wrigley

Full time employment: Posting here.

Hello,

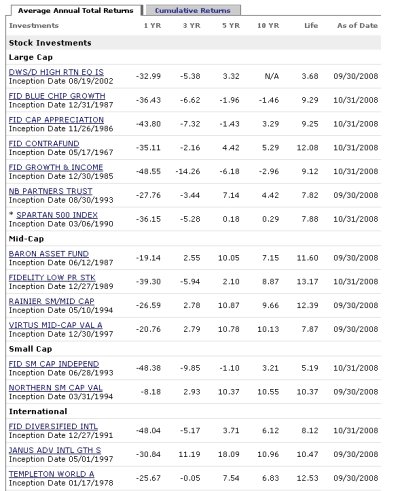

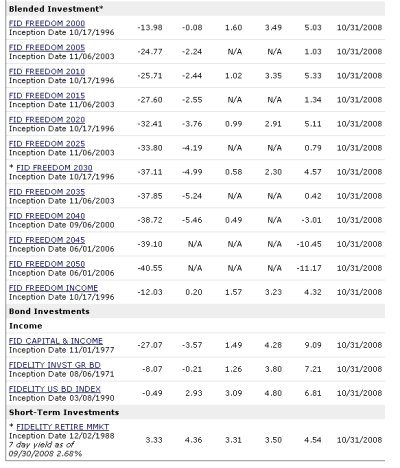

I'm looking for a bit of advice concerning my 401k. I am 48 years old and have been in the civilian workforce for the past 10 years. Prior to that I was in the U.S. Navy and retired after 20 years. I receive a small military pension and will get that as long as I'm on the right side of the dirt! I have been contributing 13% (with a 4% employer match) to my employer sponsored 401k (Fidelity) for the past 9 1/2 years. I've been contributing to FIDELITY FREEDOM FUND 2030 (50%) and FIDELITY INDEX 500 (50%). As like most, my 401k is down about 40%. About a month ago I somewhat panicked and changed my contributions to 100% FIDELITY MONEY MARKET FUND. After I emotionally sobered up I realize that this was probably not the smartest move I could have made. I'd like some suggestions as to which funds you'd recommend to place my money in and LEAVE IT ALONE for the long haul. God willing, I'm sure I'll work for another 20 years. I've got access to just about every Fidelity fund for my 401K. I've attached 2 lists of the Fidelity funds I have access to through my 401k. Thanks

Mike

I'm looking for a bit of advice concerning my 401k. I am 48 years old and have been in the civilian workforce for the past 10 years. Prior to that I was in the U.S. Navy and retired after 20 years. I receive a small military pension and will get that as long as I'm on the right side of the dirt! I have been contributing 13% (with a 4% employer match) to my employer sponsored 401k (Fidelity) for the past 9 1/2 years. I've been contributing to FIDELITY FREEDOM FUND 2030 (50%) and FIDELITY INDEX 500 (50%). As like most, my 401k is down about 40%. About a month ago I somewhat panicked and changed my contributions to 100% FIDELITY MONEY MARKET FUND. After I emotionally sobered up I realize that this was probably not the smartest move I could have made. I'd like some suggestions as to which funds you'd recommend to place my money in and LEAVE IT ALONE for the long haul. God willing, I'm sure I'll work for another 20 years. I've got access to just about every Fidelity fund for my 401K. I've attached 2 lists of the Fidelity funds I have access to through my 401k. Thanks

Mike