A few short comments in defense of the dividend withdrawal method, and why I prefer it to the total return withdrawal method.

It comes down to information and accountability.

Dividends are set by the executives and the board of directors, and failing to pay a dividend has real world consequences. Who better to know what percentage of profits can be distributed to the shareholders than the executives and BOD? They are not pulling numbers out of thin air. Its based on the best possible data and projections that the company can make. ...

Well, the executives and BOD of CTL didn't seem to know, or they did know and did not inform the investors. Though I agree, there are consequences (CTL stock price). Even if they are upfront with what they know, if business is bad, they may need to cut divs. Knowledge alone doesn't protect a business form doing poorly. See this thread for more:

Any other CenturyLink (CTL) holders here? Wondering what you guys think of the dividend cut this week (from $2.16 to $1.00 annually), especially after management assured their investors multiple times in 2018 and even as recently as December (!) that they were "comfortable" with the existing dividend. .... .

I recommend using funds/etfs to eliminate individual stock risk. For example VYM and VIG etfs.

Sure, you should diversify to avoid single stock risk, but it still holds that using the

"best possible data and projections that the company can make" doesn't assure success. And those same executives and BOD are predicting the future performance of the company, and divs can't be maintained w/o performance to back it up. That performance also drives the stock price. Where's the distinction?

... The total return method is determined by either a completely arbitrary amount or at best it is based on past historical information. It is not based on a fine grained study, looking at every single company in a portfolio individually, examining the most current data. This is not a withdrawal method where teams of accountants and finance people are pouring over the numbers and presenting a detailed report to the CEO and BOD with a recommendation (a recommendation which has real employment consequences for the people vouching for said data).

Furthermore the total return withdrawal method is subject to the irrational whims of the market, which often do not correspond to what individual companies are experiencing at the current time.

People can poo poo dividends all they want and claim they are a useless tax burden, yada yada yada. However, there is no question in my mind that the dividend withdrawal method is much safer and logical than the total return withdrawal method.

I won't "poo poo" dividends, but I will continue to evaluate these claims made by the high-div payer sector fans.

I fail to see how a "total return method" ( a term I disagree with anyhow - total return is just math, it is reality, it isn't a 'method', it is what you get from an investment) is any more/less arbitrary than selecting div payers. Regardless, if there was anything significant and actionable in what you say (which is all that matters), then we would see a clear advantage to your selections of VYM and VIG, over the 'arbitrary' selection of the Total Market (VTI).

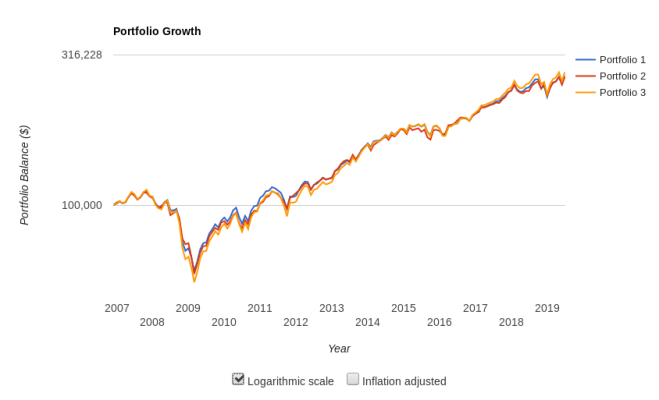

And yet, when I plug these into Portfolio Backtester, it shows that VTI outperforms a blend of VIG/VYM. And if I add in some bonds to make the performance about equal, the standard dev is very, very close.

Where's the advantage? Can you demonstrate the advantage, rather than just claim there is one? This isn't "poo-poo-ing" anything, it is letting the numbers talk.

http://bit.ly/2L7T9EL << short link

Port 1 = VTI /VBFMX 89.6/10.4

Port 2 = VYM/VIG 50/50

Port 3 = VTI 100%

-ERD50