|

|

Bonds don't appear to be doing anything more than meandering in a tight trading range

04-02-2014, 04:18 PM

04-02-2014, 04:18 PM

|

#1

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Bonds don't appear to be doing anything more than meandering in a tight trading range

The threads have mostly gone off the front page, but there have been many posts lately which seem to suggest that "there is no way but down" for bond quotations, nowhere but up for interest rates. This is incompatible with an even reasonably efficient market, but this kind of argument rarely gets traction.

But the facts are that the low interest rate on the 10 year treasury happened almost a year ago, on 4/28/2013 at 1.66%. (Rates and dates are as close as I can see them on the chart). From there over a little over one month rates climbed to 2.74% on July 5. Since then there has been a fairly narrow trading range, with a high of 3.03% on December31 and settling at 2.80% today. To me, this market strongly trended from April 28, 2013 until July 5, 2013, and has backed and filled since.

http://www.bloomberg.com/quote/USGG10YR:IND

So I don't understand from whence comes the idea that the 10 year treasury rate must necessarily go up. It seems to me that based on fundamentals, politics and the chart, it could do anything or nothing much.

I can't beat the drum here for any investment, but I also think that it seems questionable that a stampede out of bonds into stocks would have much to recommend it.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

04-02-2014, 04:45 PM

04-02-2014, 04:45 PM

|

#2

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2013

Location: Limerick

Posts: 5,655

|

If you have read many of the posts carefully, no one is saying it will happen this week or even this year. But with the excessive debt growth and money printing in the US and other countries, along with other significant concerns, sometime in the next ten years or so there will be a significant financial crisis with the debt bubble being on center stage.

|

|

|

04-02-2014, 04:58 PM

04-02-2014, 04:58 PM

|

#3

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2013

Location: Southern California

Posts: 3,999

|

I have no concerns with investing in municipal bonds because of the benefits of tax free yields. I took most of my money out of Total Bond Market because PenFed simply offered me a better rate than TBM when they had their 3% promotion.

I have no concerns about whether rates will go up. They will. Eventually. And the stock market will go down. Eventually. And in the long term, none of this will really matter.

|

|

|

04-02-2014, 06:19 PM

04-02-2014, 06:19 PM

|

#4

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Oct 2006

Posts: 7,733

|

I'll be the first to admit that I've been a chicken little about bonds for 4 to 5 year, and last year was the first year was right and even then losses in bonds were minor.

On the other hand at 2.80% less taxes and inflation I can't fund my retirement without a big cutback in lifestyle or a plan to die by 85.

When the rates went up last year 1%, my opinion on bonds switched, from you'd be an idiot to buy long or intermediate bonds especially government ones. To my current position "short or intermediate bonds are fine if you have a low enough withdrawal rate or retirement less than 30 years."

|

|

|

04-02-2014, 06:26 PM

04-02-2014, 06:26 PM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by Dash man

If you have read many of the posts carefully, no one is saying it will happen this week or even this year. But with the excessive debt growth and money printing in the US and other countries, along with other significant concerns, sometime in the next ten years or so there will be a significant financial crisis with the debt bubble being on center stage.

|

Only two comments-if your commitments are fairly short term, and do not depend on frequent access to markets for refunding, so what? In any case, I would not want leveraged bonds even though that is currently a good carry.

And 2) if this does happen, is it likely that our very expensive stock market would fare better than say, the 10 year treasury, or an intermediate bond from the same corporation whose stock you might hold? I don't see any safer alternative other than cash.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

04-02-2014, 06:39 PM

04-02-2014, 06:39 PM

|

#6

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2007

Posts: 2,525

|

Quote: Quote:

Originally Posted by Dash man

If you have read many of the posts carefully, no one is saying it will happen this week or even this year. But with the excessive debt growth and money printing in the US and other countries, along with other significant concerns, sometime in the next ten years or so there will be a significant financial crisis with the debt bubble being on center stage.

|

I've listened to the ongoing common wisdom you describe for several years now and the end result is that I shortened the duration of my bond holdings to where a significant portion of my bond allocation is in Vanguards Short term bond fund. Near as I can tell the end result is that my bond income from my 50/50 allocation has taken a hair cut for several years now but Armageddon seems to be delayed.

