ranchoparque

Dryer sheet aficionado

- Joined

- Jan 24, 2008

- Messages

- 32

I'm a conservative investor and I've been keeping just under 40% in diversified vanguard equity funds with the rest (except for about 5% cash) in diversified bond funds.

Just wondering what others think would be a minimal stock allocation to keep up with inflation? Inflation has been running about 1.7% the past year.

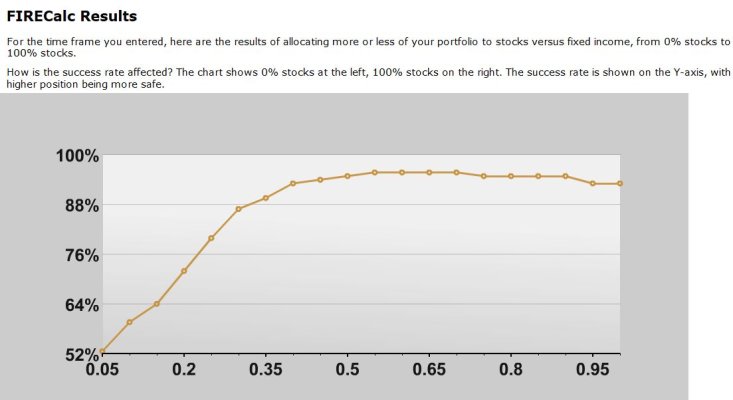

When I enter my number in Firecalc and Vanguard's retirement "nest egg" calculator my numbers seem good.

My bonds are a mix of the bonds in Target date funds, muni bond funds, short term bond funds and international bonds. I use the five year average when I enter the bonds into Firecalc.

Just wondering what others think would be a minimal stock allocation to keep up with inflation? Inflation has been running about 1.7% the past year.

When I enter my number in Firecalc and Vanguard's retirement "nest egg" calculator my numbers seem good.

My bonds are a mix of the bonds in Target date funds, muni bond funds, short term bond funds and international bonds. I use the five year average when I enter the bonds into Firecalc.