Hey, ya'll. Our home will be paid off on July 1, 2016 and I plan to retire when I turn 63 the following January. I plan on purchasing a camper van, like a Roadtrek N6, but don't want to go into debt to get it. So unless I win the lottery, I will just do without. I am glad I found this site. I am on the internet constantly looking for information about retiring.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retiring debt free!

- Thread starter dnorton50

- Start date

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It is interesting how we each have different views/tolerance of debt. My last day on payroll was 19 days after we refinanced and after I had stopped working but was on vacation.

I pay 3.375% and have earned 12.34% on average so far so for now, I'm happy with my decision.

I pay 3.375% and have earned 12.34% on average so far so for now, I'm happy with my decision.

I understand. We have worked hard to get out of debt and do not wish to take on more when I retire. When the house is paid off, we will be entirely debt free. I will have more money to do what I want to do. What's so funny is the Roadtrek campers start at 60-70,000! That's more that what I paid for my house 27 years ago. I can't see taking out what amounts to be another mortgage for a vehicle. lol

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ouch. That's a lot for a small RV. How well do they hold their value?

Our neighbors down the road have a similar van-like RV and they love it. DW is curious about them too but I had no idea they could be that much $$$$.

Our neighbors down the road have a similar van-like RV and they love it. DW is curious about them too but I had no idea they could be that much $$$$.

heeyy_joe

Thinks s/he gets paid by the post

martyb

Thinks s/he gets paid by the post

I'm retiring in 7 1/2 weeks, and we just took out a mortgage for $204,000 at 4.25% six months ago......yikes!

Kimo

Recycles dryer sheets

Hey, ya'll. Our home will be paid off on July 1, 2016 and I plan to retire when I turn 63 the following January. I plan on purchasing a camper van, like a Roadtrek N6, but don't want to go into debt to get it. So unless I win the lottery, I will just do without. I am glad I found this site. I am on the internet constantly looking for information about retiring.

You will find many different, intelligent responses regarding how much, if any, debt you should or should not retire with.....IMHO, I started getting rid of my debt about 25 years ago. Back then, all my "financial" people (banker, accountant, etc.) told me not to pay off the mortgage because I would lose my interest deduction.

Without going deep into the discussion of this, I soon realized that was the worst mistake I ever made. Once I paid off my house I never purchased another one without paying cash for it, and I have ended up buying 4 or 5 since then.

Aloha!

If you are debt free (again, my opinion) it will be the best retirement present you can give yourself.....

Yep, that's the problem. They start out high, and they don't get cheap enough fast enough.They do hold their value pretty well.

I think DW and I might enjoy something like these Class B RV's, but I can't see dropping $40K for something we take out for a few trips per year. And they aren't inexpensive to rent, either.

As far as debt-free retirement: We've got a low-interest mortgage I'm paying it off as slowly as possible, we'll still have it when I really retire, which is just fine. And I'd much rather have that than a loan payment for a car or RV.

Why be a slave to the lender? A RV isn't that important to us. If we are able to save up for it, fine. If not, it isn't the end of the world. Being this close to debt free-I am not about to go into debt again. That is $1300. per month I WON'T be paying. I get a bit crazy about this. I am a big Dave Ramsey fan. What he teaches is so right on.

As far as using an RV only a few times a year? I would be replacing my current vehicle as the Roadtrek gets really good gas mileage. I just can't see paying 20-30 years on something like that. I have the money in my emergency fund, but this definitely is NOT an emergency

treeofpain

Recycles dryer sheets

I'm 50 and not yet retired. Just paid off the mortgage and am totally debt free.

My argument to those who bring up the tax deduction argument is this: I can give the same amount of previous mortgage interest to my favorite charity and get the same deduction WITHOUT the risk associated with debt.

Yes, you can make a higher percentage on the money if invested (maybe), but you are taking more risk. All investment decisions are a balance of risk and reward, and this is no exception. Each person will have a different approach based on their own particular risk profile and goals.

My argument to those who bring up the tax deduction argument is this: I can give the same amount of previous mortgage interest to my favorite charity and get the same deduction WITHOUT the risk associated with debt.

Yes, you can make a higher percentage on the money if invested (maybe), but you are taking more risk. All investment decisions are a balance of risk and reward, and this is no exception. Each person will have a different approach based on their own particular risk profile and goals.

Kimo

Recycles dryer sheets

I'm 50 and not yet retired. Just paid off the mortgage and am totally debt free.

My argument to those who bring up the tax deduction argument is this: I can give the same amount of previous mortgage interest to my favorite charity and get the same deduction WITHOUT the risk associated with debt.

