.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,264

Cucumber, you will need to analyze how much capital gains you have in your taxable accounts and what the tax hit will be if you sell all the funds and move them into Vanguard index funds. This shouldn't be too difficult to do. Sadly, with all the fees you've been paying, I suspect the gains won't be so significant that you will need to pay all that much in taxes to make the move.

Worst case if you move all tax sheltered accounts asap, and sell the taxable funds over a couple of years to spread out the gains if need be.

One of the points of moving to Vanguard is to CHANGE FUNDS!!!!

The funds have high fees... sure, you want to do it as cheaply as possible, so you might have to time when you close out of a fund and move it to another, but I would not want to keep any of my money in the funds you have over the long term....

You are way overworking this. MOVE YOUR MONEY. I can't believe you have a $750 annual fee on top of all the high cost fees you are paying. We've all been trying to tell you over and over that your FA provides no value to you now that you know you can do it yourself.The other thing that struck me as annoying was when I mentioned that I might want to move some of our monies to a low-cost fund at Vanguard and the FA's response was that we could but we'd have to do it all ourselves and she wouldn't advise us on any of it. But isn't that why we pay her the annual fee of $750 so that she can manage our finances whether it be at Ameriprise or not? Because I would think she would need to advise us by taking into account all of our monies in total as opposed to just the money at Ameriprise in order to give us an accurate financial plan... Still waiting on a response from her in regards to the fund comparisons she made in her meeting.

From an early post you only have $50K in taxable money there. This can't generate a crushing level of capital gains to pay in one year. One of the big reason to move to Vanguard is to get access to the low fee funds. It makes no sense to move "in kind" and continue paying the high management fees.

Your FA will never "agree" that you should move your money to Vanguard. However, keep on pestering her and she may tell you to move to get rid of you.

Given your FA's slow response to fulfilling her commitment to get the info you asked, I suspect you are already headed for the door. She is probably hoping to get your assets in her numbers till the end of the quarter when sales performance is often measured for roles like hers.

Do the same favor she did for you when you put you in a front end loaded fund at 5.5%. Call Vanguard and start the move and see if you can get it done before the end of the quarter. ;-)

Nwsteve

Do the same favor she did for you when you put you in a front end loaded fund at 5.5%. Call Vanguard and start the move and see if you can get it done before the end of the quarter. ;-)

Nwsteve

Ready

Thinks s/he gets paid by the post

Maybe I'm just being crazy, but if the 5.5% front end load was not properly disclosed to me, I would demand that it be refunded to my account. That will bring the relationship to a head very quickly.

It was probably disclosed, if not in the fine-print of the documents that were actually signed, it was part of the clause that said "I agree to the terms set forth in the 35 page microtyped ACFA*" .Maybe I'm just being crazy, but if the 5.5% front end load was not properly disclosed to me, I would demand that it be refunded to my account. That will bring the relationship to a head very quickly.

Step one would be to set up an account at Vanguard today. Just a regular non-IRA Money Market account. Then drop by Ms. "Now I can't be bothered" FA's desk and stop any reinvestment of interest/dividends/CG from the existing Ameriprise accounts and have them sent to the Vanguard account. That stops the bleeding and lets the FA know that the game is over. Then take a look at all the funds with Ameriprise and see if there are any expiring back-end loads, CGs that are about to go over the 1 year mark, etc, or any other reason to wait a little longer--probably not. Then, as nwsteve suggested, get as much as possible out of there before the end of March.

After the funds are out, I'd see the branch manager about a prorated refund of the $750 advisors' fee for this year. Start nice: "This was a good first step for me, and got me started with investing. But, I came to see that the fees were more than I needed to pay, and that the advice did not put my interests first. I would like a refund for the unused portion of the year of advising I paid for." If that doesn't work, make a stink about telling your friends at work, that you'll be sure to comment on Angies List, and that you intend to write a letter to state regulators about not being told about the load and being shown misleading comparison information.

* Ameriprise Customer Fleecing Agreement

One of the points of moving to Vanguard is to CHANGE FUNDS!!!!

