Hi,

I just started working for the local government judicial court and I don't know much about investing. However, I would like to get started and don't want to end up on the wrong path where I have to curse at myself during the retirement years.

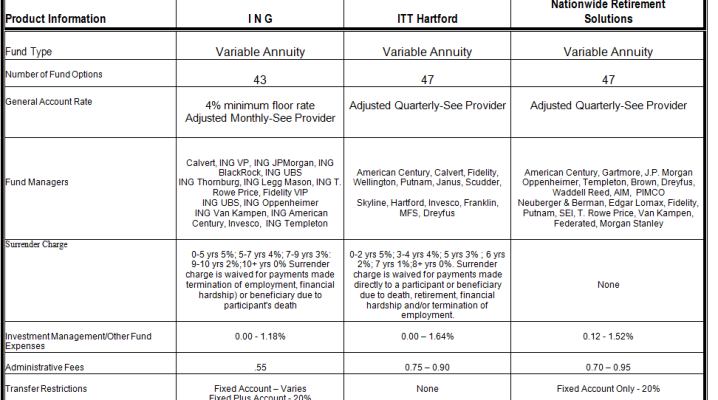

I have attached the three different 457b plans currently offered at my job, which one would you prefer? Any recommendations?

Thanks,

The newbie

I just started working for the local government judicial court and I don't know much about investing. However, I would like to get started and don't want to end up on the wrong path where I have to curse at myself during the retirement years.

I have attached the three different 457b plans currently offered at my job, which one would you prefer? Any recommendations?

Thanks,

The newbie