|

|

Too late for a double dip recession?

06-21-2012, 04:23 PM

06-21-2012, 04:23 PM

|

#1

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

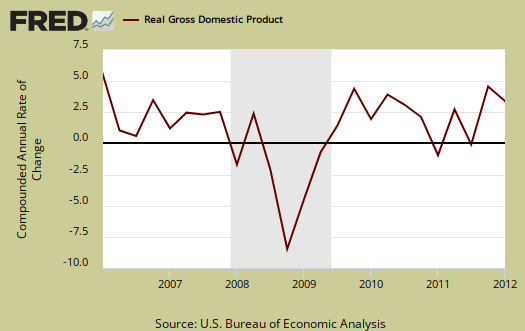

Too late for a double dip recession?

Given that the recovery is approaching its third birthday, how far away from the Great Recession do we need to get before another downturn would be considered not a “second dip” but simply a separate recession instead?

Quote: Quote:

|

Originally Posted by Investopedia

Definition of 'Double-Dip Recession' When gross domestic product (GDP) growth slides back to negative after a quarter or two of positive growth. A double-dip recession refers to*a recession followed by a short-lived recovery, followed by another recession.

|

My hyper-conservative Dad keeps scaring the sh__ out of my 63 yo novice investor sister talking about a double dip recession, he's been "warning" her for years now. Mostly semantics, a recession is a recession but...

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

06-21-2012, 04:26 PM

06-21-2012, 04:26 PM

|

#2

|

|

Recycles dryer sheets

Join Date: Jun 2012

Location: Central Ga

Posts: 230

|

Some would say we are not out of the last one yet...

__________________

If you want someone to believe in you - First you have to believe in yourself and then you go from there...

|

|

|

06-21-2012, 04:49 PM

06-21-2012, 04:49 PM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

Quote: Quote:

Originally Posted by Semiretired2008

Some would say we are not out of the last one yet...

|

Not credibly...

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

06-21-2012, 04:58 PM

06-21-2012, 04:58 PM

|

#4

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

There is no "official" definition of a double dip recession, but this seems like a reasonable point of view:

Quote: Quote:

We should first define what a double dip recession is. For purposes of this article, we shall adopt the most common definition utilized by economists -- and one which also happens to make common sense: A double dip recession is an occurrence whereby the US economy enters into a recession within a period less than 12 months following the end of the previous recession.

According to the National Bureau of Economic Research (NBER), the most authoritative source of information regarding business cycles, there have been 33 recessions registered in the US since 1854. Over this entire time frame, there have been only three recorded instances of a double-dip recession by this standard definition. The first one was in 1913, the second in 1920, and the third in 1981.

Read more: Understanding The Odds Of A Double-Dip Recession | Business News | Minyanville.com

|

So IMO after 3 years of recovery - we're looking at a new, separate recession, not that it really would make any difference.

__________________

Retired since summer 1999.

|

|

|

06-21-2012, 05:17 PM

06-21-2012, 05:17 PM

|

#5

|

|

Recycles dryer sheets

Join Date: Jun 2012

Location: Central Ga

Posts: 230

|

Midpack - my response was based not on GDP, but the overall state of the economy. I know that many economist use whenever any level of recovery starts that the recession has ended, but some and I am one of them consider that there are still several areas of importance on their way down in the current economy (average family income for one) or have not really started a recovery yet to really accept that the last recession has stopped.

__________________

If you want someone to believe in you - First you have to believe in yourself and then you go from there...

|

|

|

06-21-2012, 05:44 PM

06-21-2012, 05:44 PM

|

#6

|

|

Moderator Emeritus

Join Date: Oct 2007

Location: Portland

Posts: 4,946

|

From my analysis, the mid-2013 recession will be its own beast, with it's own unique and somewhat artificial set of causes.

