|

|

America is minting more millionaire retirees than ever

05-03-2018, 04:21 PM

05-03-2018, 04:21 PM

|

#1

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2013

Location: SoCal, Lausanne

Posts: 4,408

|

America is minting more millionaire retirees than ever

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

05-03-2018, 05:03 PM

05-03-2018, 05:03 PM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2014

Posts: 2,511

|

Quote: Quote:

|

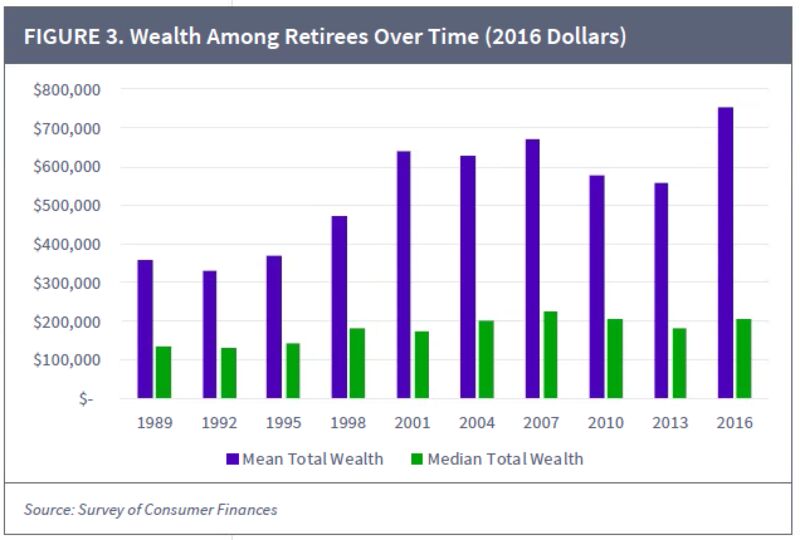

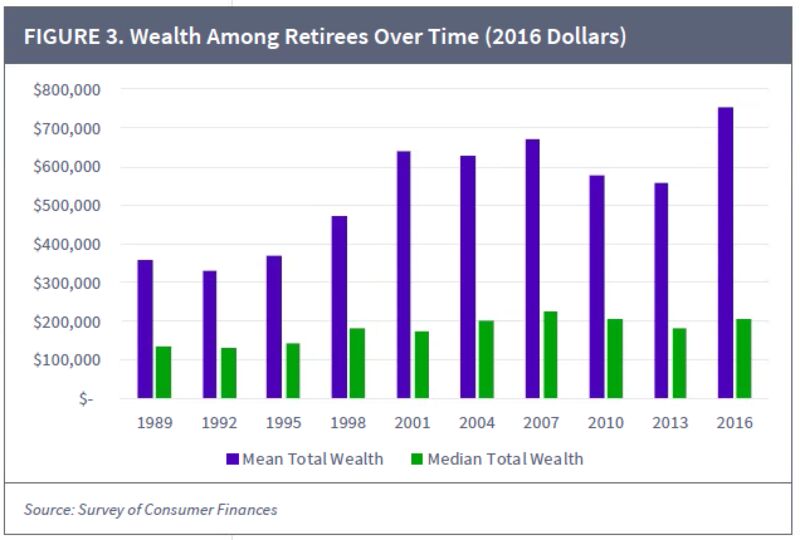

Their average wealth has risen more than 100 percent since 1989, to $752,000, and the share of those who are millionaires has doubled.

|

from the linked article.

So "wealth" doubled in about 30 years. So roughly 2.34% compounded annually. What is the total inflation in 30 years. And they not that housing is a big part.

a million is not what it use to be.

|

|

|

05-03-2018, 05:08 PM

05-03-2018, 05:08 PM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by bingybear

... What is the total inflation in 30 years. ...

|

The number I remember is 2.8%. Past 50 years: 4.5%.

|

|

|

05-03-2018, 05:15 PM

05-03-2018, 05:15 PM

|

#4

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2008

Location: No fixed abode

Posts: 8,765

|

There's a reason many "news" sources don't allow comments on their articles. Meaningless fluff.

__________________

"Good judgment comes from experience. Experience comes from bad judgement." - Anonymous (not Will Rogers or Sam Clemens)

DW and I - FIREd at 50 (7/06), living off assets

|

|

|

05-03-2018, 05:40 PM

05-03-2018, 05:40 PM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2016

Posts: 8,968

|

I'm happy to be one of them. And also following their advice to Blow More Dough!

|

|

|

05-03-2018, 05:41 PM

05-03-2018, 05:41 PM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2014

Posts: 2,511

|

Quote: Quote:

Originally Posted by OldShooter

The number I remember is 2.8%. Past 50 years: 4.5%.

|

Mine was meaning that 2.34% compounded annually for 30 years approximately doubles the original amount.

With your inflation number it seems we are loosing ground

|

|

|

05-03-2018, 06:53 PM

05-03-2018, 06:53 PM

|

#7

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2017

Location: Hog Mountian

Posts: 2,077

|

More digital bird cage lining. The previous generation sat around the radio listening to Orsen Wells, Mitch Miller, Dragnet, etc. I often have the TV on while doing other stuff. Actually watching TV - - - maybe few hours a week.

They were also kind enough to die around 67 so as to not burden SSI inordinately. As for me, I hope to bleed SSI until its white.

__________________

Never let yesterday use up too much of today.

