enret

Confused about dryer sheets

Hello,

My name is Elena, I am new to this site, and need some help.

I am 66, just retired.

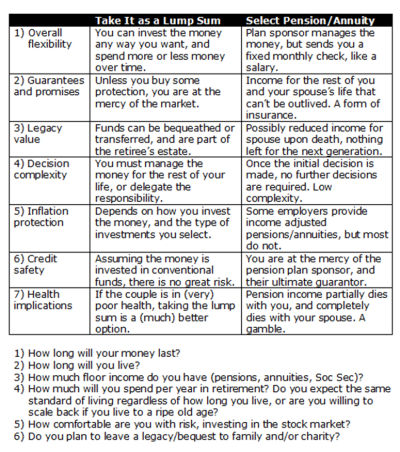

I have a pension from company, which I can take as lump sum.

$376K as lump sum or $2100 monthly with 50% survival rate for my husband. it is about 6.5% payout.

My husband is working part time, maybe for another year, he is 67.

we both have 401K . I am leaning to take pension, for safety. However looking ahead, we realize we will have considerable taxes starting at 70, with RMD from both 401K.

we currently have 300K in after tax savings. we just wonder maybe we should take my pension as lump sum, add to IRA account, and buy annuity with after tax money ?

Does it make sense? I understand that those $376K will be part if RMD, and taxed, but should be considerably lower.

thank you for your help.

Elena

My name is Elena, I am new to this site, and need some help.

I am 66, just retired.

I have a pension from company, which I can take as lump sum.

$376K as lump sum or $2100 monthly with 50% survival rate for my husband. it is about 6.5% payout.

My husband is working part time, maybe for another year, he is 67.

we both have 401K . I am leaning to take pension, for safety. However looking ahead, we realize we will have considerable taxes starting at 70, with RMD from both 401K.

we currently have 300K in after tax savings. we just wonder maybe we should take my pension as lump sum, add to IRA account, and buy annuity with after tax money ?

Does it make sense? I understand that those $376K will be part if RMD, and taxed, but should be considerably lower.

thank you for your help.

Elena