retiredinnyc

Recycles dryer sheets

This is why when I run firecalc , I use the 100% chance of surving

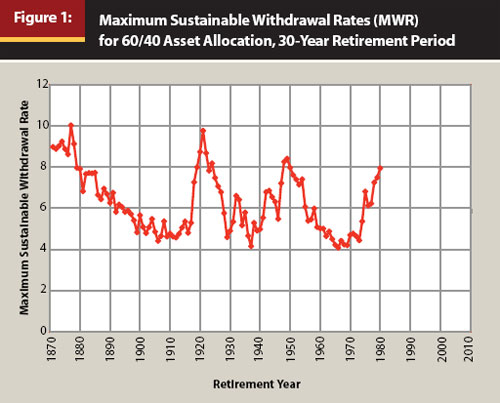

I was ready retired when I found this site, in my under informed calculations I figured I could withdraw 5% for life and still adjust for inflation. Well I have come to find out that with a 80/20 portfolio which is what I have, it's more like 3%. When I retired a 5 % withdrawal was way more than I needed. That's a good thing because it very well might have bankrupted me, so based on his numbers I think 3% withdrawal will be just fine for the next decade. Personally I haven't taken out a dime since I retired my pension is way more than my living expenses I detailed that in another-post . This is why in my opinion early retirement is for those that certainly have the means to weather the storms.

%

I was ready retired when I found this site, in my under informed calculations I figured I could withdraw 5% for life and still adjust for inflation. Well I have come to find out that with a 80/20 portfolio which is what I have, it's more like 3%. When I retired a 5 % withdrawal was way more than I needed. That's a good thing because it very well might have bankrupted me, so based on his numbers I think 3% withdrawal will be just fine for the next decade. Personally I haven't taken out a dime since I retired my pension is way more than my living expenses I detailed that in another-post . This is why in my opinion early retirement is for those that certainly have the means to weather the storms.

%