W. Rogers

|

|

|

05-03-2018, 08:31 PM

05-03-2018, 08:31 PM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2016

Posts: 9,514

|

It seemed I have read many different times that there has been a decline in millionaires. I'm happy for all who can accomplish FI and or retire wealthy.

|

|

|

05-03-2018, 08:36 PM

05-03-2018, 08:36 PM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,888

|

Quote: Quote:

Originally Posted by Freedom56

|

What did you find interesting about it?

-ERD50

|

|

|

05-03-2018, 09:21 PM

05-03-2018, 09:21 PM

|

#10

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2013

Location: SoCal, Lausanne

Posts: 4,408

|

Quote: Quote:

Originally Posted by ERD50

What did you find interesting about it?

-ERD50

|

How little TV people are watching according to the article. Three hours per day with all the binge watching on Netfix. It's not possible. Not with series such as Breaking Bad, Better Call Saul, and the Walking Dead.

|

|

|

05-03-2018, 09:27 PM

05-03-2018, 09:27 PM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

The chart in the article shows that in 2016, the mean wealth of retirees was $750K, and the median wealth was just $200K.

Most posters here have several times the above numbers.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

05-03-2018, 09:50 PM

05-03-2018, 09:50 PM

|

#12

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2013

Location: Toronto

Posts: 3,321

|

I think that Figure 3 shows that the rich got richer, everyone else - not so much (since 2004 at least - the amounts are inflation adjusted).

|

|

|

05-03-2018, 09:54 PM

05-03-2018, 09:54 PM

|

#13

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2013

Location: SoCal, Lausanne

Posts: 4,408

|

Quote: Quote:

Originally Posted by NW-Bound

The chart in the article shows that in 2016, the mean wealth of retirees was $750K, and the median wealth was just $200K.

Most posters here have several times the above numbers.

|

One would expect early retirees to have accumulated much more than the mean and median retirement population. The data is skewed by the 5/6 that have not saved as much for retirement.

|

|

|

05-03-2018, 09:56 PM

05-03-2018, 09:56 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by 6miths

I think that Figure 3 shows that the rich got richer, everyone else - not so much (since 2004 at least - the amounts are inflation adjusted).

|

Looking closely, I see that the median wealth was at the same $200K in 2004, 2010, and 2016.

However, the mean wealth which is affected more by richer people showed a decline from 2004 to 2010, then an increase in 2016.

One explanation for that is well-to-do retirees having more exposure to equities, and their wealth varies with the stock market.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

05-03-2018, 10:53 PM

05-03-2018, 10:53 PM

|

#15

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2013

Location: Toronto

Posts: 3,321

|

Also the wealthy own their homes - major meltdown in 2007 on that front as well. If one owns a home in certain areas, one is a millionaire or well on the way! My mother is a millionaire by virtue of owning a modest home in a major metro area.

|

|

|

05-04-2018, 02:39 AM

05-04-2018, 02:39 AM

|

#16

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2009

Posts: 2,985

|

Quote: Quote:

Originally Posted by 6miths

Also the wealthy own their homes - major meltdown in 2007 on that front as well. If one owns a home in certain areas, one is a millionaire or well on the way! My mother is a millionaire by virtue of owning a modest home in a major metro area.

|

Yeah, the term house poor is hitting my DM now. With limited income and ever rising property taxes and maintenance, net worth that includes a primary residence is a very misleading statistic. At age 88 her only option now is to move. And forget about a reverse mortgage if assisted living is even remotely in the picture.

Liquid assets and cash flow are where it's at.

__________________

Took SS at 62 and hope I live long enough to regret the decision.

|

|

|

05-04-2018, 03:52 AM

05-04-2018, 03:52 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,298

|

This was interesting though not suprising to me. I’m down to watching PBS Newshour and little else for news. More and more cable news is partisan garbage these days.

Quote: Quote:

The average retired 60-year-old now watches television almost three hours every day. The increases were largest in high-income, highly educated households, which experienced a 78 percent rise in couch time since 1975, versus 43 percent for lower-income households.

Retirees may not be learning much from their viewing habits, the report suggests. It cited 2016 Pew Research Center data showing that more than 55 percent of households older than age 65 watch cable news programs, and it noted that “one multi-country study found that public broadcast news (such as PBS) increased political knowledge, while cable news actually reduced knowledge that people have about actual events.”

|

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

05-04-2018, 05:47 AM

05-04-2018, 05:47 AM

|

#18

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,410

|

Quote: Quote:

Originally Posted by bingybear

from the linked article.

So "wealth" doubled in about 30 years. So roughly 2.34% compounded annually. What is the total inflation in 30 years. And they not that housing is a big part.

a million is not what it use to be.

|

Anyone remember when $10,000 a year was considered executive pay?

Main lesson for me: Forget about brokerage fees, inflation is the biggest risk to a 30-40 year retirement.

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

05-04-2018, 07:02 AM

05-04-2018, 07:02 AM

|

#19

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,298

|

Quote: Quote:

Originally Posted by marko

Main lesson for me: Forget about brokerage fees, inflation is the biggest risk to a 30-40 year retirement.

|

Inflation is a big bogey, but brokerage fees could be a significant reason a portfolio doesn’t keep up with inflation, so I wouldn’t forget about brokerage fees. Portfolio returns can easily be reduced by 1% or more compounded with higher fees.

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

05-04-2018, 08:41 AM

05-04-2018, 08:41 AM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,410

|

Quote: Quote:

Originally Posted by Midpack

Inflation is a big bogey, but brokerage fees could be a significant reason a portfolio doesn’t keep up with inflation, so I wouldn’t forget about brokerage fees. Portfolio returns can easily be reduced by 1% or more compounded with higher fees.

|

Agreed. It was more of a figure of speech than to be taken literally.

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|