Chuckanut may have been taking a well-earned vacation when we discussed Mr Ferri's 30/70 proposal a few months ago.

Here's that thread. Lots of graphs and well-thought-out opinions there (as here).

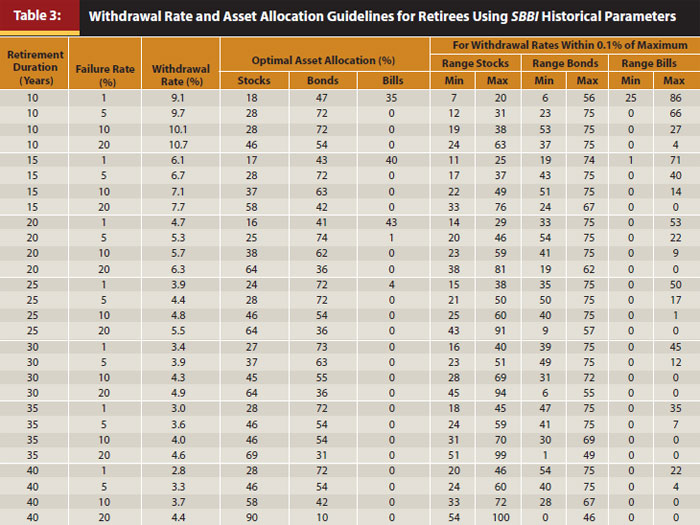

Like then, I think Mr Ferri is conflating "risk" with "volatility"--they ain't the same thing. The main "risk" is not the rising and falling of equity prices, it is inflation. Having a healthy dollop of equities has, historically, been important in order to address that risk. And as Audrey1 pointed out, if a long-term retiree goes below about 45% stocks, then the withdrawal rate needs to go down.

Chart below is from

an article by Wade Pfau:

__________________

Takeaway from the above: If your retirement horizon is 30 years or longer and you need to take a WR of more than 3.5% (of starting balance, adjusted for inflation), then you probably need more than 30% stocks if history is any guide. 45% stocks would be a better WAG for this situation.

At today's interest rates, I'd be buying some very short duration bonds if I was thinking of going to a bond-heavy allocation.

With this recommendation, I'm concerned Mr Ferri may have joined Dr Bernstein in recommending a course of action that will reduce their chances of getting a batch of nasty phone calls from clients. I'd rather they provide analysis, with all appropriate cautions, that is appropriate for the informed investor.