At work on Thursday our CEO made a visit and passed on some encouraging information.

Our China plant and the 2 plants in Holland are at full capacity supplying the APAC market (mostly China).

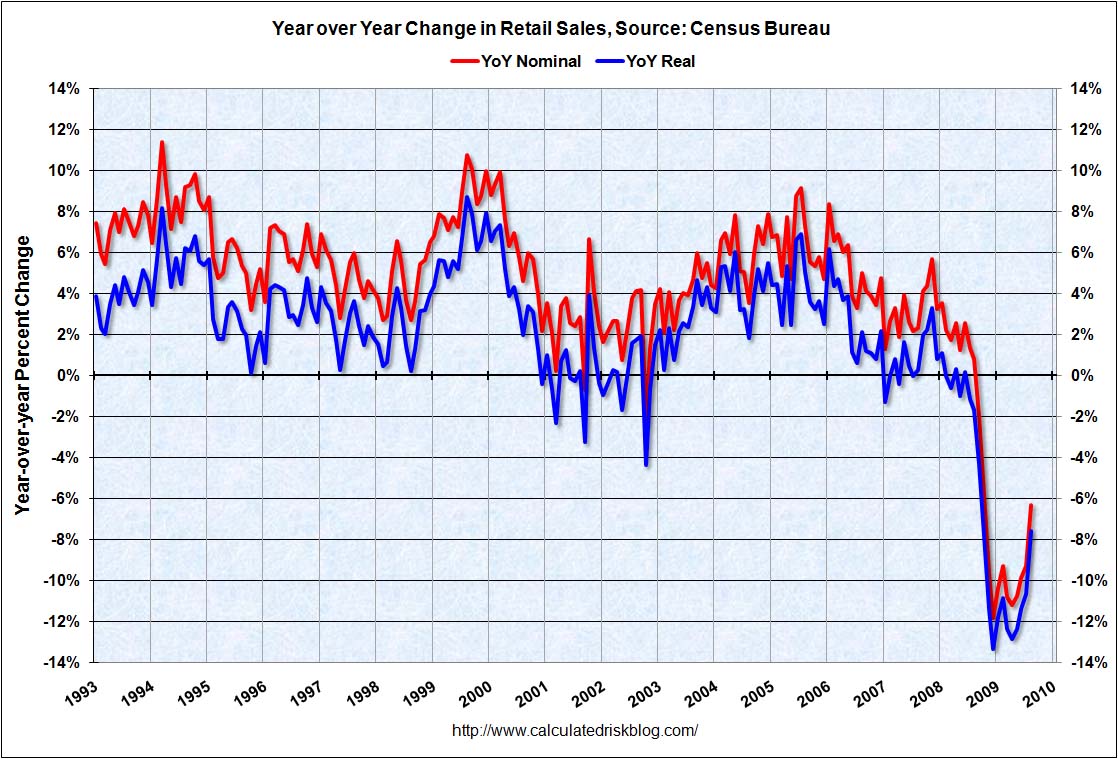

Our USA plants are at 66% capacity in the USA, but they are holding off starting up the last 3rd until they feel that the increased demand is sustainable and not part of a W or "square root" recovery.

Similarly the hiring, pay and bonus freezes stay in place for the same reason. (our business never actually laid off anyone and at our particular location we are hurting because we have been unable to replace the folks retiring).

Our China plant and the 2 plants in Holland are at full capacity supplying the APAC market (mostly China).

Our USA plants are at 66% capacity in the USA, but they are holding off starting up the last 3rd until they feel that the increased demand is sustainable and not part of a W or "square root" recovery.

Similarly the hiring, pay and bonus freezes stay in place for the same reason. (our business never actually laid off anyone and at our particular location we are hurting because we have been unable to replace the folks retiring).