retiresumtime

Dryer sheet aficionado

- Joined

- Jan 7, 2018

- Messages

- 28

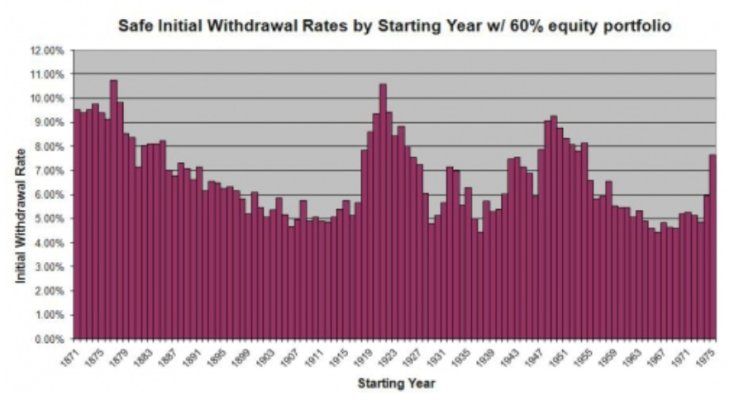

Ok all, I see people withdraw 1.5 to 2 up to 4% withdraw rate.

My question has anyone been pulling more than 5 % and if you have been pulling that much, how long have you done that, have you seen a large change in portfolio?

My question has anyone been pulling more than 5 % and if you have been pulling that much, how long have you done that, have you seen a large change in portfolio?