cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

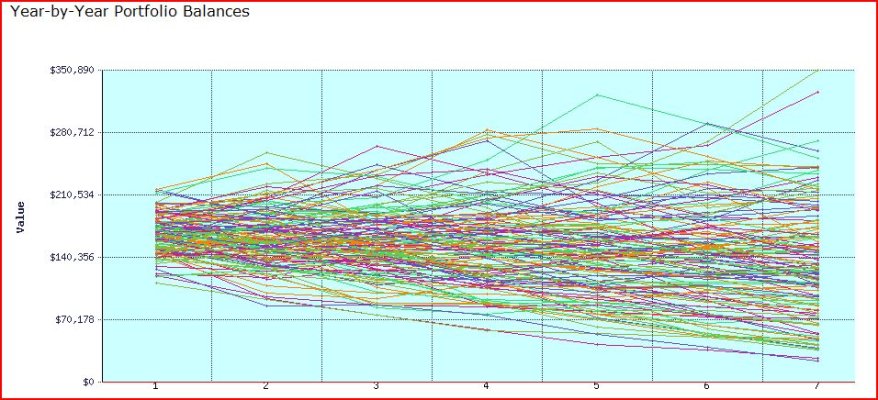

Actually the 4% scenario doesnt specify maintaining your cash balance, it just specifies not going to zero during the period of time being tested. In many instances of trial runs a portfolio may become extremely depleted during or towards the end of a 'run'.

The strategy sounds terrific if you get a fixed rate of return, but returns are variable and multi year periods of negative returns are very common. If you took out your mortgage in late 99 or 2000 with this strategy, I'm thinking it hasnt worked out very well for you over the last 8-9 years. I'd have been chugging down antacid pills by late 2002.

You could have taken on a whole lot more risk, or done a whole lot more diversification than most people and maybe pulled a positive return. But thats a whole different ball of wax.

Once you risk adjust and take into consideration the odds of having a failure to produce a positive return for these less than ten year periods, you find there are no free lunches.

The strategy sounds terrific if you get a fixed rate of return, but returns are variable and multi year periods of negative returns are very common. If you took out your mortgage in late 99 or 2000 with this strategy, I'm thinking it hasnt worked out very well for you over the last 8-9 years. I'd have been chugging down antacid pills by late 2002.

You could have taken on a whole lot more risk, or done a whole lot more diversification than most people and maybe pulled a positive return. But thats a whole different ball of wax.

Once you risk adjust and take into consideration the odds of having a failure to produce a positive return for these less than ten year periods, you find there are no free lunches.