Yes, you can make a higher percentage on the money if invested (maybe), but you are taking more risk. All investment decisions are a balance of risk and reward, and this is no exception. Each person will have a different approach based on their own particular risk profile and goals.

I just wouldn't know where to start with how much I agree with you....I had a friend tell me years ago, lets say you end up writing off 4,000.00 dollars against your income but the total of the checks for a year's worth of mortgage payments are 6,500 (all made up numbers) the point is why write a check only to be given a smaller portion back?

I know there are individuals who disagree with that but I am just stating what worked for me........

Derslickmeister

Recycles dryer sheets

- Joined

- Feb 14, 2014

- Messages

- 249

I just wouldn't know where to start with how much I agree with you....I had a friend tell me years ago, lets say you end up writing off 4,000.00 dollars against your income but the total of the checks for a year's worth of mortgage payments are 6,500 (all made up numbers) the point is why write a check only to be given a smaller portion back?

I know there are individuals who disagree with that but I am just stating what worked for me........

+1 on all of this. We paid our mortgage off 2 years ago. We plan to retire in a few more years. Having these last few years of w***ing without a mortgage, or any debt for that matter, has allowed us to pile up the cash at a rate far higher than we ever thought possible.

Kimo

Recycles dryer sheets

Yep.............so many advantages.........

W2R

Moderator Emeritus

Congratulations on retiring debt free! This is my fifth year of debt free retirement, and I am very happy that I followed my instincts on this. I paid off my mortgage 3-4 years before retiring.

This being the internet, there are a lot of opinions on paying off debt (or not) out there. I generally pick and choose the ideas that make sense to me, and politely ignore the rest.

This being the internet, there are a lot of opinions on paying off debt (or not) out there. I generally pick and choose the ideas that make sense to me, and politely ignore the rest.

Last edited:

txtig

Full time employment: Posting here.

Fully agree on paying off the debt prior to retirement. I've got about three years to go til retirement, and just recently paid off our mortgage. Feels absolutely great. I also paid off a recent car loan. Interest rate on the car loan was only 1.9% percent, but I wanted to be totally debt free for the first time in 40 years. I know a lot of folks would think that's a bad decision, but there's something about being totally debt free that's worth the paying the opportunity cost of of shedding the debt.

I also paid off a recent car loan. Interest rate on the car loan was only 1.9% percent, but I wanted to be totally debt free for the first time in 40 years. I know a lot of folks would think that's a bad decision, but there's something about being totally debt free that's worth the paying the opportunity cost of of shedding the debt.

Don't feel like the Lone Ranger, I did exactly the same thing last year when we bought a new car. Dealer wouldn't do "the deal" unless we financed through them at 1.9% then hastened to add that there was no prepayment penalty. So I made one payment and then paid off the loan.

So I got the deal and he got his vigorish from the lender.

They get good gas mileage compared to bigger RV's, but they drink quite a bit more fuel than a typical mid-size coupe.I would be replacing my current vehicle as the Roadtrek gets really good gas mileage.

For example, the 2014 Roadtrek 170 is based on the Chevy Express 2500, which gets 14 combined MPG when it is empty (it'll be a lot worse in city driving when it's a few thousand pounds heavier as an RV).

If I drive 10K miles a year and pay $4/gal for gas, then my fuel cost would be $2860/yr. Compared to a 30 MPG car, that's $1530 more per year ($127 more every month).

These are heavy vehicles, and typical in-town driving will produce very poor mileage. The mileage will be a lot better on the highway. The even higher cost Roadtreks based on the Mercedes diesel models get better mileage.

This link is a crawler that searches for Class B RV ads on ebay and craigslist. They can be had for less than $30K, if a purchaser is willing to go with a model that is 13 years old or more. The rate of depreciation probably slows quite a bit by that point, too.

Last edited:

I was in your situation a few years ago and a friend of mine is currently making the same decisions. Both of us simply searched for used Roadtreks and worked a little longer to pay for our units. We both bought units that were 3 to 4 years old so the cost was lower. I found my 2008 190 on the Roadtrek International listed above. If you aren't in a hurry, follow the site for a while and you'll find a unit you like and for the right price. Yes, it's a tradeoff because you would be working a bit longer but it worked for me and Tim. YMMV.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

...What's so funny is the Roadtrek campers start at 60-70,000! That's more that what I paid for my house 27 years ago. I can't see taking out what amounts to be another mortgage for a vehicle. lol

I would say (and I will

Going into debt or not is not a big deal either way, assuming you can get a decent rate and answer 'yes' to the above questions.

-ERD50

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

I just looked at the N6, and wow, the MSRP of $73K is a lot for this small RV. It does not have a toilet, which is a deal breaker for me.

