+1

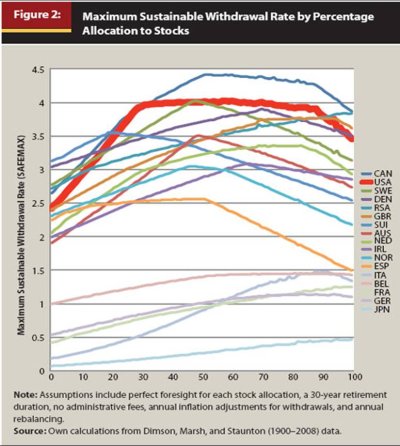

the study on which the "4% SWR" is based assumed a 30-year retirement and an equity allocation of 75%. I think also the 4%WR assumed that the portfolio would be totally consumed at the end of the 30 years and had a 5% probability that you would outlive your money. I'm going by memory here, so I'm open to correction.

If your retirement will differ from those parameters, an adjustment to the WR is probably in order.

Ok the above is incorrect. The 4% Safe withdrawal rate was intended as a level of withdrawal that would ensure that the portfolio would NOT deplete in a 30 year time period. The aftcast on this shows that it is possible, or has been possible in the past, that the portfolio could deplete. It is not likely though, and it is much more likely you would have a large estate left behind.

The best book written on this SWR topic is Unveiling the retirement myth by Otar.

Regarding the 5% chance of "outliving your money", that would be probably in the range of a 8% withdrawal rate, based on the initial year, and indexing to inflation.

Something that doesn't get mentioned much is the variance people take in their withdrawal rate. If you retire on 2M asset base, use 4% WR (80k initial year), and the portfolio falls 40% the first year, it is unlikely you will still feel find pulling 80k + inflation the very next year. However, this is actually what these SWF studies are suggesting. They are using the number of 4% as the very first year, and regardless of asset movement, continuing to withdraw the same amount (not percentage!) plus inflation in all following years. The understanding here is that your assets fluctuate, but your spending should not.

The 4% withdrawal rate depends on many things for portfolio survival, the biggest of which in my opinion is management and trading fees. If you have a million dollar portfolio, pay 1.5% in management and trading fees, and decide to withdraw using this 4% rule, you are actually withdrawing 5.5% as per the studies conducted. This is kind of my primary reason for shying away from any asset management. (that being said, I am considering a flat fee DFA advisor).

I'd love to talk more about this topic with anyone interested. If anyone hasn't already, really check out that book. I actually read it first from the free download the offer gave, and then decided to buy the paper copy ($50!, way expensive for a financial book), but worth every penny to me. The book was written and targeted to retirement advisors if I recall correctly.