ESRwannabe

Full time employment: Posting here.

- Joined

- Mar 19, 2010

- Messages

- 889

This is the kind of article I like to read:

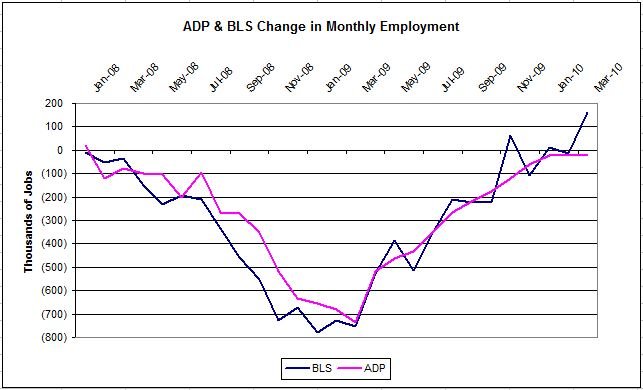

yes it's a v shaped recovery risk of double dip "relatively low" liz ann sonders says: Tech Ticker, Yahoo! Finance

I will say that hitting a new high just recently in my portfolio has made me feel a lot better. My city never slowed down much due to a large military base here and now that the weather is nice again, the stores/restaurants are packed. I'm hopeful that this recovery is real and unemployment will start going down.

yes it's a v shaped recovery risk of double dip "relatively low" liz ann sonders says: Tech Ticker, Yahoo! Finance

I will say that hitting a new high just recently in my portfolio has made me feel a lot better. My city never slowed down much due to a large military base here and now that the weather is nice again, the stores/restaurants are packed. I'm hopeful that this recovery is real and unemployment will start going down.

...

...