When I shopped for an RV 4 years ago, I spent a long time over the decision of whether I should pay more for a used class B or a diesel class C, compared to getting a used generic gasoline class C which was quite a lot less. I went with the latter, because I was not sure if I would like this mode of travel. It turned out that I enjoyed it, and a more expensive RV would still be OK as it would not go to waste.

The cheaper and larger used gasoline class C that I got turned out to be not a bad choice, as the price difference pays for a lot of fuel. Even while towing a car, I still get 9.5 to 9.8 MPG, averaged over trips of 3-4K miles and with speed of 60 MPH and in mountainous Western states. Driven over the RV life of 100K miles, the difference between 9.5 MPG and, say, 15 MPG is 3,900 gallons. That is less than the price difference of greater than $25K when I was shopping for mine. Maintenance cost is also less for the gas engine.

The main drawback is that although this is a shorter C of 25', it is more than 8' wide and my wife is afraid to drive it and has never been in the driver seat. Additionally, a smaller RV may not require a toad for excursions. But unless the RV is a class B it is still cumbersome to drive a smaller class C like the Sprinter-based RV into town. Also having to break camp when you want to go sightseeing is a chore when you do not have the toad.

When I shopped for an RV 4 years ago, I spent a long time over the decision of whether I should pay more for a used class B or a diesel class C, compared to getting a used generic gasoline class C which was quite a lot less. I went with the latter, because I was not sure if I would like this mode of travel. It turned out that I enjoyed it, and a more expensive RV would still be OK as it would not go to waste.

The cheaper and larger used gasoline class C that I got turned out to be not a bad choice, as the price difference pays for a lot of fuel. Even while towing a car, I still get 9.5 to 9.8 MPG, averaged over trips of 3-4K miles and with speed of 60 MPH and in mountainous Western states. Driven over the RV life of 100K miles, the difference between 9.5 MPG and, say, 15 MPG is 3,900 gallons. That is less than the price difference of greater than $25K when I was shopping for mine. Maintenance cost is also less for the gas engine.

The main drawback is that although this is a shorter C of 25', it is more than 8' wide and my wife is afraid to drive it and has never been in the driver seat. Additionally, a smaller RV may not require a toad for excursions. But unless the RV is a class B it is still cumbersome to drive a smaller class C like the Sprinter-based RV into town. Also having to break camp when you want to go sightseeing is a chore when you do not have the toad.

Last edited:

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We paid off our mortgage over four years ago and have been debt free ever since. I never understood paying $1.00 in interest to a bank to save $0.28 to $0.39 in taxes. I know the stock market has produced some nice returns over the past few years, but buying stocks leveraged with mortgage money can cost a lot of nights of lost sleep when the markets aren't so friendly, a lot of people made bad decisions in 2006-2008 that cost them dearly. Living debt free has been great and we'll never be in debt again except for short term credit card use that gets paid off as soon as it appears on my computer screen.

I know RV use is a lifestyle choice, and I have family that love traveling in an RV for the comfort and experiences they have. But for me, I can spend a lot of nights in nice hotels for the cost of owning and operating an RV. I personally hate driving large vehicles anywhere and prefer a sedan, but if the RV lifestyle is the choice you make, there are lots of high quality used vehicles on the market that you can buy for much less than a new one. Enjoy the lifestyle but don't let it drain your finances.

I know RV use is a lifestyle choice, and I have family that love traveling in an RV for the comfort and experiences they have. But for me, I can spend a lot of nights in nice hotels for the cost of owning and operating an RV. I personally hate driving large vehicles anywhere and prefer a sedan, but if the RV lifestyle is the choice you make, there are lots of high quality used vehicles on the market that you can buy for much less than a new one. Enjoy the lifestyle but don't let it drain your finances.

ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We paid off our mortgage over four years ago and have been debt free ever since. I never understood paying $1.00 in interest to a bank to save $0.28 to $0.39 in taxes. ...

You don't understand it because it actually does not make any sense to pay $1.00 to save $.028-$.39. But that is not the point, and it would be foolish to take on debt solely for the tax deduction.

The tax deduction is an added benefit, it is part of the equation. Not the sole reason.

The odds are highly in one's favor that a 75/25 portfolio will outperform a low-rate mortgage over a 30 year period. Forget the short term, we are talking retirement portfolios here, and long term thinking.

I never lost a moment of sleep due to my reasonable level of debt. Why would I? With a mortgage of less than 10% of my portfolio value, under what conditions could that debt drive me from a 'no-worry' condition to a 'sleepless nights' condition? Now that is something I don't understand. I'll hazard a guess that more sleepless nights have been created by people using too much of their portfolio to pre-pay a mortgage (creating liquidity problems), than it has for those who had the money to pre-pay, but decided to keep it invested. Unreasonable fear of risk, unreasonable carelessness with risk, and unreasonable fear of debt can all lead to unreasonable decisions.

