walkinwood

Thinks s/he gets paid by the post

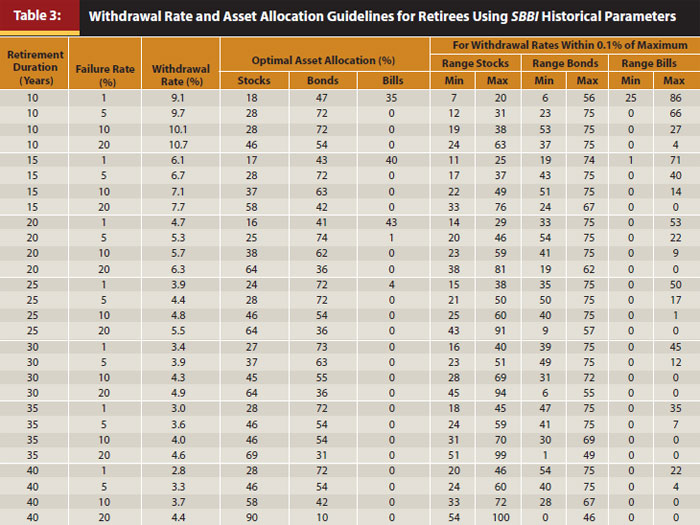

Rick Ferri makes a case for using a 30/70 (equity/bond) allocation in retirment instead of 60/40.

The Center of Gravity for Retirees

I would like to hear his opinion on allocation for longer retirement periods like most of us who ER have. He may participate in a discussion on this at Bogleheads. (I'll add the link if I find a discussion. Please add if you see it first).

The Center of Gravity for Retirees

I would like to hear his opinion on allocation for longer retirement periods like most of us who ER have. He may participate in a discussion on this at Bogleheads. (I'll add the link if I find a discussion. Please add if you see it first).

Last edited: