wmc1000

Thinks s/he gets paid by the post

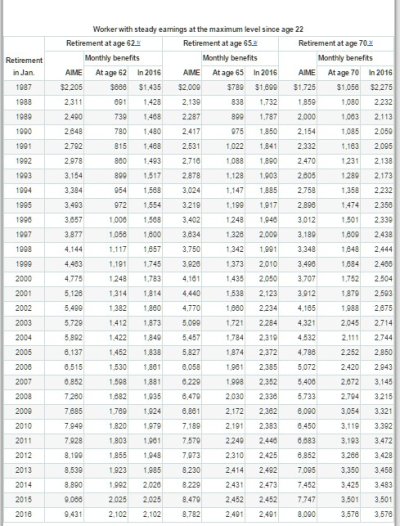

DW and I have decided to take it at 65 so as to coincide with medicare start. Not that we need the money but since ACA will be out of the picture then might as well take the slightly less payout for the maximum number of years. Have run my spreadsheets using a combination of different SS draw dates from 64 to 70. The results at age 95 longevity are relatively miniscule compared to total asset value at the end. In any event none of my projections leave wife out of money even were I to die at any age from 65 on up so all is good.