As I've said many times before, the pay-off or not question (assuming reasonable levels of debt at a reasonable rate), discussed so often here, is probably the least important question for a retiree. So if you prefer to pre-pay, do it. But I think the data shows it is a mistake to assign much importance to it. It's not likely to either help nor hurt your retirement in any big way.

-ERD50

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

....Yes, you can make a higher percentage on the money if invested (maybe), but you are taking more risk. All investment decisions are a balance of risk and reward, and this is no exception. Each person will have a different approach based on their own particular risk profile and goals.

....I know there are individuals who disagree with that but I am just stating what worked for me........

Count me in with the group that disagrees with Kimo. I recently saw an interesting article where the author backtested this for 10 year periods of time based on a view that the average mortgage life is less than 10 years. In 75% of the trials the investment results exceeded the mortgage interest. Since I plan to have my mortgage for a longer period, the probability of coming out ahead become higher than 75%, especially since I started during a period of low interest rates.

See The Retirement Cafe: Investing the Mortgage

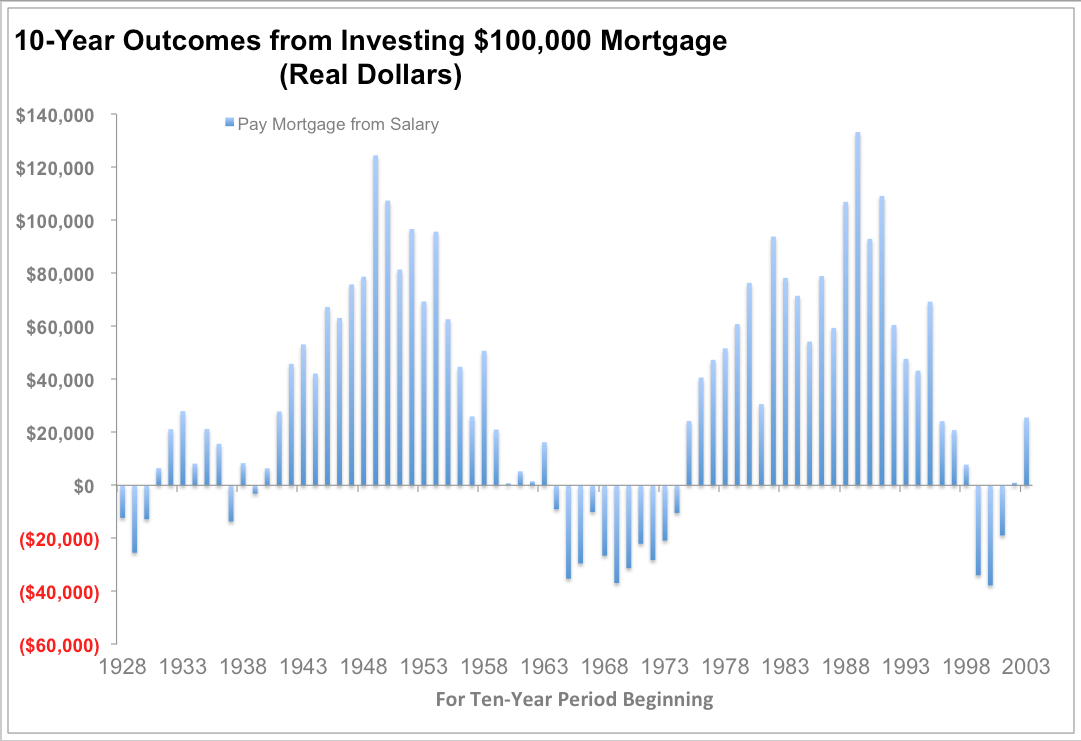

.....To explain my point, I modeled real stock and bond returns and historical mortgage rates1 for 76 ten-year rolling periods from 1928 to 2013. Each year, I assumed that an investor borrowed a 30-year fixed rate mortgage (FRM) at the average mortgage rate that year and held the mortgage for 10 years. (The average mortgage gets paid off after about 7 years.)

I assumed that the investor then invested the $100,000 in a portfolio of 50% S&P 500 index and 50% 10-Year U.S. Treasury Notes. At the end of ten years, the investor cashes in the portfolio, pays off the mortgage balance and I calculate his profit or loss, as shown in the chart below.

.....

I concede there is some risk, understand the risk and accept it. I'm in a position where if things start to go sideways I can always just write a check and pay of the mortgage which further increases my chance of gain/reduces my risk of loss.

Similar threads

- Replies

- 33

- Views

- 926

- Replies

- 61

- Views

- 8K