Thank you, Midpack, for taking the time to answer me.

I would like to answer your post point by point, so this post may be a bit longer than usual by my standards.

1. Like you I had no interest in going back to this thread/topic, but I appreciate your viewpoint because it is different from mine - however you still show patience and respect for other people's views.

2. sorry if this is going to sound blunt, but the chart you refer to does not mean much to me. The reason ? I do believe we are going to have another huge black swan. How ? Where ? When ? I don't know. But trees don't reach the sky. Five years ago we witnessed the biggest crash in our lifetime. Unprecedented help came from central banks in G7 countries to keep the system afloat. Who knows if these central banks will intervene next time round ? Do you know for sure ? No. I don't either. The system is broken, IMO (not a political comment, my view only). Are debts around the world going to be bigger than the global wealth produced one day ? Something has to give in. This is why I always say to forum particicipants who ask about Firecalc that I would FIRE only when Firecalc results = 100%. I don't settle for less than 100% because I am afraid of future financial crises.

And my family was devastated in Europe during Word War II, which does not help my psyche / feelings of security.

3. I agree with you - there are hundreds of detailed AA vs success rate threads. A little story here. I bought my condo in spring 2008. I wanted to pay cash only. Some condo, in a nice area, small but functional. I remembered the real estate agents (

ALL of them) telling me "why don't you get a mortgage and get something much bigger ? Prices will keep going up ! You can afford it. EVERYONE DOES IT!" I remember saying to them that I did not buy a condo as an investment, just a place to live - and prices had increased dramatically over the last 20 years. I remember saying "Trees don't reach the sky". They looked at me with incredulity. Six months later, Lehman Brothers imploded and real estate prices are unlikely to get back to the same levels in my lifetime.

This was my first real estate purchase ever. Do you see where I am coming from ? I am extra conservative because 1) delayed gratification 2) afraid to lose money 3) state of mind - optimistic, liberal on many topics but conservative, pessimistic in finance topics 4) no faith in the present "system". 5) personal history.

4. Agreed that 0% equity has not been the lowest risk strategy because of inflation. Please look in all my posts and tell me where I have said so in any post ? Nowhere. All I have said is that I tend to be very conservative.

I am aware of the inflation risk but it is a risk I am willing to take. At the present my investment in Europe (State garanteed contracts signed 30 years ago) generate close to 4%. On average, my investments in EU + US generate close to 3.5%, still over inflation. Something I can live with.

5. Yes. I have played with FIRECALC or other resources, read many threads here when I could, shared and learned. And this is why I decided last year to buy some Wellesley and also deferred annuities. Baby steps.

6. You are correct. I have never provided any substantial/quantifiable detail post to support my near zero equity AA POV from an actual risk perspective. But do I have to ? I am not here to teach anyone anything, and I freely admit I am not an expert in finance.

Only here to share my experience in a respectful way (although not afraid of putting bullies back in their place

), always in an honest and open way. My views may be in the minority here but they carry as much weight as anyone else's in an open forum. This website is a place to share experiences and learn from them, IMO.

7. I do not do market timing. No time for this. I have always been the same with money.

8. I hope you are right about Japan, but it does not mean much to all those who have retired in the last 20 years or so.

9. Many of us were shaken by the US markets in 2009, and

I remain justified in my fears. I respect those who rode it out, but it is something I did not have the courage to do. Now - where would you be without federal and central banks intervention in 2008-2009 ? Would the Dow still be at 7,000 and stay there like in Japan ? Would you say the same about your approach then ? You got lucky, and of course that is fine with me.

10. I agree again. There have always been risks in investing, and there always will be.

I made the choice of choosing the inflation risk and try to sleep well when I can. Can't afford the stress at work with patients (not FIRED yet) AND the stress about my finances.

11. It is your right and prerogative to go with a probability based on actual past history, and it is my right and prerogative not to go that way (like when I bought my condo - I had a non typical approach or view). I won't repeat my feelings about financial security because of my personal or family history. I can't talk for most members and I don't want to give a so-called "expert financial advice". Again, I am here to share my view and learn sometimes from other views. I appreciate some members don't have the luxury of a low withdrawal and a (near) zero equity AA. I guess I got lucky with my pay, and many others got lucky with houses they bought 30 years ago and now can sell them with 1000% profit. Others got lucky with inheritances. Others got lucky because they bought when the DOW was at 6,500 and now made a 100% profit.

12. thank you for writing "You're most welcome to your views and your low volatility (not lowest risk/most conservative) approach. We're all unique..." I feel the same about your views which I value and respect equally.

