audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

NoFor the folks that retired around 2000, do you have additional sources of income to support your portfolio ?

NoFor the folks that retired around 2000, do you have additional sources of income to support your portfolio ?

For the folks that retired around 2000, do you have additional sources of income to support your portfolio ?

For the folks that retired around 2000, do you have additional sources of income to support your portfolio ?

The returns from Mathjak do not take into account the impact of SWR drawdown, correct ?

I think this can be modeled with firecalc. 1MM start value, use 11yrs, and set it to provide spreadsheet data under the investigate tab, then look at sheet results the last line starts in 2000 showing portfolio value. With 4% SWR it looks close to what raddrs table shows. I agree with using longer dated bond yields instead of cash. At the current time though I wouldn't expect much support from bonds going forward.

Wade Pfau wrote this article on safe withdrawal rates in other countries:

An International Perspective on Safe Withdrawal Rates: The Demise of the 4 Percent Rule?

The safe withdrawal rate for Japan (table 3) was 0.47%!!!!

Note that the only safe conclusion from this depressive study is: work until you die!

Wade Pfau wrote this article on safe withdrawal rates in other countries:

An International Perspective on Safe Withdrawal Rates: The Demise of the 4 Percent Rule?

The safe withdrawal rate for Japan (table 3) was 0.47%!!!!

Note that the only safe conclusion from this depressive study is: work until you die!

Simple - their investment universe is NOT limited to Japan.so now the question is if thats the swr for a retiree in japan how is it that in real life the older population is spending so much that they account for a full 40% of all consumer spending in japan..

i think sometimes all these studies in swr end up not reflecting what the real world actually sees happening .

think about if our swr was .47% and that was our real number. how little would seniors be accounting for total spending here? not much.

i want to say they are doomed to fail anyway if they spend it so what the heck lets spend it is their attitude but somehow i dont think thats a retirees instinct.

well you brains figure out how a country with almost zero swr is being supported by it seniors because i cant. .

Megatrends: The World's Aging Population

Wade Pfau wrote this article on safe withdrawal rates in other countries:

An International Perspective on Safe Withdrawal Rates: The Demise of the 4 Percent Rule?

The safe withdrawal rate for Japan (table 3) was 0.47%!!!!

Note that the only safe conclusion from this depressive study is: work until you die!

Unstated final clause: "If historical US equity performance after previous periods of underperformance is still a useful guide." I can see, though, how just living through a period of very poor performance folks might take little comfort in that. The little voice will be screaming "what if it really is different this time? After all, the last decade has been fairly 'different.' "as long as 2000 saw at least .86% real return a year as an average the first 15 years the 4% swr is safe.

Simple - their investment universe is NOT limited to Japan.

I think in that "what if" scenario it was an unreasonable assumption that someone would limit their investments to their country of residence.

What I find interesting is that in Japan a 4% WR gives you a 37.5% failure over 30 years periods while a 5% WR only raises that to 40% failure.

If you're gonna take out 4%... might as well go for 5%

(to me, this points out that there were 'unlucky' years that need to be avoided... clearly not something an investor can control)

Well, it's not like the "bad luck" started there. Ask the Chinese, the Koreans, or the residents of Oahu if there is more to the story.Indeed. For Japan the unlucky period includes having a couple of atomic bombs dropped on you.

Well, it's not like the "bad luck" started there. Ask the Chinese, the Koreans, or the residents of Oahu if there is more to the story.

What some see as "bad luck" others see as another in a string of events that are not "luck" but the result of clear cause and effect. That's all--and maybe there are lessons for us in that.My comment was meant in the context that war and mayhem are not good for the early retiree living of his investments. (this is the ER forum right?) It was certainly not meant as any sort of endorsement of the Japanese policies prior or during WWII and I'm sorry you interpreted my comment in that fashion. As my son likes to say "relax"

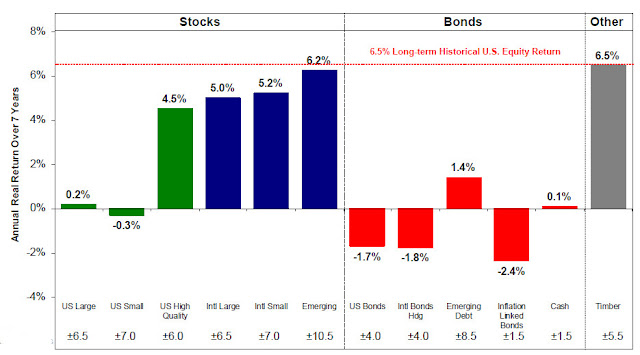

I think after a long period of low real returns on equities, it might be reasonable to expect a better real return going forward. But maybe not on the S&P500. Might need to diversify a bit more......considering we have not had a 1% real return on the s&p 500 for 12 years that is a tall order .

am i missing something here ?

What Returns Are Safe Withdrawal Rates REALLY Based Upon? - kitces.com | Nerd's Eye View

I was responding to mathjak107,

Sure, market history can certainly be used as an artifact to see how withdrawal rates would be affected in the "new retirement funding" of IRA/401(k);s of the current time, but if you're not in the market to accumulate or depend on it for retirement income, it makes little sense to consider it. Those who retired in the mid-60's (the point of time under discussion) were not necessarily concerned with safe withdrawl rates nor widely invested in the market.

'i too would want as many actual points that happened in history as a guide for building my plan.'

IIRC, the book 'Triumph of the Optimists' has returns and std. deviations for 15 countries over 100 years, 1900-2000. By that standard, US 1926-2000 data is about 5% of the available years. And generally the best years.