Achiever51

Thinks s/he gets paid by the post

- Joined

- Feb 28, 2007

- Messages

- 1,015

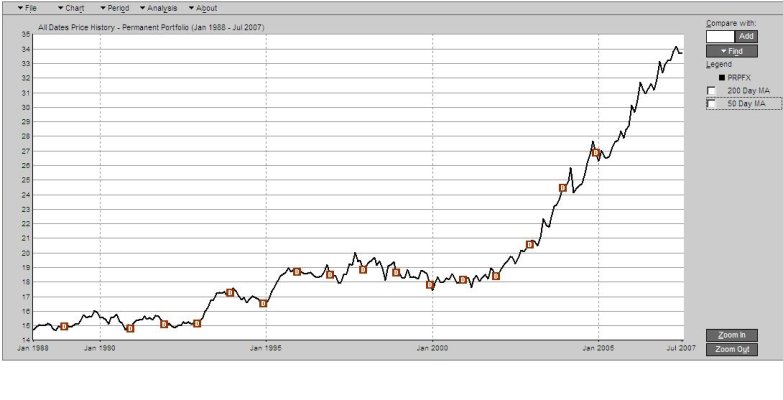

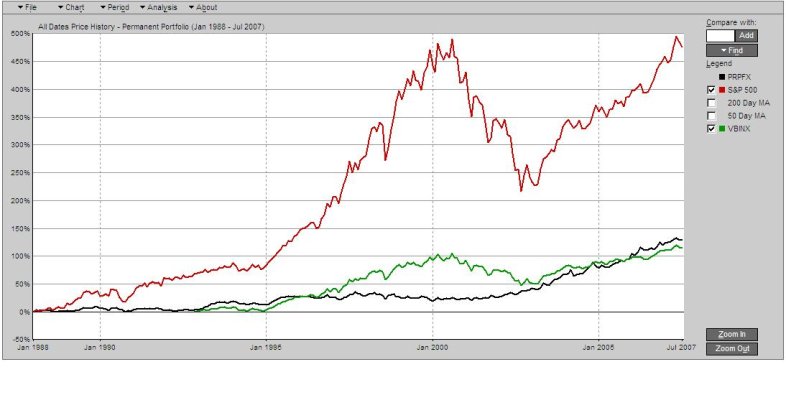

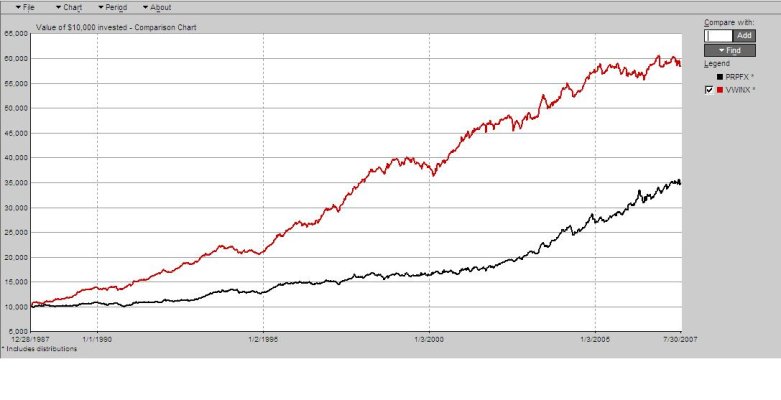

Curious to know if anyone is familiar with PRPFX? Its expense ratio is 1.35% -- but I noted that in this recent correction, PRPFX is only down 0.35%. Any insights? (Not that I'm running scared or anything, but I'm keeping my eyes open........)

http://permanentportfoliofunds.com/pdfs/perm/Permanent_033107.pdf

From their website:

Permanent Portfolio

Designed to provide growth at low risk, the primary goal of Permanent Portfolio is to preserve and increase the real long-term purchasing power of each shareholder’s investment, regardless of economic climate.

To accomplish this goal, the fund employs a time tested investment strategy of categorical diversification. Permanent Portfolio’s investment categories have been chosen and weighted with the goal of providing downside protection in all foreseeable economic conditions. For over 24 years, this strategy has not wavered despite significant market fluctuations.

