ExFlyBoy5

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

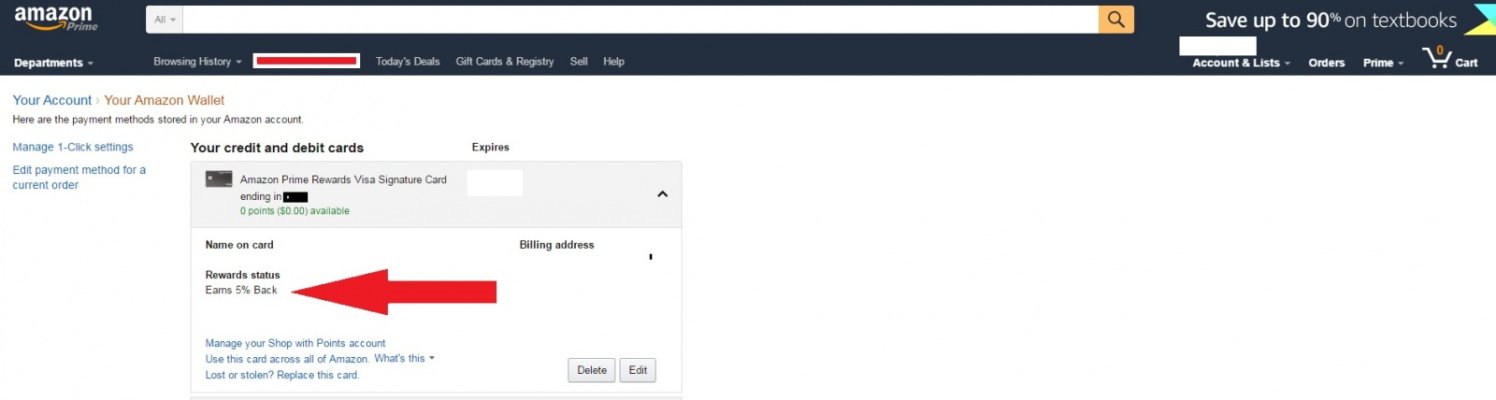

Strange how that works - I now have three Chase cards, the first is a Disney Visa that I never use with a $7500 limit that has never increased, the second is an IHG Rewards Visa that I only use for hotel stays and that one came with a $32,000 credit limit, now this Amazon card that also came with a $7500 limit.

I also got a $70 gift card - between that and the 5% it saved me $85 on an order last night.

Well, this AM I got an email from Chase showing that the limit had been increased to $7,000. Still not sure why the initial amount was $500, but whatever. Prior to getting this card, my Chase cards had the following limits:

Freedom: 10K

Marriott: 18K

IHG: 6K

Sapphire Reserve: 32K

So even before the Amazon card, Chase had extended me over $65,000 of credit and that is all reporting an income that isn't all that large (since I *am* retired).

Nonetheless, glad to get the 5% (and the $70 credit!) since I use Amazon for a LOT of my purchases.