Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

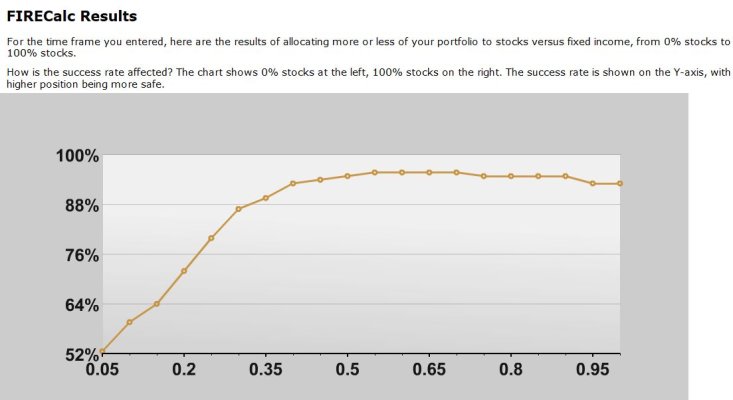

Here is an interesting article by Rick Ferri in which he claims that for those already retired a 30/70 asset allocation is the best overall, combining much less volatility with descent growth.

I bring this up because of a recent session doing 'what-if' tests with Firecalc. It seems that my preferred success rate (100%) does not decrease below that level as I add more bonds until my AA ratio gets to be about 20/80. In fact, some of the higher bond levels show larger possible end of life accumulations - I assume because at sometime I would have avoided a big hit in a down market.

The Center of Gravity for Retirees

I bring this up because of a recent session doing 'what-if' tests with Firecalc. It seems that my preferred success rate (100%) does not decrease below that level as I add more bonds until my AA ratio gets to be about 20/80. In fact, some of the higher bond levels show larger possible end of life accumulations - I assume because at sometime I would have avoided a big hit in a down market.

The Center of Gravity for Retirees

I propose the center of gravity for those who have accumulated enough for retirement to be 30% stocks and 70% bonds. This is a conservative mix that has enough equity to growth with inflation and enough fixed income to keep portfolio volatility at bay. Historically, a 30/70 allocation has earned the highest Sharpe ratio. This is the point on the efficient frontier that has earned the best risk-adjusted return as illustrated in Figure 2.