This one will be followed by "more of the same", the slow growth regime we are currently experiencing, as the consumer an private sector continue to work off debt until its down to the long term sustainable level of 50% of GDP, rather than the recent high in 2007 of 300% of GDP. Remember, some 70% of the US economy is domestic consumer spending. With falling real income, poor employment prospects, and no more home refinancing that powered the 2003-2007 recovery cycle, I don't expect so see any real improvement for several more years.

|

|

|

06-21-2012, 06:20 PM

06-21-2012, 06:20 PM

|

#7

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2004

Location: LaLa Land

Posts: 4,698

|

Hmmmm, I'm still waiting for the first dip to end.

__________________

Work is something you do to get enough $ so you don't have to....Me.

|

|

|

06-21-2012, 06:38 PM

06-21-2012, 06:38 PM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

The problem with the official definition of a recession is that there can be a disconnect between what officially happens and what people feel. If you aggregate all these quarters since mid-2009, it looks like you have maybe 30% compound growth. Even accounting for population growth, per capita that's probably still at least 25%. How many of you have 25% more income than you did in 2009? Mine's pretty much stuck in place since then (and has been stuck save for one 2% raise since 2006), and I'm probably fortunate enough to be in the top income quartile. And when you factor inflation into it, especially "real" inflation in essential goods, it's probably a real *decline* of at least 10%.

So the official numbers can say the recession is long over, but many people have reason to feel like it never ended.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

06-21-2012, 08:21 PM

06-21-2012, 08:21 PM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2011

Location: NC Triangle

Posts: 5,807

|

I think the media is whipping people up into a frenzy.

__________________

|

|

|

06-21-2012, 08:29 PM

06-21-2012, 08:29 PM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

The start and end of a recession are defined by the change in GDP. So, a recession is declared to be ending when the GDP is increasing again. But because the GDP is increasing from a lower number, the recession's end does not correspond to the full recovery point, which is when the GDP gets back to its earlier higher point.

Looking at the chart that Midpack posted, I would estimate that the cumulative increases since mid 2009 have added up back to where we were at the end of 2008. But of course there is the effect of inflation as ziggy pointed out.

So, I looked up bea.gov, and the following are the annual GDP numbers, in nominal dollars as well as in 2005 dollar values.

| Year | GPD in billions of nominal dollars | GDP in billions of 2005 dollars | | 2005 | 12,623.0 | 12,623.0 | | 2006 | 13,377.2 | 12,958.5 | | 2007 | 14,028.7 | 13,206.4 | | 2008 | 14,291.5 | 13,161.9 | | 2009 | 13,939.0 | 12,703.1 | | 2010 | 14,526.5 | 13,088.0 | | 2011 | 15,094.0 | 13,315.1 |

So, the economy has recovered (barely after correction for inflation), but why does it feel so lousy? Why is the unemployment number still bad?

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

06-22-2012, 06:24 AM

06-22-2012, 06:24 AM

|

#11

|

|

gone traveling

Join Date: Sep 2003

Location: DFW

Posts: 7,586

|

Quote: Quote:

Originally Posted by 73ss454

Hmmmm, I'm still waiting for the first dip to end.

|

Me too, I guess a "dip" being over is like beauty, its in the eyes of the beholder. Many that lost a bundle and got out of the market; those that are unemployed or under employed; and those that are living off measily interest rates probably feel the great recession never ended.

|

|

|

06-22-2012, 06:46 AM

06-22-2012, 06:46 AM

|

#12

|

|

Administrator

Join Date: Apr 2006

Posts: 23,041

|

"The news media are, for the most part, the bringers of bad news... and it's not entirely the media's fault, bad news gets higher ratings and sells more papers than good news."

- Peter McWilliams

__________________

Living an analog life in the Digital Age.

|

|

|

06-22-2012, 07:08 AM

06-22-2012, 07:08 AM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Quote: Quote:

Originally Posted by NW-Bound

So, the economy has recovered (barely after correction for inflation), but why does it feel so lousy? Why is the unemployment number still bad?

|

Just because we got out of a very bad recession and have been in recovery, doesn't mean that things are going to go back to the good old rah-rah days of high GDP and low unemployment of the past couple of decades. There has been a profound economic shift. We are in new times. World-wide growth has slowed considerably. We are going through a de-leveraging phase (paying off debt) for companies and individuals that will last a long time. Many economists say to expect low growth and high unemployment for a long time. Some pundits have coined it "the new normal", but it seems more like a return to the pre-80s business cycles.

