You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2018 YTD investment performance thread

- Thread starter robnplunder

- Start date

Brat

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Crossed back into positive territory last week. A long way to go to earn this year's MRDs however.

copyright1997reloaded

Thinks s/he gets paid by the post

EOM numbers, [-]0.7% YTD (Approximate).[/-] Approximately 67/33 allocation.

ETA: I now have no idea what the real number is. I have a huge and complicated) google spreadsheet on which I track equity prices across all of my accounts. I am having an issue with historical price quotes, including quotes from 12/29/2017 (which I use to generate YTD values on each holding). This is happening on some but not all holdings, which is why I didn't immediately see the error.

I started to look at this after seeing other people post and thinking that "my numbers really suck". Now I know why, because they aren't being calculated correctly.

Now I know why, because they aren't being calculated correctly.

A back of the envelope calculation using account values adjusted for some money transfers...around +1.8%. YTD.

ETA: I now have no idea what the real number is. I have a huge and complicated) google spreadsheet on which I track equity prices across all of my accounts. I am having an issue with historical price quotes, including quotes from 12/29/2017 (which I use to generate YTD values on each holding). This is happening on some but not all holdings, which is why I didn't immediately see the error.

I started to look at this after seeing other people post and thinking that "my numbers really suck".

A back of the envelope calculation using account values adjusted for some money transfers...around +1.8%. YTD.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

End of month already. Time goes by fast.

On market close of 2/28, YTD result is 2.06%.

Just two days ago, it was a lot higher at 4.7%. I "lost" one year of living expenses in two trading days. Isn't volatility wonderful?

At end of January YTD: 5.79%. It was close to 8% last Friday, before the big drop...

On market close of 2/28, YTD result is 2.06%.

Just two days ago, it was a lot higher at 4.7%. I "lost" one year of living expenses in two trading days. Isn't volatility wonderful?

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

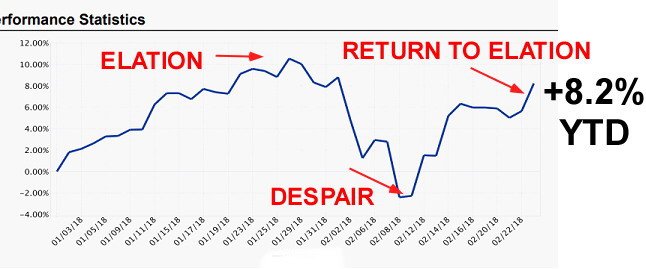

Are we back to despair yet?

- Joined

- Oct 13, 2010

- Messages

- 10,735

I have to wait until 8:30pm or so for my 401K provider to refresh to today's close. I skipped January due to being out of town. It was looking bright on 1/23, the last time I looked. I think someone said there was a bump after that, though

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

End of month already. Time goes by fast.

On market close of 2/28, YTD result is 2.06%.

Just two days ago, it was a lot higher at 4.7%. I "lost" one year of living expenses in two trading days. Isn't volatility wonderful?

Hey you are on pace for 12% yearly....

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Hey you are on pace for 12% yearly....

Or one can look at it this way.

End of Jan: 5.79%. End of Feb: 2.06%. That's -3.73%/month.

10 more months in the year. So, -37.3% left to go?

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Wish my 401(k) providers could add it up by then. I usually need to wait til next morning to get previous day's end total.I have to wait until 8:30pm or so for my 401K provider to refresh to today's close. I skipped January due to being out of town. It was looking bright on 1/23, the last time I looked. I think someone said there was a bump after that, though

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Or one can look at it this way.

End of Jan: 5.79%. End of Feb: 2.06%. That's -3.73%/month.

10 more months in the year. So, -37.3% left to go?

Glass half full... Your options strategies will prevail.

+1.95 ytd, 100% equities. At one point I was up over 7% and then took a 9% elevator ride down, only to rebound up to about +4% and to then finally settle at 1.95%. One things for certain, volatility is here and interest rates are on the rise. That easy money addiction is gonna have to be waned.

Been a while since I've seen volatility like this. Well I think since 2016. Dow just snapped the longest monthly winning streak since 1958. If anyone here was invested during that bull, and this bull, I would like some adoption papers

Been a while since I've seen volatility like this. Well I think since 2016. Dow just snapped the longest monthly winning streak since 1958. If anyone here was invested during that bull, and this bull, I would like some adoption papers

- Joined

- Oct 13, 2010

- Messages

- 10,735

Wow, a lot of positive numbers for the year. I'm not in the plus column....I'm at -0.6% for the year. Dropped a couple three percent since I looked in late January

robnplunder

Thinks s/he gets paid by the post

Barely up at 0.19%. Thanks God that Feb is over. Hope to see a better month ahead.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

YTD (February 28, 2018) returns for a collection of 'close-to' 60/40 funds (from Morningstar.com):

0.00% VSMGX Vg LifeStrategy Moderate Growth (60/40)

-.06% VTWNX Vg Target Retirement 2020 (55/45)

0.06% VBIAX Vg Balanced Index (60/40), no foreign

-.22% DGSIX DFA Global 60/40 I, small-cap & value tilted

-.79% VWENX Vg Wellington (66/34)

0.05% VTTVX Vg Target Retirement 2025 (63/37)

0.71% VGSTX Vg STAR (63/37)

Some notable YTD losers

-1.68% VWIAX Vg Wellesley (38/62)

-2.10% VBTLX Vg Total US Bond Index

-2.86% VSIAX Vg Small-cap value index

-11.5% VGSLX Vg REIT Index

0.00% VSMGX Vg LifeStrategy Moderate Growth (60/40)

-.06% VTWNX Vg Target Retirement 2020 (55/45)

0.06% VBIAX Vg Balanced Index (60/40), no foreign

-.22% DGSIX DFA Global 60/40 I, small-cap & value tilted

-.79% VWENX Vg Wellington (66/34)

0.05% VTTVX Vg Target Retirement 2025 (63/37)

0.71% VGSTX Vg STAR (63/37)

Some notable YTD losers

-1.68% VWIAX Vg Wellesley (38/62)

-2.10% VBTLX Vg Total US Bond Index

-2.86% VSIAX Vg Small-cap value index

-11.5% VGSLX Vg REIT Index

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Given that total bond (VBTLX) is down -2.10%, and S&P is up +1.81%, a 60/40 mix of the two should give a YTD return of 0.25%.

By the way, BND (Vanguard Total Bond ETF) is down -2.26%, including the dividend on 2/1/18. There's a small mistrack compared to VBTLX above.

By the way, BND (Vanguard Total Bond ETF) is down -2.26%, including the dividend on 2/1/18. There's a small mistrack compared to VBTLX above.

Wow, a lot of positive numbers for the year. I'm not in the plus column....I'm at -0.6% for the year. Dropped a couple three percent since I looked in late January

I am with you, running -0.64% ytd. All the best models I track have similar performance for the same allocations. Paul Merriman's picks (moderate), Bogleheads 3 fund and 4 fund etc.

I am always amazed so many do better with only 60 to 70% equities......than these index fund models with similar allocations.

As pointed out my Wellington and Wellesley funds pull all the stars down.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

When you do not index, anything is possible, outsize gains as well as huge losses.

If you look through the thread, earlier a poster did perhaps 100% Boeing. It's 22% up YTD. And that's on top of huge gain of near 90% last year.

Darn, if I doubled my money like that, I would head to Seattle to buy meself that waterfront home I wanted all my life.

I am a lot more diversified, but with a bit of overweight in semiconductors. And I worked hard in looking for opportunities to write covered call options, as well as buying the dip earlier in Feb. All that work to get meself 2.06% YTD. Yes, I am running a bit more than 70% stock right now.

Yes, I am running a bit more than 70% stock right now.

Compared to negative numbers, my 2.06% YTD is not too shabby. The problem is I may give it all up tomorrow too.

Is the market an interesting game or not? I think it's more like a chess game than Las Vegas.

If you look through the thread, earlier a poster did perhaps 100% Boeing. It's 22% up YTD. And that's on top of huge gain of near 90% last year.

