Major Tom

Thinks s/he gets paid by the post

My thoughts too. I'd be living high on the hog if I were withdrawing 4.5%!4.5%? Oh no!! Better ramp up my lifestyle.

My thoughts too. I'd be living high on the hog if I were withdrawing 4.5%!4.5%? Oh no!! Better ramp up my lifestyle.

I also found it interesting that he bases this on tax-advantaged portfolio:

I don't know about the rest of you, but I don't have anything close to a majority of my retirement funds in a tax-advantaged account. Wish I did, but even with maxing out 401ks, etc. it wasn't close and I couldn't FIRE just with those amounts. So assuming everything is coming from tax-advantaged seems like a weird assumption. Seems like there would be a bigger tax hit if that was your source of income during retirement. Think the number would be different if it all came from a regular investment account? It seems so to me since you've already paid some taxes on the funds already during your w*rking life.

I find it difficult to believe a 75/25 portfolio begun in 2000 and adjusted for inflation is doing “Well”. I am assuming he meant 3-5 year treasuries when he said 75/25 stock intermediate term treasuries. Of course he also does not define what he means by stocks — other than to call them common stocks, but the S&P500/ ST bonds which was being floated in the years after this study as sure to last 30 years with a 4% withdrawal was down to 491 thousand at the end of 2015. A inflation adjusted 60%+ portfolio decline. I cannot imagine a 4.5% withdrawal having a chance of success there.

Raddr's Early Retirement and Financial Strategy Board • View topic - Hypothetical Y2K retiree update

Let's assume he meant the Total Stock Market index.

The portfolio you linked to uses the S&P500 and a 6 month commercial paper for the equity/bond portion. Choose a different asset and you'll get a different result. Besides, the S&P500 returned almost 12% in 2016 and commercial paper rates rose during the year, so that portfolio is on its way up.

Interestingly, lower down on the same page that you referenced, a guy shows the performance of a VBINX based portfolio w/constant 3% inflation & it is doing pretty well considering what we've been through over the last 16 years.

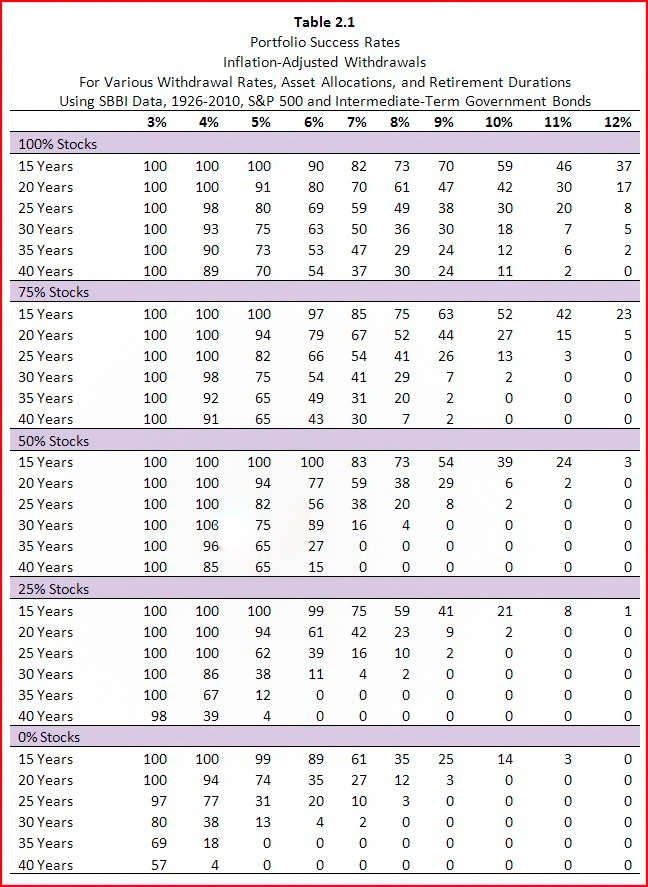

at 4% , 90% of all the rolling 30 year periods since 1926 left you with more than you started with . 67% left you with 2x what you started with and 50% left you with 3x what you started with .

Actually for someone with a low spending requirement, I think it is better to have more in tax advantaged accounts even if they are not Roth. The money is only taxed as you take it out. If you take it out at near poverty levels, you are really not going to pay much if any tax.

Example you have 1.2 million in a 401K and 500k in after tax account. A married couple pulling a taxable $20,000 out of the 401K and taking $15,000 in dividends and capital gains from the after tax account is going to pay $0 in federal tax.

I ran this as a $20,000 taxable 401K or IRA distribution, $7,000 in qualified dividends from the taxable account and $8,000 in long term capital gains from the taxable account. I used 2016 tax software.

$35,000 to live on, $0 tax due.

Probably can bump up a bit more on the figures and still be $0 tax.

I agree that good early results show that you didn't get one of those bad scenarios where you get hit by an early bear. Some increase seems reasonable.That is why I favor some prudent ratcheting up of withdrawals/spending as one avoids the burly bear.

If someone retired 5 years ago with $1 million and a 4% WR and they now have $1.5 million then I see no reason why they cannot prudently ratchet up to 4% of $1.5 million.... it is just as prudent as someone with $1.5 million who is just now retiring starting with a 4% WR.

again , constant inflation will give you totally different skewed results . it is like trying to use average returns when spending down .

milevsky demonstrated how there can be as much as a 15 year difference in how long the money lasts using averages vs actual sequences

The average safe withdrawal rate for all those 200+ retirees is, believe it or not, 7%! However, if you experience a major bear market early in retirement, as in 1937 or 2000, that drops to 5.25%. Add in heavy inflation, as occurred in the 1970's, and it takes you down to 4.5%.

So with no early bear market or *heavy* inflation, your SWR can be SEVEN percent

Wow.

But most calculators don't make the distinction. Someone unaware of the differences might underspend.. With 80% of my portfolio in pretax, I THOUGHT I was overspending but now I might not be.not really , since this is based on it being in some form of retirement account only .