The link you provided has nothing at all with the argument that you make... it mainly says that a lot of blue states pay more in federal income tax than they receive in federal benefits... that is not any news... but what I said was that state and local taxes were used to fund state and local programs so people in low SALT areas don't benefit from state and local taxes paid in high SALT areas.

I went back to one of my high income years while working and my SALT deduction, including property taxes for two homes was only $22k... IMO if your SALT is $40-70k you're living pretty high on the hog and are unlikely to get much sympathy.

While I live in a relatively high SALT state, it is not as near as high as the NY metro area.

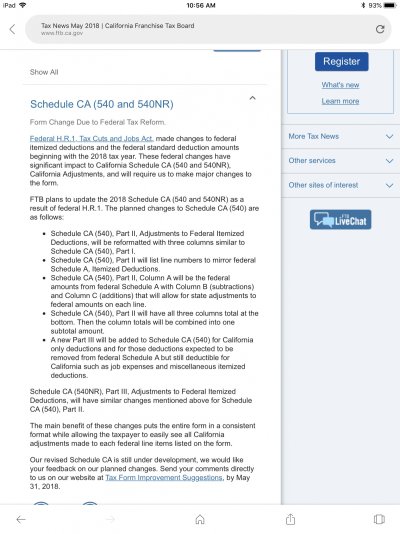

Below is a good graphic of federal taxes paid vs benefits received. It robably has been relatively consistent from one year to another but does change a bit over time.