Darn, if I doubled my money like that, I would head to Seattle to buy meself that waterfront home I wanted all my life.

I am a lot more diversified, but with a bit of overweight in semiconductors. And I worked hard in looking for opportunities to write covered call options, as well as buying the dip earlier in Feb. All that work to get meself 2.06% YTD.

Compared to negative numbers, my 2.06% YTD is not too shabby. The problem is I may give it all up tomorrow too.

Is the market an interesting game or not? I think it's more like a chess game than Las Vegas.

Last edited:

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

The covered call options got me 0.56% YTD (counted in the 2.06% YTD total).

If I could continue at this rate, the covered call writing would bring 3.4% for the year. That would be awfully good, as my WR is only 2.5% (unless I splurge on something big, which is not likely).

Don't know if I will succeed, but I am tryin'...

If I could continue at this rate, the covered call writing would bring 3.4% for the year. That would be awfully good, as my WR is only 2.5% (unless I splurge on something big, which is not likely).

Don't know if I will succeed, but I am tryin'...

poppydog

Recycles dryer sheets

(UK poster here.). Our FTSE100 is down 6% on the year, having recovered about four points from early February. I do have some international exposure and, excluding new savings, am down 2.3%. Including the new inputs, I’m down just 1.3% and I’m content with that.

DW and me are retiring at the end of April when we will collect a considerable amount of tax free cash from employers pension schemes - so I’m happy to see markets stay flat for a few months so that I can invest this cash at cheaper prices.

DW and me are retiring at the end of April when we will collect a considerable amount of tax free cash from employers pension schemes - so I’m happy to see markets stay flat for a few months so that I can invest this cash at cheaper prices.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Given that total bond (VBTLX) is down -2.10%, and S&P is up +1.81%, a 60/40 mix of the two should give a YTD return of 0.25%.

By the way, BND (Vanguard Total Bond ETF) is down -2.26%, including the dividend on 2/1/18. There's a small mistrack compared to VBTLX above.

Down 14 bps, which should make sense on a 50/50 portfolio.

gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

+0.06%. Whee?

Islandtraveler

Recycles dryer sheets

Blended rate up 2.23% 80/20 I feel like a financial wizard .

copyright1997reloaded

Thinks s/he gets paid by the post

When you do not index, anything is possible, outsize gains as well as huge losses.

If you look through the thread, earlier a poster did perhaps 100% Boeing. It's 22% up YTD. And that's on top of huge gain of near 90% last year.

Darn, if I doubled my money like that, I would head to Seattle to buy meself that waterfront home I wanted all my life.

I am a lot more diversified, but with a bit of overweight in semiconductors. And I worked hard in looking for opportunities to write covered call options, as well as buying the dip earlier in Feb. All that work to get meself 2.06% YTD.Yes, I am running a bit more than 70% stock right now.

Compared to negative numbers, my 2.06% YTD is not too shabby. The problem is I may give it all up tomorrow too.

Is the market an interesting game or not? I think it's more like a chess game than Las Vegas.

Ding ding ding. (+1). In my case I have about 30% of my assets in individual securities, which causes me to overweight certain sectors. Looking at my industry pivot, I was helped by Financials (+4.6%, some holdings: JPM, BAC, C, KBE, BCS), Technology (+5.7%, some holdings: AAPL, ADI, MSFT, CY, ...), Medical(+3.0%, some holdings: ABBV, ABT, EW, CAH, IBB,...). About 10% of my assets are in technology holdings in addition to those provided by broad market indexes (e.g. VTI), and about 6% overweight in Medical. I've been overweight in these areas for quite a while. I am also slightly overweight non USA holdings, with 74% of my non fixed holdings being USA based funds/companies.

As you say, this also elevates the downside risk profile, but interestingly enough I typically have a smaller beta on a daily basis due to having considerable cash/low duration fixed holdings.

Yes, the market is a very interesting game. One that I like to play.

Similar threads

- Replies

- 124

- Views

- 5K

- Replies

- 15

- Views

- 7K

- Replies

- 50

- Views

- 5K