Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not unlike FIRECALC in that it’s based on history. It doesn’t have all the bells & whistles that FIRECALC does, and the output graph takes a little getting used to - but it:

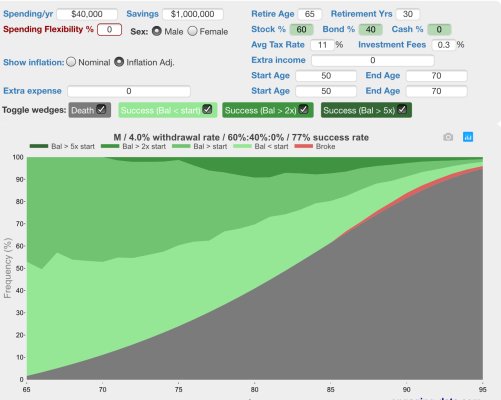

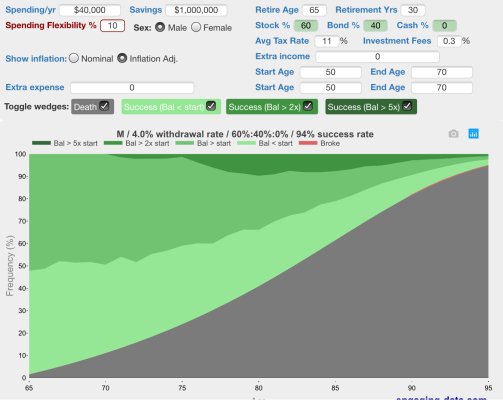

Note the example below with an 11% tax rate. With no spending flexibility success rate was 77%. With just 10% spending flexibility the success rate jumps to 94%.

https://engaging-data.com/will-money-last-retire-early/

- displays instantly

- you can add a “Spending Flexibility %” which I find useful

- you can factor in a tax rate! and

- if you hover over the graph it displays lots of probability detail.

Note the example below with an 11% tax rate. With no spending flexibility success rate was 77%. With just 10% spending flexibility the success rate jumps to 94%.

Spending Flexibility = Percentage of your annual spending that you could reduce when portfolio balance is lower than your initial balance. This only applies when your portfolio balance is lower than your initial balance (on an inflation-adjusted basis).

https://engaging-data.com/will-money-last-retire-early/

Attachments

Last edited: