Floridatennisplayer

Recycles dryer sheets

- Joined

- May 3, 2014

- Messages

- 485

Planning on retiring in a few more years. However, after years and years of contributing into retirement accounts, the thought of doing withdrawals even thought the right thing, seems painful to me.

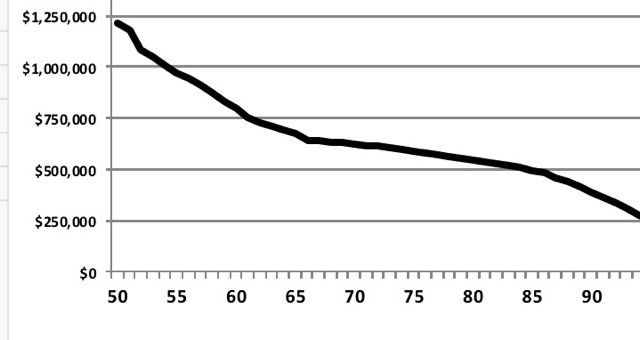

SS will cover the majority of my expenses and I'll have to withdraw some cash out which is already bugging me. I guess I have been conditioned to NEVER TOUCH THAT is still in my head, even though that's what it's designed for. I hate the thought of DEPLETION.

Any of you struggle with this reversal in processes? Just curious. And all the calculators give me the green light, FYI.

Thanks.

SS will cover the majority of my expenses and I'll have to withdraw some cash out which is already bugging me. I guess I have been conditioned to NEVER TOUCH THAT is still in my head, even though that's what it's designed for. I hate the thought of DEPLETION.

Any of you struggle with this reversal in processes? Just curious. And all the calculators give me the green light, FYI.

Thanks.