The longest winter ever has me so cabin fever stressed, that I have given up on today and tomorrow, and am looking into the Crystal Ball for the coming months and years.

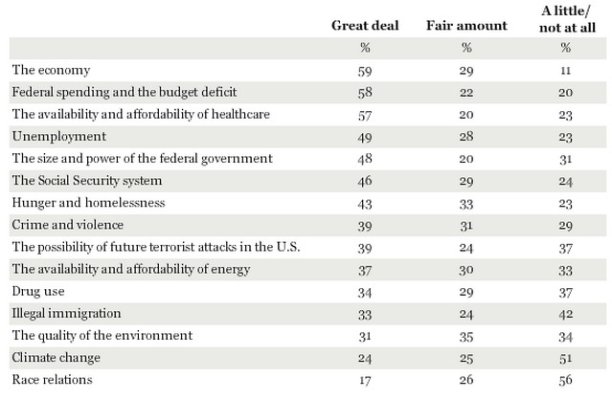

Top of my worry list is Oil and Gas... and not those in the Gallup Poll list shown, below, or even politics, global warming, nuclear holocaust or going broke.

To kick it off, here's the basic reason...

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2241rank.html

.... and knowing the level of stability of the nations on the list.

Top of my worry list is Oil and Gas... and not those in the Gallup Poll list shown, below, or even politics, global warming, nuclear holocaust or going broke.

To kick it off, here's the basic reason...

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2241rank.html

.... and knowing the level of stability of the nations on the list.