The six investment categories and main investments for Permanent Portfolio include:

http://permanentportfoliofunds.com/pdfs/perm/Permanent_033107.pdf

From their website:

Permanent Portfolio

Designed to provide growth at low risk, the primary goal of Permanent Portfolio is to preserve and increase the real long-term purchasing power of each shareholder’s investment, regardless of economic climate.

To accomplish this goal, the fund employs a time tested investment strategy of categorical diversification. Permanent Portfolio’s investment categories have been chosen and weighted with the goal of providing downside protection in all foreseeable economic conditions. For over 24 years, this strategy has not wavered despite significant market fluctuations.

The six investment categories and main investments for Permanent Portfolio include:

GOLD: Bullion and coins held in major banks and with accredited commodity exchange depositories. Gold is expected to profit from inflation, especially runaway inflation.

SILVER: Bullion and coins held in the same form as gold. Silver is expected to profit from inflation or a soft landing, and possibly gain during runaway inflation.

SWISS FRANC ASSETS: Current and call accounts at Swiss and non-Swiss banks, and Swiss government bonds. The Swiss franc is expected to profit from inflation, especially runaway inflation.

STOCKS OF U.S. AND FOREIGN REAL ESTATE AND NATURAL RESOURCE COMPANIES: Stocks of companies whose assets should allow them to appreciate or depreciate in much the same manner as real estate and natural resources. These stocks are much more liquid than real estate and natural resources. They are expected to profit from continued inflation.

AGGRESSIVE GROWTH STOCKS: Common stocks and stock warrants that tend to move further, in either direction, than the general stock market. Such stocks are intended to allow Permanent Portfolio to have a stake in any extended bull stock market but to do so with a limited risk to the overall Portfolio. Because all the Portfolio’s stocks are purchased for cash, without the use of margin, they can never lose more than is invested in them no matter what the future brings. And they are in a position to potentially profit dramatically if prosperity continues. They may hold much of their purchasing power during runaway inflation.

U.S. TREASURY BILLS, BONDS & OTHER DOLLAR ASSETS: Short-term securities (one year or less to maturity) issued or guaranteed by the U.S. government or its agencies. These investments provide liquidity and stability, and their yields tend to match the rate of inflation closely. Long-term bonds (as long as 30 years to maturity) that may profit greatly if a deflation or soft landing caused interest rates to drop from today’s levels to the level of 2% to 3% that normally has prevailed during non-inflationary periods. Because a deflation would cause widespread defaults on lower-grade bonds, only long-term bonds issued or guaranteed by the U.S. government or its agencies are held by the Portfolio.

SILVER: Bullion and coins held in the same form as gold. Silver is expected to profit from inflation or a soft landing, and possibly gain during runaway inflation.

SWISS FRANC ASSETS: Current and call accounts at Swiss and non-Swiss banks, and Swiss government bonds. The Swiss franc is expected to profit from inflation, especially runaway inflation.

STOCKS OF U.S. AND FOREIGN REAL ESTATE AND NATURAL RESOURCE COMPANIES: Stocks of companies whose assets should allow them to appreciate or depreciate in much the same manner as real estate and natural resources. These stocks are much more liquid than real estate and natural resources. They are expected to profit from continued inflation.

AGGRESSIVE GROWTH STOCKS: Common stocks and stock warrants that tend to move further, in either direction, than the general stock market. Such stocks are intended to allow Permanent Portfolio to have a stake in any extended bull stock market but to do so with a limited risk to the overall Portfolio. Because all the Portfolio’s stocks are purchased for cash, without the use of margin, they can never lose more than is invested in them no matter what the future brings. And they are in a position to potentially profit dramatically if prosperity continues. They may hold much of their purchasing power during runaway inflation.

U.S. TREASURY BILLS, BONDS & OTHER DOLLAR ASSETS: Short-term securities (one year or less to maturity) issued or guaranteed by the U.S. government or its agencies. These investments provide liquidity and stability, and their yields tend to match the rate of inflation closely. Long-term bonds (as long as 30 years to maturity) that may profit greatly if a deflation or soft landing caused interest rates to drop from today’s levels to the level of 2% to 3% that normally has prevailed during non-inflationary periods. Because a deflation would cause widespread defaults on lower-grade bonds, only long-term bonds issued or guaranteed by the U.S. government or its agencies are held by the Portfolio.