frayne

Thinks s/he gets paid by the post

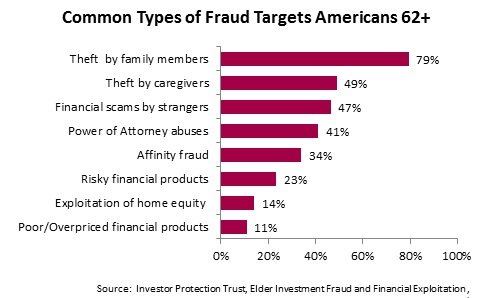

I watch this show on and off during the week and I am always surprised at how seemingly intelligent people can be taken by some slick talking person with promise of a guaranteed rate of return. I am also shocked at how little oversight and regulation there is concerning so called financial advisors, counselors, wealth managers, etc. The most despicable are those who prey on older widows and retired folks who unwittingly fall for the sales pitch. The other thing that is amazing, those when caught, tried, and convicted usually get fairly light sentences.

Personally I think the death sentence would be a too lenient punishment for these reprobates.

Personally I think the death sentence would be a too lenient punishment for these reprobates.

Last edited: