|

|

05-08-2019, 10:08 AM

05-08-2019, 10:08 AM

|

#101

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,374

|

Quote: Quote:

Originally Posted by brewer12345

I will not be eligible to claim ss until about the time the trust fund will be depleted.

|

But if the present discount factor for early benefits and premium factor for delayed benefits remain in place then the payout rate for delaying will be the same... it will just be that the numerator and denominator are 20% lower.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

05-10-2019, 03:51 PM

05-10-2019, 03:51 PM

|

#102

|

|

Recycles dryer sheets

Join Date: Feb 2013

Location: Makakilo and Reno

Posts: 374

|

I have 3 Variable annuities I purchased through Vanguard 6-7 years ago and I would never get rid of them.

|

|

|

05-10-2019, 03:59 PM

05-10-2019, 03:59 PM

|

#103

|

|

Dryer sheet wannabe

Join Date: Feb 2019

Posts: 17

|

I was never a fan of annuities but I came across an article that people who buy annuities are happier about their finances because they know their revenue stream. That is itself for me is a big enough reason to buy some annuities in the future.

|

|

|

05-10-2019, 04:04 PM

05-10-2019, 04:04 PM

|

#104

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,022

|

Quote: Quote:

Originally Posted by seattledan

I was never a fan of annuities but I came across an article that people who buy annuities are happier about their finances because they know their revenue stream. That is itself for me is a big enough reason to buy some annuities in the future.

|

Who wrote the article, someone who works for the insurance industry? A link to the article would be nice.

For me, giving up control of money I saved, invested and grew for decades to "know my revenue stream" would not be a happiness-inducing trade off. YMMV.

__________________

Numbers is hard

|

|

|

05-10-2019, 04:25 PM

05-10-2019, 04:25 PM

|

#105

|

|

Recycles dryer sheets

Join Date: Nov 2012

Location: Olympia

Posts: 150

|

Quote: Quote:

Originally Posted by SumDay

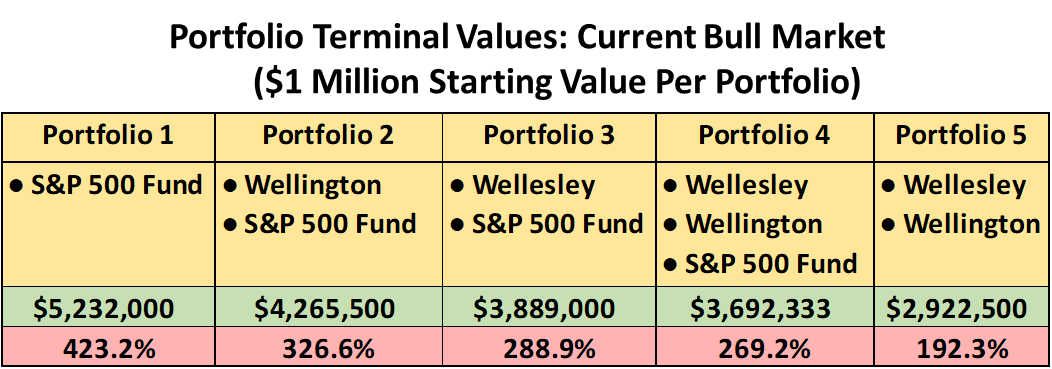

I stumbled across this article about what happened to Vanguard's Wellington and Wellesley funds during the great recession:

https://seekingalpha.com/article/420...vanguard-funds

It's one of those annoying formats that forces you to click NEXT to see all 13 pages, but there are some really illuminating charts that show what happened to various portfolios during 07-09.

This one is page 8:

|

Not so striking if you put this chart together with the losses suffered from 2007-2009, where portfolio #5 not only keeps you in the market but has about twice the return.

In the end S&P500 is within about 10% of the Portfolio #5, but I doubt many had such a 100% equity portfolio and stayed with it ??

Dave

|

|

|

05-10-2019, 04:53 PM

05-10-2019, 04:53 PM

|

#106

|

|

Recycles dryer sheets

Join Date: Nov 2012

Location: Olympia

Posts: 150

|

Quote: Quote:

Originally Posted by corn18

I just did my monthly check on a 15 year period certain SPIA with no COLA. 1.58% APR. That is pathetic. I'll check again next month. I love how they say the payout rate is 8.24%. While that is absolutely the truth, they certainly don't advertise the APR as 1.58%.

|

How does APR relate to a 15 year period certain cash flow?

The IRR on that investment which you can easily do with excel XIRR formula puts the result at just shy of 3% (2.98%) with an 8.12% payout for a 60 year old in WA, which makes much more sense than a 1.58% number. Insurance company payouts are going to be closer to the long bond return.

|

|

|

05-10-2019, 05:07 PM

05-10-2019, 05:07 PM

|

#107

|

|

Recycles dryer sheets

Join Date: Nov 2012

Location: Olympia

Posts: 150

|

Quote: Quote:

Originally Posted by SoReadyToRetire

I used to listen to Clark Howard on the radio all the time. I always remember that he said to NEVER buy annuities, because they're too much of a ripoff. That has stuck with me.

HOWEVER--now that I'm so close to retiring, and the stock market has been flying so high, I fear/expect another big crash. I'd really like to hang onto the gains I've made over the last few years (wouldn't we all).

Annuities seem like a reasonable way to do that, given that you get a guaranteed income in bad times and a little bit of a "raise" in good times (if I understand correctly).

What do y'all think about annuities as a way to preserve present wealth?

(Btw, I'd like to retire in 1.5 years at the MOST, and right now my hubby and I combined have $770K in our IRAs/401k's.) I'd hate for even December 2018 to happen again soon and bring us to our knees at this point!!!

|

In the first place annuities don't preserve your wealth they transfer it all to the insurance company with some future promise from them. If you buy a strict immediate annuity with no survivorship clause it is all gone when you die.

In the second place you have not really given us enough information to really help you or answer your question. Much of whether $770k retirement IRA is going to be enough for you depends on your budget and unforeseen expenses in retirement.

Strictly speaking on average if you need more than $31k per year from the retirement account you in all likelyhood could run out of money. Sending your money to the insurance company will probably not improve on that, as they would be strictly backing your money up by buying bonds and we all know what the return on bonds is right now - about 3%.

|

|

|

05-10-2019, 05:40 PM

05-10-2019, 05:40 PM

|

#108

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,374

|

Quote: Quote:

Originally Posted by FinancialDave

How does APR relate to a 15 year period certain cash flow?

The IRR on that investment which you can easily do with excel XIRR formula puts the result at just shy of 3% (2.98%) with an 8.12% payout for a 60 year old in WA, which makes much more sense than a 1.58% number. Insurance company payouts are going to be closer to the long bond return.

|

Yup.... IRR for 8.12% payout on 15 year period certain is about 2.74%... 7 year CD is 2.90%.

=(1+RATE(15*12,100000*8.12%/12,-100000,0))^12-1

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

05-10-2019, 06:54 PM

05-10-2019, 06:54 PM

|

#109

|

|

Recycles dryer sheets

Join Date: Jul 2008

Posts: 141

|

Quote: Quote:

Originally Posted by corn18

It sounds like you are referring to a variable or indexed annuity. Those are absolutely a ripoff and the insurance company charges ridiculous fees for them. And the paperwork is usually over 50 pages long. STAY AWAY!.

|

Misinformed.

Index annuities do not charge fees.

|

|

|

05-10-2019, 07:35 PM

05-10-2019, 07:35 PM

|

#110

|

|

Moderator

Join Date: Jul 2017

Posts: 5,776

|

Quote: Quote:

Originally Posted by REWahoo

Who wrote the article, someone who works for the insurance industry? A link to the article would be nice.

For me, giving up control of money I saved, invested and grew for decades to "know my revenue stream" would not be a happiness-inducing trade off. YMMV.

|

https://www.towerswatson.com/en/Insi...ment-Happiness

See if this works. Note the definition of the term annuity.

__________________

Use it up, wear it out, make it do or do without.

|

|

|

05-10-2019, 08:05 PM

05-10-2019, 08:05 PM

|

#111

|

|

Recycles dryer sheets

Join Date: Sep 2016

Posts: 342

|

Quote: Quote:

Originally Posted by SoReadyToRetire

I used to listen to Clark Howard on the radio all the time. I always remember that he said to NEVER buy annuities, because they're too much of a ripoff. That has stuck with me.

HOWEVER--now that I'm so close to retiring, and the stock market has been flying so high, I fear/expect another big crash. I'd really like to hang onto the gains I've made over the last few years (wouldn't we all).

Annuities seem like a reasonable way to do that, given that you get a guaranteed income in bad times and a little bit of a "raise" in good times (if I understand correctly).

What do y'all think about annuities as a way to preserve present wealth?

(Btw, I'd like to retire in 1.5 years at the MOST, and right now my hubby and I combined have $770K in our IRAs/401k's.) I'd hate for even December 2018 to happen again soon and bring us to our knees at this point!!!

|

On his radio show earlier this week and Clark Howard opened the hour talking about annuities. He said there were two types that he liked - immediate and longevity. Here is his blog post where he explains his reasoning:

https://clark.com/personal-finance-c...i-buy-annuity/

|

|

|

05-10-2019, 08:12 PM

05-10-2019, 08:12 PM

|

#112

|

|

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Join Date: Jun 2002

Location: Texas: No Country for Old Men

Posts: 50,022

|

Quote: Quote:

Originally Posted by MarieIG

|

Thanks.

Quote: Quote:

|

In this article, annuities refer to the broad class of financial instruments that pay a guaranteed distribution of income at specified intervals and amounts over a stated period of time. While the primary source of annuity income for most survey participants in this analysis is from a defined benefit plan, some purchased an annuity contract through an insurance company. In 2010, 44% of retirees received income from a defined benefit plan and 10% from an annuity.

|

This 2012 article would have been more accurately titled "Pensions and Retirement Happiness".

__________________

Numbers is hard

|

|

|

05-10-2019, 08:30 PM

05-10-2019, 08:30 PM

|

#113

|

|

gone traveling

Join Date: Sep 2014

Posts: 225

|

when I retired and had to go on fixed income I looked at all of the annuity products and came away with the feeling they were rip offs... they just don't pay out with any good rates...

So instead I went out and built my own kind of annuity with corporate bonds... the advantage is... no fees to pay to anyone, I can choose the duration that I want and to purchase a corporate bond via Fidelity is like a few dollars... the bonds payout every six months.. I don't pay taxes on them until April of each year... and when every body is complaining about interest rates being so low and how they can remember when rates were 8%, 9% or 10%, you still can get those rates today... when a company issued bonds back in the 80's when interest rates were much higher than they are today those bonds have maturity dates that are very long... some bonds have maturity dates going out for 100 yrs... and those same high interest rate bonds are still trading today... you just pick a high interest rate bond and if the maturity date is the date your looking for, you just buy the bond just like you would have back in 1985.... those bonds didn't just go away... and whats nice is you can today buy bonds paying out ~ 10% with 30 yr maturities that will pay you every six months for 30 yrs and when the maturity date comes then the company will pay you back the face value of the original bonds ... face value is $1000 per bond... so you get 30 yrs of interest rate coupons and you get your money back when they mature...

so go out and build your own annuity.... thats how some of the annuity companies do it...

|

|

|

05-10-2019, 08:32 PM

05-10-2019, 08:32 PM

|

#114

|

|

Full time employment: Posting here.

Join Date: Jan 2008

Location: Flyover America

Posts: 679

|

Quote: Quote:

Originally Posted by REWahoo

Thanks.

This 2012 article would have been more accurately titled "Pensions and Retirement Happiness".

|

It is not surprising that having a consistent income stream would result in higher satisfaction survey results.

People like income streams they just don't like to "pay for them" (annuity) or if forced to pay for them they're ok (Social Security, Pensions).

|

|

|

05-10-2019, 08:38 PM

05-10-2019, 08:38 PM

|

#115

|

|

Moderator Emeritus

Join Date: Apr 2011

Location: Conroe, Texas

Posts: 18,731

|

Quote: Quote:

Originally Posted by dixter

when I retired and had to go on fixed income I looked at all of the annuity products and came away with the feeling they were rip offs... they just don't pay out with any good rates...

So instead I went out and built my own kind of annuity with corporate bonds... the advantage is... no fees to pay to anyone, I can choose the duration that I want and to purchase a corporate bond via Fidelity is like a few dollars... the bonds payout every six months.. I don't pay taxes on them until April of each year... and when every body is complaining about interest rates being so low and how they can remember when rates were 8%, 9% or 10%, you still can get those rates today... when a company issued bonds back in the 80's when interest rates were much higher than they are today those bonds have maturity dates that are very long... some bonds have maturity dates going out for 100 yrs... and those same high interest rate bonds are still trading today... you just pick a high interest rate bond and if the maturity date is the date your looking for, you just buy the bond just like you would have back in 1985.... those bonds didn't just go away... and whats nice is you can today buy bonds paying out ~ 10% with 30 yr maturities that will pay you every six months for 30 yrs and when the maturity date comes then the company will pay you back the face value of the original bonds ... face value is $1000 per bond... so you get 30 yrs of interest rate coupons and you get your money back when they mature...

so go out and build your own annuity.... thats how some of the annuity companies do it...

|

Hopefully, you didn't have any pre-bankruptcy GM bonds in the mix, right?

__________________

*********Go Yankees!*********

|

|

|

Prefer total access all monies saved

05-10-2019, 08:50 PM

05-10-2019, 08:50 PM

|

#116

|

|

Recycles dryer sheets

Join Date: Mar 2012

Location: San Francisco

Posts: 69

|

Prefer total access all monies saved

Quote: Quote:

Originally Posted by REWahoo

Who wrote the article, someone who works for the insurance industry? A link to the article would be nice.

For me, giving up control of money I saved, invested and grew for decades to "know my revenue stream" would not be a happiness-inducing trade off. YMMV.

|

I concur - life time of savings just to be assured Iíll get a monthly payout by giving someone ie financial entity all my loot guaranteed- how you define guaranteed...😆

Iíve really appreciated various wise opinions on these threads - Chuck was right, I stay away! I read some good ideas to consider here ( I wouldnít) But if stream of income via annuity gives you peace of mind maybe it is for you. I do have the benefit of a pension so it is a stream analogous to an pooled annuity I suppose. AA 70/30 on a low 7 figure savings annualized to spend 25yrs from age 60. I like stocks, I like the long term benefit I sleep well in every season.

Will buying an annuity help you sleep well? Is it a AAA issuer? You donít mind losing control of your funds/fees/penalties? Go for it, thatís the beauty here we all give each other something to think about.

So retired at 51 off 1 entire year but now I work 16hr for pay besides volunteering for few organizations so guess I lost my ďretiredĒ status for now but Ok.

|

|

|

05-10-2019, 08:51 PM

05-10-2019, 08:51 PM

|

#117

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,374

|

Quote: Quote:

Originally Posted by dixter

.... and when every body is complaining about interest rates being so low and how they can remember when rates were 8%, 9% or 10%, you still can get those rates today... when a company issued bonds back in the 80's when interest rates were much higher than they are today those bonds have maturity dates that are very long... some bonds have maturity dates going out for 100 yrs... and those same high interest rate bonds are still trading today... you just pick a high interest rate bond and if the maturity date is the date your looking for, you just buy the bond just like you would have back in 1985.... those bonds didn't just go away... and whats nice is you can today buy bonds paying out ~ 10% with 30 yr maturities that will pay you every six months for 30 yrs and when the maturity date comes then the company will pay you back the face value of the original bonds ... face value is $1000 per bond... so you get 30 yrs of interest rate coupons and you get your money back when they mature...

so go out and build your own annuity.... thats how some of the annuity companies do it...

|

What about premiums and effective yields?

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

05-10-2019, 09:45 PM

05-10-2019, 09:45 PM

|

#118

|

|

gone traveling

Join Date: Sep 2014

Posts: 225

|

Quote: Quote:

Originally Posted by pb4uski

What about premiums and effective yields?

|

depends on if the bond is priced at above or below par... the coupon rates don't change over time... for example, if a bond is issued with a coupon rate of say 10% then the yield or coupon rate is still 10%.. that doesn't change.. what fluctuates is if the bond is presently trading above par value or below par value or at par value... my experience with my bond choices is if the fed raises interest rates then the bonds go down in trading value... for example, a 10% bond issued in say 1985 at 10% will have a trading value today above par value... and if the fed lowers interest rates that same bond will go lower but not below par value... but the bond while still in effect never looses its par value at maturity... if you purchase a bond above par then you should determine the difference of the above par value vs the par value and see what time frame it will take for the coupons to recover your cost on above par values... so as a example you buy a bond at above par... lets say $1100 so the difference is Par value $1000 - above par $1100 = $100 so at a 10% coupon it will take 1 year of coupon to give you back the difference.. then if you hold the bond to maturity the effective yld is 10% as you have been paid back the difference ... and it goes the other direction if you purchase a bond and below par value... in that case your effective yld would be higher than the 10% coupon... the jest is to create a steady income stream... so your not typically buying and selling bonds.. your goal is to buy the bond and let them create the income stream...

|

|

|

05-10-2019, 09:51 PM

05-10-2019, 09:51 PM

|

#119

|

|

gone traveling

Join Date: Sep 2014

Posts: 225

|

Quote: Quote:

Originally Posted by aja8888

Hopefully, you didn't have any pre-bankruptcy GM bonds in the mix, right?

|

I don't or didn't have any GM bonds.. but, it is my understanding that Bond holders are typically taken care of better than common stock holders during issues like what GM went thru....

I did go through the American Airlines ordeal and came out very very well with the way they handled that... I actually made money when they went BR..

don't know how the bond holders of GM did...

|

|

|

05-10-2019, 09:54 PM

05-10-2019, 09:54 PM

|

#120

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,374

|

My point was that if you buy bonds today unless you are buying junk then you are not getting 8% or 9% or 10%.... probably more like 3-4%.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|