Maybe it will all come out OK in the end but it is starting to feel like the last time I was convinced by the common argument that made a lot of sense at the time (I'm talking 1979 - 1980). The argument was "massive inflation is coming. Gold is the only investment that holds value" So I bought gold and I sat on it until I sold out after waiting for close to 20 years for my investment to do something other than go down.

Oh well, I guess I'm hard of learning...

|

|

|

04-02-2014, 07:22 PM

04-02-2014, 07:22 PM

|

#7

|

|

Full time employment: Posting here.

Join Date: Jan 2012

Posts: 518

|

I confess that I don't understand the nuances of the bond markets but all this speculation about bonds being bad, or doomed, reminds me of how people bail out of stocks during crashes and buy during highs... in short, market timing.

I maintain bonds as part of my allocation to reduce the volitility of my portfolio and provide some income in the form of dividends. It's possible that "this time it's different" and the nature of bonds has fundamentally changed, but I kinda doubt it.

I'm not sure if my perspective is dumb or smart, but I'm just sticking with my AA and letting it ride...

|

|

|

04-02-2014, 07:33 PM

04-02-2014, 07:33 PM

|

#8

|

|

Recycles dryer sheets

Join Date: Jul 2013

Posts: 385

|

The individual muni bonds I have bought in the past year (and continue to buy on a selective basis in the secondary market) with a 4% federal tax free yield and a 12-15 year maturity are all trading about 2-3% higher than what I paid. Meanwhile, despite all of the naysayers, I have been collecting an after tax yield of 6.5%+. Many here bought the Penn Fed 3 year CD at 3% with an after tax yield of somewhere between 1.8 and 2.5% depending on tax bracket. I will take individual muni-bond ladders for the fixed income portion of my portfolio all day.

I have compared corporate bonds to munis and because of fear muni bonds are trading at a substantial discount. Certainly one needs to be careful but a reward is to be seen. Remember a State cannot file for bankruptcy so State GOs do not have the Chapter 9 Bankruptcy risk.

Having said that I have noticed that new issue munis are very expensive. One needs to go often out to 2035 to get a 4.0% yield. That is too long and expensive for me. I have been focusing in on the 12-15 year maturities and no longer. Just my opinion

|

|

|

04-02-2014, 08:06 PM

04-02-2014, 08:06 PM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2013

Location: Limerick

Posts: 5,655

|

Obviously, everyone has to make their own investment choices based on their risk tolerance, but I suggest reading up on the global debt situation before investing in bonds, especially bond funds. Personally, I've chosen to avoid bonds simply because the returns aren't worth the risk. A 2% increase in interest rates will cause a 15% drop in the value of an intermediate term bond fund, wiping out several years of returns. And that's only for a 2% increase. The rise on rates may happen quickly if triggered by a default or some other event by one of the larger economies. Watch japan closely.

I'm not a fan of gold since it doesn't earn any returns, so I only have gold in the firm of collectable coins. From what I've read that makes sense, stocks of companies that sell products or services that would still be needed in a depressed or inflationary economy are the best bets. Especially companies that would have pricing power to raise prices in case inflation rises quickly. I also own real estate rental properties. Finding good investments for what may be coming is tough, but I believe the stock market would come back better that the bond market, since rates are unlikely to get this low again for a long time.

|

|

|

04-02-2014, 09:20 PM

04-02-2014, 09:20 PM

|

#10

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2013

Location: Western US

Posts: 1,214

|

With Japan in mind - the bond market can stay ration'l longer than they can remain insolvent.

|

|

|

04-02-2014, 09:35 PM

04-02-2014, 09:35 PM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2008

Posts: 7,438

|

Job market is still tepid, because there isn't the demand for companies to justify greater hiring, or so they say. I had to go to the mall to order some glasses. Lots were packed on Saturday afternoon, taking at least 15 minutes to find a space, though there is paid valet parking.

Then I picked up the glasses Tuesday during lunch. Lots weren't packed but still the mall had a lot of people at mid day.

Must be window shopping, though I guess job market here in Santa Clara Valley is doing better than the national average.

So without a competitive job market driving up wages, it's difficult to get sustained inflation.

OTOH, a notification popped on my phone from Bloomberg saying the Brazil central bank raised interest rates to 11% today because of food price shocks due to a prolonged drought down there.

Couple of years ago, the BRIC countries were the economic toast of the world. Brazil is going to host the World Cup in a few months but who knows what their economy will be like?