The funds have high fees... sure, you want to do it as cheaply as possible, so you might have to time when you close out of a fund and move it to another, but I would not want to keep any of my money in the funds you have over the long term....

I think you have a good point!! I'll probably end up just moving all my money over to Vanguard. Haven't decided on if I want to just suck it up and pay the back-end fee or leave it at Ameriprise until the back-end fee expires. This whole thing is a mess but on the bright side, I learned my lesson and I learned to save.

You are way overworking this. MOVE YOUR MONEY.

I can't believe you have a $750 annual fee on top of all the high cost fees you are paying. We've all been trying to tell you over and over that your FA provides no value to you now that you know you can do it yourself.

From an early post you only have $50K in taxable money there. This can't generate a crushing level of capital gains to pay in one year. One of the big reason to move to Vanguard is to get access to the low fee funds. It makes no sense to move "in kind" and continue paying the high management fees.

Your FA will never "agree" that you should move your money to Vanguard. However, keep on pestering her and she may tell you to move to get rid of you.

Thanks for the tough love! haha! I really appreciate your advice and I'm 99.9% sure that's where I'm headed. You made very valid points. After you mentioned it, I thought about it and it doesn't make sense to move the funds "in kind". Thanks for setting me straight and for your wisdom!!

Given your FA's slow response to fulfilling her commitment to get the info you asked, I suspect you are already headed for the door. She is probably hoping to get your assets in her numbers till the end of the quarter when sales performance is often measured for roles like hers.

Do the same favor she did for you when you put you in a front end loaded fund at 5.5%. Call Vanguard and start the move and see if you can get it done before the end of the quarter. ;-)

Nwsteve

I like the way you think!! She actually got back to me tonight. She didn't provide all the info that I asked for though. We did multiple comparisons but she only sent one of them. She said the file was too big. Really?!?! It was maybe 20 pieces of paper at most. Anyway, the comparison she sent was MFS International Value C (MGICX) vs the Vanguard International Value Inv (VTRIX). The MFS fund which she has me invested in appears to be performing better than the Vanguard fund. I'm guessing this is why she chose to send this one and not the other ones that we compared. Either way, I'll probably be calling Vanguard by the end of the week.

It was probably disclosed, if not in the fine-print of the documents that were actually signed, it was part of the clause that said "I agree to the terms set forth in the 35 page microtyped ACFA*" .

Step one would be to set up an account at Vanguard today. Just a regular non-IRA Money Market account. Then drop by Ms. "Now I can't be bothered" FA's desk and stop any reinvestment of interest/dividends/CG from the existing Ameriprise accounts and have them sent to the Vanguard account. That stops the bleeding and lets the FA know that the game is over. Then take a look at all the funds with Ameriprise and see if there are any expiring back-end loads, CGs that are about to go over the 1 year mark, etc, or any other reason to wait a little longer--probably not. Then, as nwsteve suggested, get as much as possible out of there before the end of March.

After the funds are out, I'd see the branch manager about a prorated refund of the $750 advisors' fee for this year. Start nice: "This was a good first step for me, and got me started with investing. But, I came to see that the fees were more than I needed to pay, and that the advice did not put my interests first. I would like a refund for the unused portion of the year of advising I paid for." If that doesn't work, make a stink about telling your friends at work, that you'll be sure to comment on Angies List, and that you intend to write a letter to state regulators about not being told about the load and being shown misleading comparison information.

* Ameriprise Customer Fleecing Agreement

You're correct!! The 5.75% fee was never told to us but probably was in the documents we signed.

I just think that is a sleazy thing to do... It's our fault though, even though we trusted her, we should know what we are signing.

I just think that is a sleazy thing to do... It's our fault though, even though we trusted her, we should know what we are signing. Thanks for the tip on stopping the reinvesting of dividends, interest & CG. I didn't even think of that. I'll contact her and let her know to put a stop to it.

I'm so excited for this whole ordeal to be over!!!!