The article surprised me. Somehow, I felt that new, added jobs, would go to younger persons, with businesses looking ahead, and being able to absorb the lower pay scale.

This article indicates precisely the opposite.

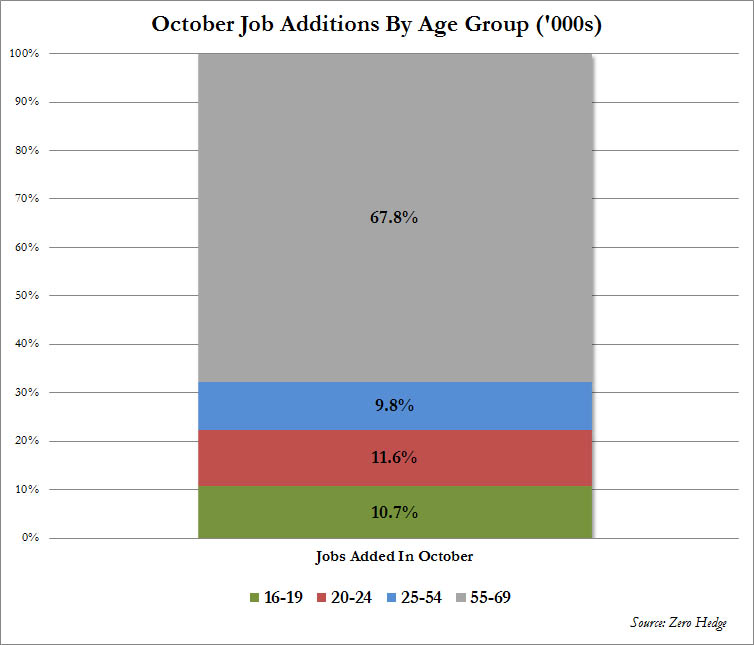

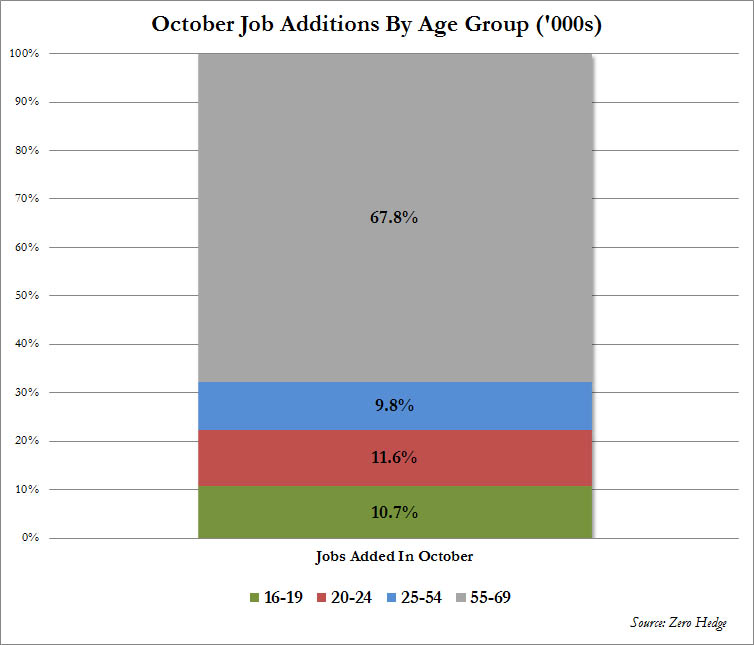

The chart:

This article indicates precisely the opposite.

Chart Of The Day: America's Geriatric Work F(a)rce | ZeroHedgewhen broken down by age group, the total October increase shows that of the new jobs, 10.7% went to those aged 16-19 (source), 11.6% went to those aged 20-24 (source), a tiny 9.8% went to the prime agr group: 25-54 (source), and a massive 67.8% went to America's baby boomers: those aged 55 and over (source), and who refuse to leave the workforce and make way for others.

The chart:

...

... ).

).