We are slowly moving from 70/30 to 60/40, below is our current AA.

Almost all new investment money are going into bonds right now just to keep up with soaring stocks. I keep evaluating AA about every 6 months to see if any adjustments needed.

About spending: our multi-year records show that we need about $60-$70k to live on, so we are projecting to withdraw $90k from investments, where $20k will be allocated to taxes and healthcare.

Also plan is to limit taxable income to 400% of Federal poverty level as it will allow for healthcare subsidy. We live in low cost state but our insurance market is outrageous

We need to boost our taxable to make sure that they can support us with income for 5 years before we could access Roth accounts. At that period I think we will produce taxable income by converting some 401k money to Roth. Of cause it is just a plan and subject to modifications as all will depend on 2024 laws.

Thanks for the detailed reply, it was an interesting read. I haven't started shifting much from the current 80/20 because I believe I'm about 7yrs away. I'm also living very comfortably spending $60k per yr and that's in a high cost of living area. Out of the $60k I spend $20k goes towards my mortgage so I figure that'll cover my healthcare and taxes in retirement. Furthermore I expect to save about $10k per yr in retirement just from moving to a LCOLA and not having the typical work related expenses (daily lunches, weekly laundry, gas etc). So I'm targeting $50-55k per yr total and roughly 1.5MM nest egg with a paid for house.

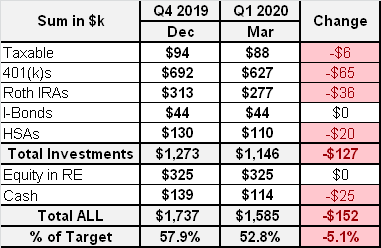

Although to be honest, I am kind of happy that about a year ago I started to change our AA to more conservative one and now have healthy position of cash and Bond funds that I will continue to move to stocks, have to make lemonade

Although to be honest, I am kind of happy that about a year ago I started to change our AA to more conservative one and now have healthy position of cash and Bond funds that I will continue to move to stocks, have to make lemonade