NameRedacted

Recycles dryer sheets

- Joined

- Oct 23, 2016

- Messages

- 236

I don't want to use my real name until retired, I'm afraid. In the meantime you can call me NameRedacted but my close friends call me Name.

I've been lurking here for about 2-3 weeks and I wish I had found this site earlier. I'm most impressed with the depth and breadth of knowledge displayed here.

I'm 55 and planning to hand in my notice on December 16th (just 69 days, 9.85 weeks, 2.26 months or 0.189 years to go). I pretty much have to wait until then as I have a large chunk of stock options vesting on December 15th, otherwise I'd quit tomorrow. i have been planning to retire for a year or two but didn't have sufficient FI until recently.

I have quite a few questions but the most important one is "Can someone make the case for buying bonds?". Everything I read seems to indicate I should have about 25-50% in fixed income, but I just don't see how that makes any sense at the moment.

Here is a little about my situation. Not sure how much of this matters.

I'm not married but have been living with my gf for 16 years now. No kids. Own our own house no mortgage. Live in a relatively low cost area.

I have 1,250,000 in savings as follows

540,000 in taxable accounts (74% individual stocks, 26% cash)

490,000 in IRA's and Roths (95% individual stocks, 5% cash)

220,000 in company stock

+ 50,000 in company stock vesting in December

I plan to sell most of the company stock in November, waiting until then to get the LT capital gains. I thought about selling in January since I'll be in a lower tax bracket but then I'd be over the limit to get ACA help I think. I'll need to calculate which works out best, but I really don't like having such a large amount in a single stock - so the sooner I sell that the better I think.

That would leave me with a large chunk of cash that I 'ought' to put into bonds but I look at the rates being paid currently and the probability that rates are going to rise and just can't see what benefit I get from buying bonds now when they are surely going down in price and have such low returns.

I should mention that I think I have a higher propensity to take risks than the average person my age. I have never owned mutual funds but instead buy individual stocks and specialize in stocks that are in trouble. So for example, I bought Chipotle a few months back and Deutsche Bank a few weeks ago. However, in the last two years I've been eschewing and selling risky stocks and more and more buying blue chips, in preparation for retirement. So that now I own mostly large cap dividend stocks, and only occasionally have a sudden rush of blood to the head and buy Wells Fargo.

That brings me back to the question. Once I have all this cash on hand I know I should be diversifying into fixed income but it just seems like I'm almost guaranteed to lose money. Can someone give any reason why bonds make sense at this point in time? Why not just buy multiple large cap dividend stocks like GM or T or VZ and pick up a 4-5% dividend, or even just purchase CDs, which would provide protection against a stock market crash.

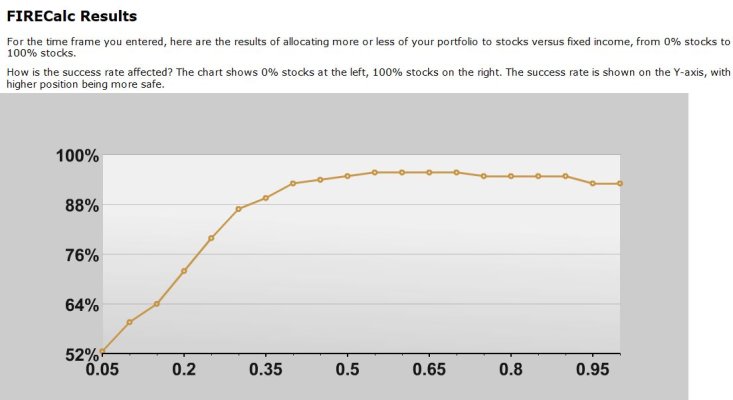

I plugged my numbers into FireCalc and used the Investigate option, "Investigate changing my allocation", and it shows 100% success rate at 75-100% in stocks and less than 100% at anything less than 75%. I was somewhat surprised at that I expected 100% stocks to guarantee at least some failure.

Maybe it's just because I've been buying stocks for so long that I feel very comfortable with them and have lived through quite a number of downturns, whereas I know almost nothing about bonds.

Can someone knock some sense into me?

If this is posted in the wrong section, feel free to move it. I'm kind of new here.

I've been lurking here for about 2-3 weeks and I wish I had found this site earlier. I'm most impressed with the depth and breadth of knowledge displayed here.

I'm 55 and planning to hand in my notice on December 16th (just 69 days, 9.85 weeks, 2.26 months or 0.189 years to go). I pretty much have to wait until then as I have a large chunk of stock options vesting on December 15th, otherwise I'd quit tomorrow. i have been planning to retire for a year or two but didn't have sufficient FI until recently.

I have quite a few questions but the most important one is "Can someone make the case for buying bonds?". Everything I read seems to indicate I should have about 25-50% in fixed income, but I just don't see how that makes any sense at the moment.

Here is a little about my situation. Not sure how much of this matters.

I'm not married but have been living with my gf for 16 years now. No kids. Own our own house no mortgage. Live in a relatively low cost area.

I have 1,250,000 in savings as follows

540,000 in taxable accounts (74% individual stocks, 26% cash)

490,000 in IRA's and Roths (95% individual stocks, 5% cash)

220,000 in company stock

+ 50,000 in company stock vesting in December

I plan to sell most of the company stock in November, waiting until then to get the LT capital gains. I thought about selling in January since I'll be in a lower tax bracket but then I'd be over the limit to get ACA help I think. I'll need to calculate which works out best, but I really don't like having such a large amount in a single stock - so the sooner I sell that the better I think.

That would leave me with a large chunk of cash that I 'ought' to put into bonds but I look at the rates being paid currently and the probability that rates are going to rise and just can't see what benefit I get from buying bonds now when they are surely going down in price and have such low returns.

I should mention that I think I have a higher propensity to take risks than the average person my age. I have never owned mutual funds but instead buy individual stocks and specialize in stocks that are in trouble. So for example, I bought Chipotle a few months back and Deutsche Bank a few weeks ago. However, in the last two years I've been eschewing and selling risky stocks and more and more buying blue chips, in preparation for retirement. So that now I own mostly large cap dividend stocks, and only occasionally have a sudden rush of blood to the head and buy Wells Fargo.

That brings me back to the question. Once I have all this cash on hand I know I should be diversifying into fixed income but it just seems like I'm almost guaranteed to lose money. Can someone give any reason why bonds make sense at this point in time? Why not just buy multiple large cap dividend stocks like GM or T or VZ and pick up a 4-5% dividend, or even just purchase CDs, which would provide protection against a stock market crash.

I plugged my numbers into FireCalc and used the Investigate option, "Investigate changing my allocation", and it shows 100% success rate at 75-100% in stocks and less than 100% at anything less than 75%. I was somewhat surprised at that I expected 100% stocks to guarantee at least some failure.

Maybe it's just because I've been buying stocks for so long that I feel very comfortable with them and have lived through quite a number of downturns, whereas I know almost nothing about bonds.

Can someone knock some sense into me?

If this is posted in the wrong section, feel free to move it. I'm kind of new here.