accountingsucks

Recycles dryer sheets

- Joined

- Jan 28, 2006

- Messages

- 346

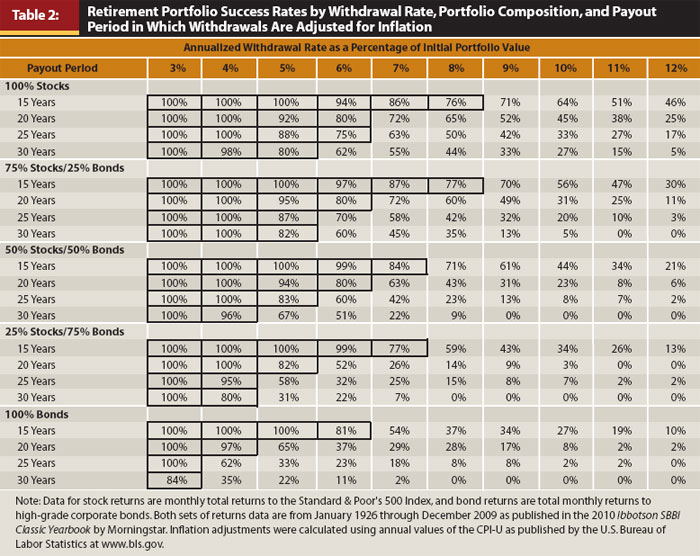

I am planning to have a 3% withdrawal rate and after tax expenses of $40K. This would imply i need $1.32 Million. Now, with 2% inflation, my expenses rise $800 per year but at say 10% tax bracket I need another $80 for taxes for $880 total. $880X33 means i need to build my portfolio from year 1 by $29040 just to keep up with inflation.

So to account for both the inflation growth plus my $40K annual spend, I would need $40000+29040 = 69040/1320000 = 5.2% total return on my portfolio assuming I never intend to draw down principal which is what I am aiming for.

Am I missing something? Seems abit of a lofty expectation given a 60/40 portfolio. I guess withdrawal rates contemplate you drawing down the balance over time but my preference is not to do that until I get Canadian pension in my mid 60's.

So to account for both the inflation growth plus my $40K annual spend, I would need $40000+29040 = 69040/1320000 = 5.2% total return on my portfolio assuming I never intend to draw down principal which is what I am aiming for.

Am I missing something? Seems abit of a lofty expectation given a 60/40 portfolio. I guess withdrawal rates contemplate you drawing down the balance over time but my preference is not to do that until I get Canadian pension in my mid 60's.

... I saw the Canadian pension thing but thought perhaps it was from a prior job and that the OP was in the US. Same principle applies though... do a hypothetical return and include that cost in your expenses. Given OP is Canadian, 10% may not be enough.

... I saw the Canadian pension thing but thought perhaps it was from a prior job and that the OP was in the US. Same principle applies though... do a hypothetical return and include that cost in your expenses. Given OP is Canadian, 10% may not be enough.