Hi.

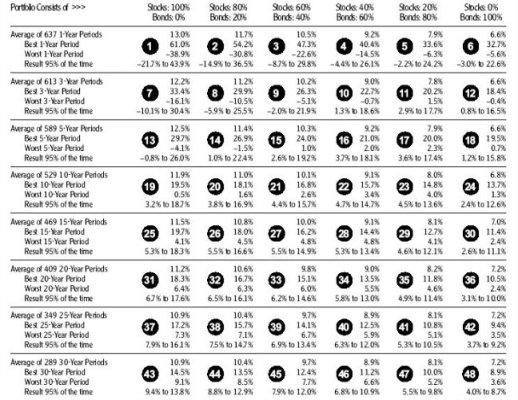

I am just looking for a guestimate. If I have an 80% stock / 20% bond portfolio, about what percentage of a decrease can I expect to occur in the total value of my investment portfolio when the bull market ends?

Am I correct in understanding that the end of a bull market consistently leads to a decrease in the value of a stock oriented investment portfolio?

Can the beta value of an investment portfolio be used to predict the amount of decrease that may occur at the end of a bull market? If beta is not relevant, is there another value that may help with the prediction.

I am just trying to estimate the range of loss my investment portfolio may experience at the end of a bull market.

I am just looking for a guestimate. If I have an 80% stock / 20% bond portfolio, about what percentage of a decrease can I expect to occur in the total value of my investment portfolio when the bull market ends?

Am I correct in understanding that the end of a bull market consistently leads to a decrease in the value of a stock oriented investment portfolio?

Can the beta value of an investment portfolio be used to predict the amount of decrease that may occur at the end of a bull market? If beta is not relevant, is there another value that may help with the prediction.

I am just trying to estimate the range of loss my investment portfolio may experience at the end of a bull market.