Neighboring Argentina, which had been recovering from the crisis/depression in the late '90s, is now seeing their currency plummeting, precipitating another crisis.

US, for all the money printing and QE, is faring better than most. Yet we have a drought out here in CA and we may not be immune to food shocks in other regions, since we import produce from South America.

|

|

|

04-03-2014, 03:55 AM

04-03-2014, 03:55 AM

|

#12

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2009

Posts: 2,985

|

I have a hunch that 10 year interest rates may stay lower for quite some time. However, nobody knows what will happen. Therefore I basically stick to my desired allocation and hope for the best. I must confess that while all of my equity holdings are in low cost index funds, my bond fund holdings include actively managed funds.

__________________

Took SS at 62 and hope I live long enough to regret the decision.

|

|

|

Bonds don't appear to be doing anything more than meandering in a tight tradi...

04-03-2014, 04:46 AM

04-03-2014, 04:46 AM

|

#13

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2010

Location: midwestern city

Posts: 4,061

|

Bonds don't appear to be doing anything more than meandering in a tight tradi...

I am worried about bonds. This is one of the reasons why I stick to CDs.

__________________

Very conservative with investments. Not ER'd yet, 48 years old. Please do not take anything I write or imply as legal, financial or medical advice directed to you. Contact your own financial advisor, healthcare provider, or attorney for financial, medical and legal advice.

|

|

|

04-03-2014, 05:02 AM

04-03-2014, 05:02 AM

|

#14

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,716

|

Quote: Quote:

Originally Posted by haha

So I don't understand from whence comes the idea that the 10 year treasury rate must necessarily go up. It seems to me that based on fundamentals, politics and the chart, it could do anything or nothing much.

I can't beat the drum here for any investment, but I also think that it seems questionable that a stampede out of bonds into stocks would have much to recommend it.

Ha

|

I agree with this, have kept pretty much the same allocation for the past couple of years, and don't plan to change it any time soon. The key driver to interest rates is not money supply, it is credit demand, and in the US and everywhere else in the world that is weak.

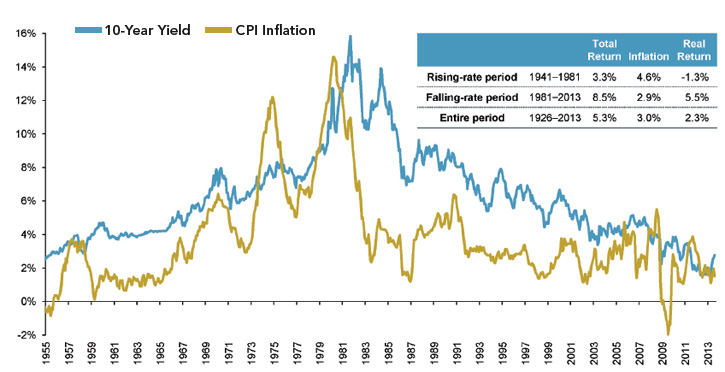

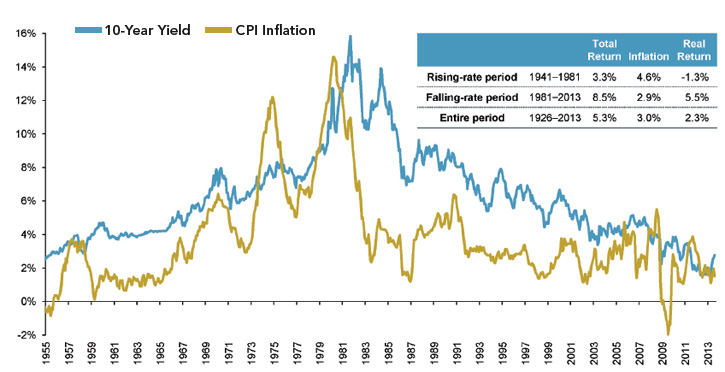

If demand for credit were to return to levels seen in previous expansions periods, 10 year treasuries could yield somewhere around 2.0% above inflation. At current levels, that would be an increase of around 1.6% or so, which is meaningful but no calamity. Crestmont has some good charts on real 10 year yields over time http://www.crestmontresearch.com/doc...0-yr-yield.pdf

I continue to see high quality fixed income as a safe place to keep investment money.

|

|

|

04-03-2014, 08:16 AM

04-03-2014, 08:16 AM

|

#15

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,019

|

Quote: Quote:

Originally Posted by haha

The threads have mostly gone off the front page, but there have been many posts lately which seem to suggest that "there is no way but down" for bond quotations, nowhere but up for interest rates. This is incompatible with an even reasonably efficient market, but this kind of argument rarely gets traction.

|

+1 Replies to this thread are expressing various concerns and giving a lot of reasons why yields might go up, but everything mentioned here well-known, so there is no reason to think that these factors are not already priced in.

