Hopeful

Recycles dryer sheets

- Joined

- Aug 6, 2013

- Messages

- 212

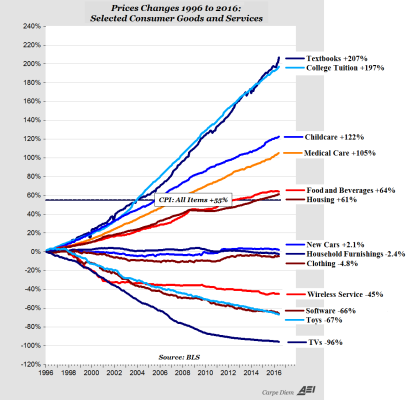

A lot of news has been directed to the rising costs of colleges and level of student debt. When I graduated I think I had a total of $7,000 of loans, which was easily paid off once I started working. Now it seems not uncommon to hear of debts close to $100,000.

Once thing I think does not get discussed often is the correlation between these easy to get loans and the sky rocketing college costs. As students are able to easily acquire high student loans, colleges seem far too eager to raise prices to take advantage of the "easy" money. It would seem that if the student loans were reduced or limited colleges would be forced to bring tuitions more in line.

It reminds me of the housing bubble in the late 2000's. Banks were practically giving money away to people they knew couldn't afford it. As a result the housing prices sky rocketed in correlation to this easy money.

Once thing I think does not get discussed often is the correlation between these easy to get loans and the sky rocketing college costs. As students are able to easily acquire high student loans, colleges seem far too eager to raise prices to take advantage of the "easy" money. It would seem that if the student loans were reduced or limited colleges would be forced to bring tuitions more in line.

It reminds me of the housing bubble in the late 2000's. Banks were practically giving money away to people they knew couldn't afford it. As a result the housing prices sky rocketed in correlation to this easy money.