RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

When I had my full-time job, I probably made about 6x what I could make at a part-time job like those. So one more year there was worth about 12 years of part-time work, so it seemed like a no-brainer to me to pad my investments while I was making good money.Perhaps this veers off topic, but I'm interested that nobody mentions part-time w*rk after retirement, particularly if a big drop in the market early in retirement increases the SORR significantly. I just retired, although I continue some consulting on the side. I had imagined picking up something p/t at a ski area for a free pass, or at a garden center for a discount on the many plants I so desperately need. ;-)

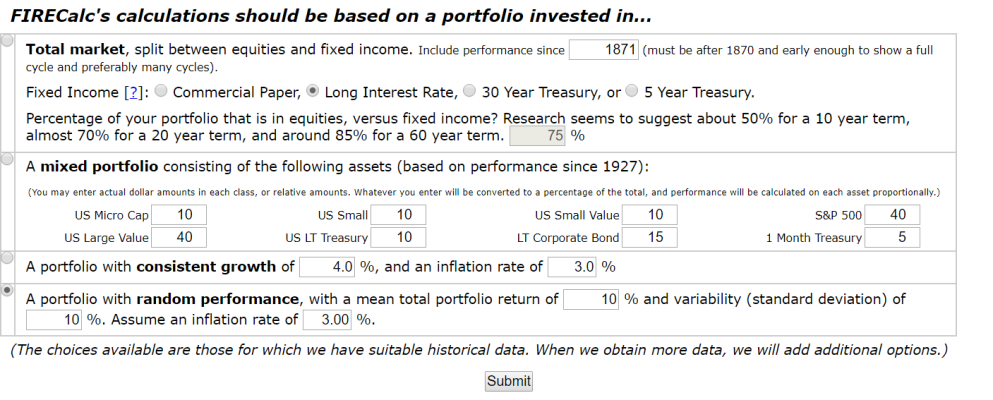

While I also worked through innumerable calculators, tinkering with variables, I am comfortable with the idea that I am still healthy and could easily pick up some extra income if things were too tight. So much of future spending scenarios seemed too difficult to predict. (I'm one of those that needed FIRECalc to be at 100% in many varied scenarios, and used perhaps a dozen other calculators in the last few years. And yes, non-Fidelity investors can use Fidelity's calculator.)

I don't want to go back to full-time at all, but I could happily earn enough for those new appliances we want, DH's dream to add (yet) another garage, or take a ski trip out West.

YMMV. As you say, you might only have to work more if you have get off to a bad start in retirement, so if you really want out of a job due to a toxic environment, involuntary separation, etc, it's worth the risk with that backup plan.

You may also say that you like skiing or gardening, so a part-time job there would seem like a hobby. Maybe, maybe not. People have suggested to me I should do ski patrol or instruction, but I'd rather not be on someone else's schedule, and out there when it's raining or bitterly cold. I friend of mine who taught liked the teaching part but always bitched about how the managers treated the instructors. Gardening, you may think you're going to be re-potting, watering, and pruning plants, only to find out you're unloading and stacking heavy bags of rock and dirt and cleaning restrooms and other jobs like that.