studbucket

Recycles dryer sheets

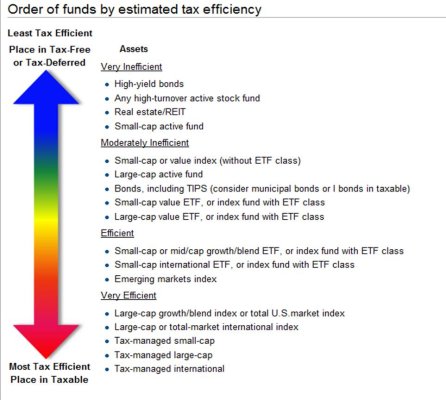

When it comes to my whole portfolio, I'm combining my 401k/Roth and taxable investments into 1 big pool. However, I'm curious, for the stuff I do put in my tax-advantaged 401k/Roth, would there be a reason or advantage to keeping more bonds in there or more stocks in there vs. taxable?

As in, if all my stocks were in taxable and all my bonds were in 401k, would it really be any different than if my bonds were in taxable and stocks were in 401k?

To me, it seems better to put assets that get a higher ROI in the 401k, but I wanted to see if there was something that I'm missing.

I feel like I poorly explained this, and if you need additional details, let me know.

As in, if all my stocks were in taxable and all my bonds were in 401k, would it really be any different than if my bonds were in taxable and stocks were in 401k?

To me, it seems better to put assets that get a higher ROI in the 401k, but I wanted to see if there was something that I'm missing.

I feel like I poorly explained this, and if you need additional details, let me know.