Ready

Thinks s/he gets paid by the post

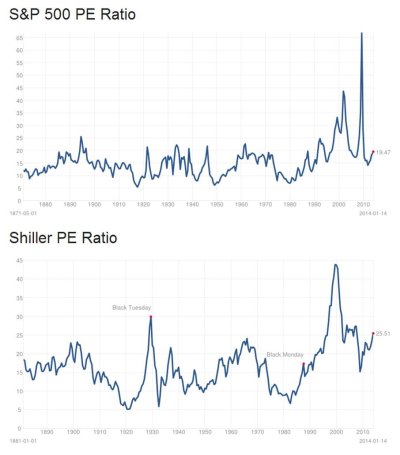

I continue to ready daily news reports reminding us that the various PE ratios analysts like to look at suggest we are nearing all time highs, similar to the ratios we saw right before the 2000 and 2008 bear markets. The often quoted Schiller PE Ratio is now at 25.49, when it's historic average has been about 15. It has me wondering if anyone has thought about adjusting their AA strategy based on the various PE ratios that are used to analyze the markets.

For example, if my normal AA is 60/40, would it be unreasonable to say I'm going to keep it 60/40 as long as the Schiller PE ratio stays below 20. Once it goes above 20, I will adjust to 50/50. I suppose this is just market timing, but is it any different than the market timing we do by rebalancing when our AA is out of alignment due to fluctuations in our stock and bond portfolios?

As long as we decide this is our strategy for the long term, is this really market timing? Is it just "tilting"? Or does it make no sense at all to make adjustments to our AA based on PE ratios?

For example, if my normal AA is 60/40, would it be unreasonable to say I'm going to keep it 60/40 as long as the Schiller PE ratio stays below 20. Once it goes above 20, I will adjust to 50/50. I suppose this is just market timing, but is it any different than the market timing we do by rebalancing when our AA is out of alignment due to fluctuations in our stock and bond portfolios?

As long as we decide this is our strategy for the long term, is this really market timing? Is it just "tilting"? Or does it make no sense at all to make adjustments to our AA based on PE ratios?