Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

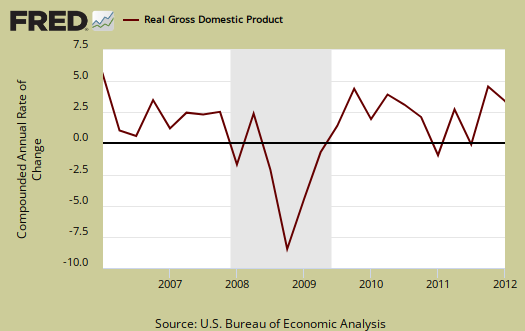

Given that the recovery is approaching its third birthday, how far away from the Great Recession do we need to get before another downturn would be considered not a “second dip” but simply a separate recession instead?

My hyper-conservative Dad keeps scaring the sh__ out of my 63 yo novice investor sister talking about a double dip recession, he's been "warning" her for years now. Mostly semantics, a recession is a recession but...

Investopedia said:Definition of 'Double-Dip Recession' When gross domestic product (GDP) growth slides back to negative after a quarter or two of positive growth. A double-dip recession refers to*a recession followed by a short-lived recovery, followed by another recession.

My hyper-conservative Dad keeps scaring the sh__ out of my 63 yo novice investor sister talking about a double dip recession, he's been "warning" her for years now. Mostly semantics, a recession is a recession but...