ER_Hopeful

Recycles dryer sheets

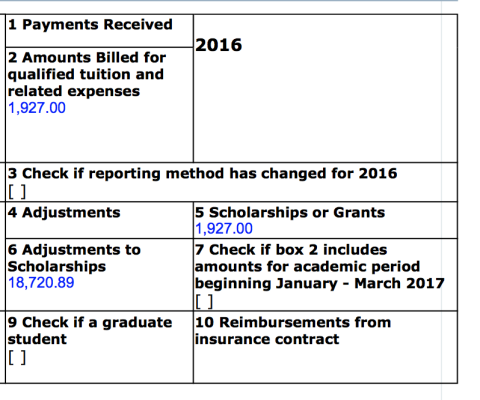

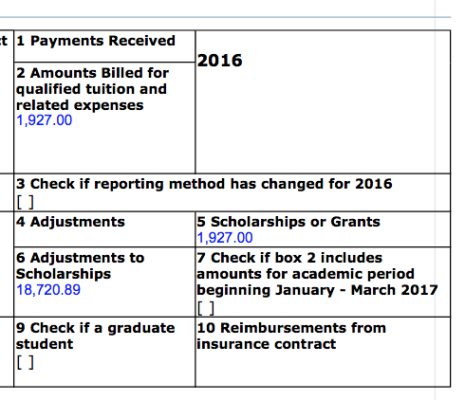

doing one of relative's tax return. She got a 1098-t and box 5(scholarship) has an amount (pls see attached.), looks like it's treated as income because it increased her tax amount. Just want to double check with the folks here.

backgroun info, may not make any difference.

she is in the military and was deployed to a combat zone a few years ago. After returning to the U.S., she starting attending Devry and her tuition is footed by the govt.

She has very low income now and she owes close to $1700 on the federal, does the govt offer any payment plans?

thanks.

backgroun info, may not make any difference.

she is in the military and was deployed to a combat zone a few years ago. After returning to the U.S., she starting attending Devry and her tuition is footed by the govt.

She has very low income now and she owes close to $1700 on the federal, does the govt offer any payment plans?

thanks.