13. Newbies will think what they want to think by reading different views. Even opposite ones.

14. I do care about other members too. I have always corrected medical information when I read something that was wrong, even when I got criticized for giving some advice (read the cholesterol threads again

). I can't read all the posts though. I care about newbies too - do you see all my posts welcoming everyone in the "Hi - I am..." section ? I have always expressed myself openly, no propaganda (as another poster called it), and no hidden agenda. Just a different minority viewpoint. But I wanted to spend the time this morning to give some more background info for you to see where I am coming from. Not to brag about what I do outside work also (I was told I talked too much about it

) , but I spend my spare time also to only care about people...

15. "unfounded" - we just agree to disagree. That's all. In my view, blind faith that stocks will never come down sharply by 50% or more, that another huge black swan won't come up again - is clearly a mistake. While you got lucky five years ago, millions have been ruined either in stocks or real estate. No FIRE for them. And the financial crisis is not over yet.

I don't pretend to have the best answers either (see my signature). Again, I am only here to share my view with others. And I value this site also - like you I am quite prolific with my posts despite working full time still. Last year I learned here about annuities, LTCI, Wellesey, monthly cash flows etc. all of which I implemented.

My post is getting very long. The longest ever for me I believe. Time to stop. Thank you for reading.

And take care.

I had no interest in going back to this thread/topic,

but as you requested a response via PM (attn Mods).

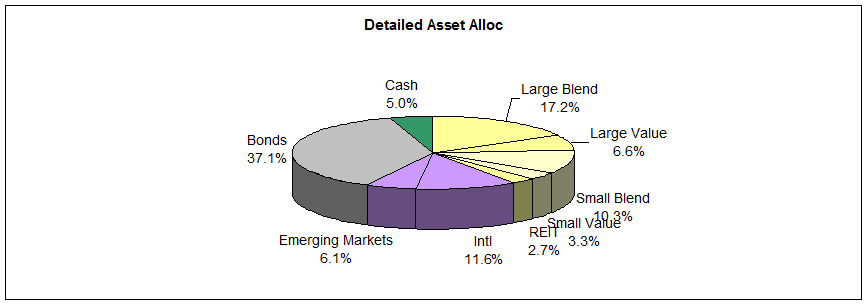

The chart that REW (re)posted above in #33 shows success rates (risk) vs AA from 0% to 100% equity, hopefully that alone will raise questions for anyone. And there have been hundreds of (carefully detailed) AA vs success rate threads, here's just one

http://www.early-retirement.org/forums/f28/more-firecalc-results-vs-equity-allocation-65093.html. 0% equity has NOT been the lowest risk strategy from 1871 thru present, not even close. Play with FIRECALC or other resources and test for yourself. We have been over this at great length.

Respectfully, have you ever provided any substantial/quantifiable detail to support your (near) zero equity AA POV from an actual risk perspective?

If you want to play "what if", you can justify any POV, it's just another variation on market timing. The final script for Japan has not yet been written BTW, now matter how inevitably grim it seems. I am sure many of us were shaken by US markets in 2009, and those who feared equities felt justified in their fears. But those who rode it out (self included) were repaid and then some. How many threads have there been from buy-n-hold investors here sharing all-time highs for their portfolios, even after withdrawals? Most of us have read the ultimately wrong "death of equities" and "this time it's different" articles all our investing lives. There have always been risks in investing, and there always will be.

I'm inclined to go with probability based on actual past history, and chose a conservative withdrawal/spending rate to deal with volatility instead of avoiding equity altogether. Most members don't even have the luxury of a low withdrawal and a (near) zero equity AA, that you do (congrats).

You're most welcome to your views and your low volatility (not lowest risk/most conservative) approach. We're all unique in how we weigh the retirement math/probabilities (relatively objective) vs the emotional aspects (less measurable) of our financial choices. You seem to weigh the latter more heavily than most, and that's your prerogative. Though not understanding the math/probabilities leads many to emotional choices.

Newbies might think zero equity is the lowest risk/most conservative approach,

it sounds correct - but it's not based on all past history (thanks largely to inflation).

I'm sure other members will tell me (again) what do I care about newbies or others here I don't even know? A character flaw of mine I guess. I don't pretend to have all the right/best answers, I make myself look stupid often enough. But I value this site because of all the good information and leads it has provided to many, self included. So when I see a post that's seems clearly unfounded - believe me I've learned to

not reply more often than not, but sometimes it's just irresistable when it's a POV that's being repeated often.

And I think I've lost any interest in this particular debate FWIW...I am tired as anyone of hearing myself talk about this topic.

This board has been invaluable to me and I know to others as well. I think we each of us have an obligation to share our knowledge and experience with others. If we don't, then what's the point? Dialogue, respectful discourse, and education are essential to a learning community which is what this is.

This board has been invaluable to me and I know to others as well. I think we each of us have an obligation to share our knowledge and experience with others. If we don't, then what's the point? Dialogue, respectful discourse, and education are essential to a learning community which is what this is.