accountingsucks

Recycles dryer sheets

- Joined

- Jan 28, 2006

- Messages

- 346

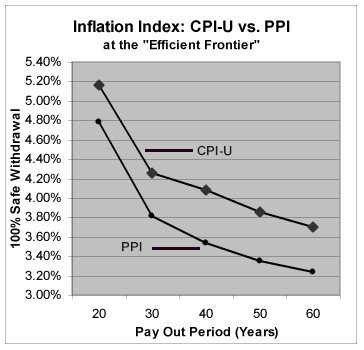

I have thought about alot of different scenarios as to when I would like to "retire". I think what I've settled on is a compromise being that I'd like to get to a portfolio that supports a 4%SWR AND continue working in a part time or consulting capacity such that I do not have to draw on my portfolio until I'm in my 50's. My biggest beef with working is the inflexibility in hours and/or vacation time. I should be able to achieve this between age 40 and 42 with a portfolio value of about 850K. Currently I am 34 and am about 1/3rd of the way there + my home is paid off.

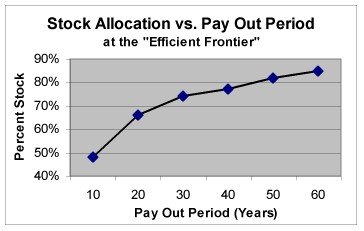

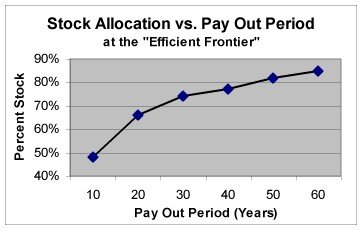

My question is, given these facts what should my asset allocation be today, at 40 and 50 years old? Should I be more aggressive with my equity allocation or stick to the "age in bonds" allocation that I'm currently trying to get too? Or perhaps I need to be more conservative? At the moment I am about 70% equities, 5% bonds and 25% cash as I try to decipher what the markets are doing.

Does anyone have any book recommendations specifically dealing with asset allocations?

My question is, given these facts what should my asset allocation be today, at 40 and 50 years old? Should I be more aggressive with my equity allocation or stick to the "age in bonds" allocation that I'm currently trying to get too? Or perhaps I need to be more conservative? At the moment I am about 70% equities, 5% bonds and 25% cash as I try to decipher what the markets are doing.

Does anyone have any book recommendations specifically dealing with asset allocations?