easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

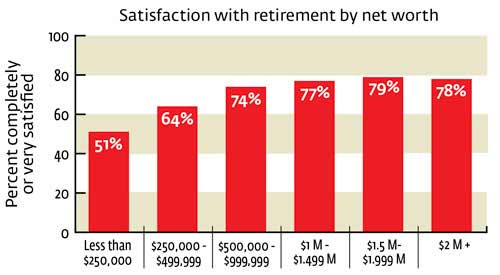

According to this, $1 million (and an old fashion pension) is still the sweet spot for satisfaction and retirement.

retirement-steps-that-work: Personal Finance News from Yahoo! Finance

retirement-steps-that-work: Personal Finance News from Yahoo! Finance