And there are a lot of things that can happen to trigger a flight to safety and drive treasury yields lower, so it's not safe to assume the only way for rates to go is up.

Finally, with the focus on bonds while stocks are at an all-time high, one needs to be careful to avoid getting blindsided by a stock market crash, which would do a lot more damage than any bond bubble bursting.

|

|

|

Bonds don't appear to be doing anything more than meandering in a tight tradi...

04-03-2014, 08:33 AM

04-03-2014, 08:33 AM

|

#16

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2013

Location: Limerick

Posts: 5,655

|

Bonds don't appear to be doing anything more than meandering in a tight tradi...

Quote: Quote:

Originally Posted by Which Roger

+1

And there are a lot of things that can happen to trigger a flight to safety and drive treasury yields lower, so it's not safe to assume the only way for rates to go is up.

Finally, with the focus on bonds while stocks are at an all-time high, one needs to be careful to avoid getting blindsided by a stock market crash, which would do a lot more damage than any bond bubble bursting.

|

It's very possible in the short term bond yields may go lower since the government is practicing financial repression. However, long term with rising debt and printing of money, lower rates are unlikely.

What do you base your statement on that a stock market crash would do more damage than a credit crisis causing significantly higher interest rates? Just look at the last crash where the market recovered in just a few years but housing and employment are still struggling to improve. And that us with the government absorbing much of the bad debt. What happens when the government can no longer afford more debt or no one buys our debt for the low rates we now see?

|

|

|

04-03-2014, 09:03 AM

04-03-2014, 09:03 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2004

Location: SW Ohio

Posts: 14,404

|

If Treasury rates and prices haven't moved much in the last year or two, I'm not sure how that supports the argument that they won't in the future.

Let's look at the chart and find a relatively high point in the 10 T-Bill rate. That would, from a historical/reversion to the mean standpoint, seem to be a good way to reduce our risk of getting burned when rates rise, and in providing some monthly returns that might match inflation.

Does the present time look like such a point? I'm not talking about day trading/momentum grabbing "let's buy some bonds and see if we can make money selling them in a week" activity, I'm asking if this looks like a good point to buy intermediate-term bonds to keep in one's portfolio permanently. And this is irrespective of the other (valid) points about the macro-issues of indebtedness on the part of the US government and other developed nations.

|

|

|

04-03-2014, 09:32 AM

04-03-2014, 09:32 AM

|

#18

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

If you go with a rule that it's OK to extend maturities if the yield curve is sloped enough (something like 20 bp/year), then it's reasonable to consider intermediate bonds here.

Below is a chart I updated today showing spreads (slope of yield curve) between 5 years and 3 months. The left hand y-axis is the spread, right hand is the 5 year Treasury yield.

|

|

|

04-03-2014, 10:38 AM

04-03-2014, 10:38 AM

|

#19

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by samclem

If Treasury rates and prices haven't moved much in the last year or two, I'm not sure how that supports the argument that they won't in the future.

|

It doesn't, and that certainly was not an argument I was trying to make. The future, as always, is unknown. My only goal was to point out that there seems to be no evidence that bonds prices can only go down, which seemed to be the consensus among posters who opined on this topic. Plus as I said, that is just not how markets work.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

04-03-2014, 11:35 AM

04-03-2014, 11:35 AM

|

#20

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2013

Posts: 1,019

|

Quote: Quote:

Originally Posted by Dash man

What do you base your statement on that a stock market crash would do more damage than a credit crisis causing significantly higher interest rates?

|

I was referring to portfolio value, not broader economic implications. The last crash saw stocks fall 55%, which is a lot more than bonds would lose if a bubble burst.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|

Quote:

Quote:

Linear Mode

Linear Mode