__________________

Retired since summer 1999.

|

|

|

06-22-2012, 08:30 AM

06-22-2012, 08:30 AM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Aug 2006

Posts: 12,483

|

We are headed for another recession almost as bad as the 2008 debacle........

__________________

Consult with your own advisor or representative. My thoughts should not be construed as investment advice. Past performance is no guarantee of future results (love that one).......:)

This Thread is USELESS without pics.........:)

|

|

|

06-22-2012, 11:38 PM

06-22-2012, 11:38 PM

|

#15

|

|

Recycles dryer sheets

Join Date: Dec 2011

Posts: 388

|

Although many commentators use an informal definition of a recession as two consecutive quarters of negative GDP growth, that is not what the NBER uses for its definitive call on recessions. In fact the NBER doesn't even have a precise definition of recession:

The Committee does not have a fixed definition of economic activity. It examines and compares the behavior of various measures of broad activity: real GDP measured on the product and income sides, economy-wide employment, and real income. The Committee also may consider indicators that do not cover the entire economy, such as real sales and the Federal Reserve's index of industrial production (IP).

The NBER's Business Cycle Dating Committee

So, the NBER could declare a recession even for a period of positive GDP growth, although I don't know if it ever has.

The distinction is not merely academic. After all real GDP grew each year from 1934 to 1937, although we think of the Great Depression as having lasted througout the thirties.

The upshot is that the continuing employment depression matters a lot in assessing the condition of the economy. We have certainly not yet recovered from the employment "dip" in 2008 or indeed since the peak in labor market participation in 2000.

|

|

|

06-23-2012, 06:36 AM

06-23-2012, 06:36 AM

|

#16

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

Some interesting observations, maybe we should use unemployment as an indicator of economic health instead of GDP? Though it seems unemployment figures have some issues as well...

Can't use market returns, equity or fixed income as they don't correlate well either except in the long run...

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

06-23-2012, 07:16 AM

06-23-2012, 07:16 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

I don't think it's reasonable to expect to go back to the "full employment" environment of the early 2000s. Historically, that was quite an anomaly.[Actually, I guess not - I hadn't seen charts prior to 1970. I just remember people talking as if 5% was the "best" we could expect]. Each decade or so has its own employment trends. I think the NBER criteria seem reasonable enough in terms of judging business cycles. Weak expansion or strong expansion - they're still expansions even if one feels better than the other. I think we got spoiled in the 80s and 90s. If you use that as your yardstick for economic growth, nothing else will "feel" like growth.

__________________

Retired since summer 1999.

|

|

|

06-23-2012, 09:08 AM

06-23-2012, 09:08 AM

|

#18

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Quote: Quote:

Originally Posted by steelyman

I think the media is whipping people up into a frenzy.

|

Say it ain't so. The media never do that.

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

06-23-2012, 09:09 AM

06-23-2012, 09:09 AM

|

#19

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2005

Location: North Oregon Coast

Posts: 16,483

|

Quote: Quote:

Originally Posted by NW-Bound

So, the economy has recovered (barely after correction for inflation), but why does it feel so lousy? Why is the unemployment number still bad?

|

Because much of the GDP growth is coming from productivity increases and overworking existing salaried employees rather than hiring?

__________________

"Hey, for every ten dollars, that's another hour that I have to be in the work place. That's an hour of my life. And my life is a very finite thing. I have only 'x' number of hours left before I'm dead. So how do I want to use these hours of my life? Do I want to use them just spending it on more crap and more stuff, or do I want to start getting a handle on it and using my life more intelligently?" -- Joe Dominguez (1938 - 1997)

|

|

|

06-23-2012, 09:25 AM

06-23-2012, 09:25 AM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

I'd think the long term unemployed number + the current unemployed would be a better indicator of our economic health. Have not seen any charts showing long term unemployed numbers over the years to the current time.

Is it too late for a double dip recession? I think it is, but maybe that's because I'm not suffering. Have a house and am happily unemployed.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|